Fundamentally overvalued. That is commonly held view of the Australian Dollar.

Reserve Bank of Australia (RBA) Governor Glenn Stevens is just one of many respected figures predicting a lower dollar.

"It's going to be pretty surprising if it remains this high over a very long period," Mr Stevens told a parliamentary committee last month.

For weeks FIIG has been highlighting the risk of a sharp fall in the AUD and how bond investors can profit from this. Last week we saw the AUD fall from 93c to 90c in just four days, and for no one particular reason.

Falling coal and iron ore prices; a slump in business investment; an overpriced housing market; rising unemployment; falling national income; government spending cuts; and the high AUD itself are combining to put the risk of an Australian recession at its highest level for more than 20 years.

Yet the AUD stubbornly remains above 90c. Most people blame currency traders chasing yield for this disconnect with the “real” value of the AUD. This disconnect between the strong actual value and weak fundamental value of the dollar provide investors with an opportunity to profit.

The truth is investment markets tend to rise smoothly and fall hard. This is the impact of the cycle of human greed and fear. Greed builds slowly, but fear is instantaneous. You don’t hear about markets crashing up, only down.

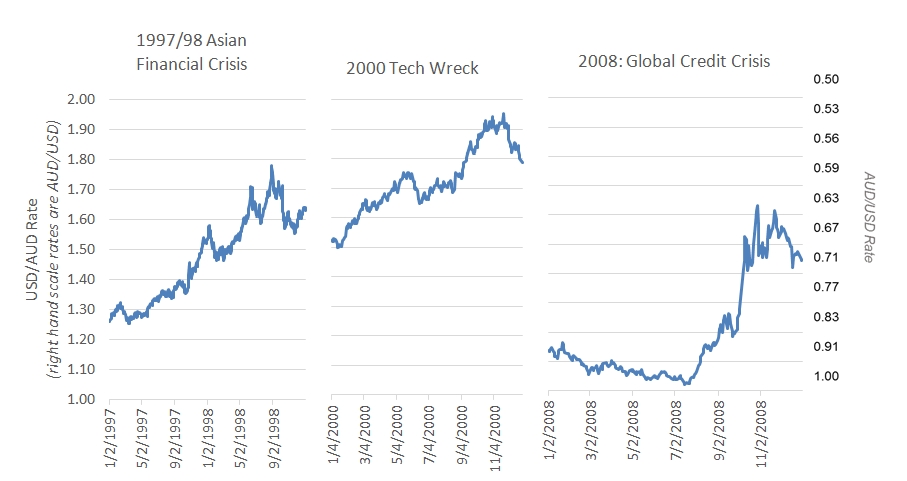

When it comes to currency, the three largest corrections in the AUD versus the USD have occurred around major global crises in confidence such as the 1997/98 Asian crisis, the 2001 “Dotcom” crisis, and the recent GFC.

There are profits to be made as an investor in these times, and one way to do this is through an investment in USD denominated corporate bonds (“USD bonds”). For Australian investors, a fall in the AUD against the USD will increase the AUD value of these bonds. This increase in value will most likely occur at a time of losses in equities, i.e. times of global fear. So you can either look at a USD bonds investment as a trading strategy if you believe there is a market shakeup on the horizon, or as a hedge to cover your losses in equities at such times.

The charts below illustrate that the USD has jumped 20-30% against the AUD during each of these crises. Smaller shocks to confidence have seen smaller moves too, i.e. it won’t take a major global crisis to provide an opportunity to profit from a rising USD.

Source: Bloomberg

Figure 1: Rise in the USD vs the AUD during global financial crises

Note: These charts are shown as USD/AUD. In Australia we are accustomed to seeing this expressed as AUD/USD. The current rate of AUD/USD is 90.23 cents, which is USD/AUD 110.83 cents, or 1.10 on the chart above.

When the next correction occurs for the AUD, it will be fears of a “hard landing” of the Chinese economy coupled with the unwinding of the cheap leverage that the US Federal Reserve has made available in recent years.

A China-related fear cycle is the worst possible scenario for most Australian investors. The world sees Australia as the beneficiary of Chinese economic growth, so if there are fears of a slowdown in that growth that in turn will hurt our stock market and the AUD. Both are likely to see 10-20% corrections depending upon how significant the fear regarding China.

These are not forecasts. It is critical when setting an investment strategy not to have one forecast and put all of your money behind that bet. Most SMSF investors were successful at running their own business or running a business for someone else. A good business manager sets a business plan around an expected set of forecasts, but then builds in contingency plans for other scenarios. Investment planning is no different to business planning – invest for your expected set of forecasts, but have contingency plans.

Most people don’t believe China will collapse in a property or credit bubble any time soon. But if you think there is a chance it will happen, you need to have investments in place that will profit from this scenario. It was intuitive for you to plan for contingencies when you ran a business, and so it should be intuitive to do the same as you manage your investments.

Some Australian investors use unhedged international shares for this purpose. That’s an ineffective hedge as fears of a China slowdown will hit all international share markets. Some simply buy US Dollars, but find they are earning no interest while they sit and wait for a fall in the AUD.

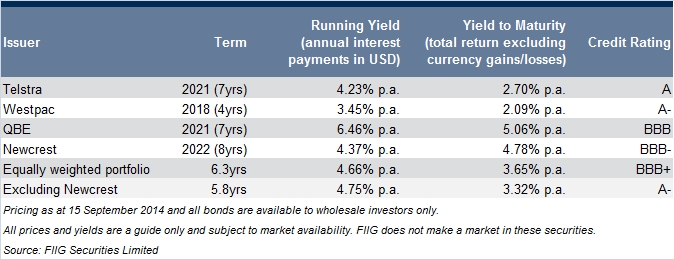

At FIIG we have another idea. A portfolio of Investment Grade Australian companies currently pay a running yield of around 4.66% p.a. in USD. In other words, for every USD $100,000 invested, you will receive USD $4,660 per annum on average. (You can exclude Newcrest if you want to avoid the mining sector, but this will lower your total return slightly.)

Figure 2: USD Investment Grade Portfolio Illustration

There are other bonds available with yields of up to 8.5% p.a. in USD. Ask your FIIG relationship manager for details.

This means you can invest in USD bonds, offering a hedge against a fall in the AUD, but earn 3-4% p.a. rather than the zero interest USD bank accounts offer. And unlike using international shares as a way of getting an exposure to the USD, with USD denominated corporate bonds you have a simple, transparent and low capital risk investment with the security of some of Australia’s largest companies.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.