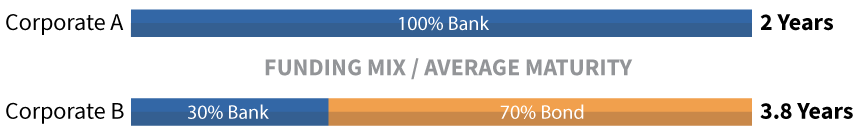

By optimising the balance between short term funding, such as bank debt, and long term funding, such as bonds, corporates can mitigate refinancing risk and reevaluate debt facilities based on the funding environment and their strategic requirements.

Bonds can be structured to have tenors of greater than 5 years, flexible covenants and no amortisation, complementing short term bank facilities and increasing the stability of a company’s capital structure.

Borrowers can create a competitive environment for their capital, leading to improved covenant packages, reduced funding costs and retention of funding headroom.