NPAT was €1,324m –and increase of 244% compared 3Q11 (which was impacted by the sovereign debt crisis). Results were strong and of high quality driven by higher revenues and lower impairments. There was notably strong performance in Corporate and Institutional Banking (CIB) (strong Fixed Income, Currency & Commodities - FICC, contained costs) and French retail (higher revenues, lower impairments). Deleveraging is now over, and done at a much lower cost than guided and expected. The excess of capital continues to increase with a Basel III Core Tier 1 of 9.5% at 3Q12. Given the healthy funding and liquidity position BNP may decide to use the first repayment windows in 1Q13 to at least partially repay the Long-Term Refinancing Operation LTRO funding (issued by the European Central Bank (ECB) to fund Eurozone banks).

Deleveraging

BNP indicated that the deleveraging plan is now fully achieved. BNP had initially guided for losses on loan sales of €800m when the deleveraging plan was announced in September 2011. In the 2Q12 results the guidance was halved to “less than €400m”. With the 3Q12 results BNP has announced that the total losses on loans sold amount to only €250m. This therefore is a solid achievement.

Profitability

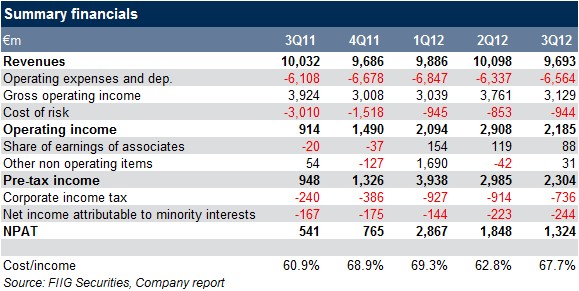

NPAT was €1.32bn up sharply compared to 3Q11 (€541m) which was impacted by the sovereign debt crisis.

Revenues were down 3.4% YoY to €9.69bn. Significant one-off revenue items totalled -€347m: an own credit adjustment (-€774m) and an exceptional amortisation of the fair value adjustment of part of Fortis’ banking book due to early redemptions (+€427m).

Revenues of the operating divisions rose 8.4% with a 1.3% rise in Retail Banking, 3.7% in Investment Solutions and 33.2% in CIB which had been impacted by the crisis in the third quarter 2011. The performance in CIB was mostly driven by strong FICC revenue growth (above peers) and contained costs while the in retail banking was mostly due to French retail (higher revenues and lower impairments than expected).

Operating expenses, which totalled €6.56bn were up 7.5%, primarily due to a low basis for comparison in the third quarter 2011 in CIB.

The Group’s cost of risk was €944m (or 55bps). It fell 68.6% compared 3Q11, which included €2.14bn impact from the writing down of Greek sovereign debt (part of the Greek assistance programme). Excluding this impact, it rose 8.6%.

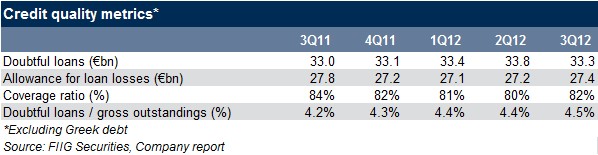

Doubtful loans to total loans continued to trend upward with macroeconomic deterioration to 4.5% 3Q12. Coverage is solid at 82%.

Capital

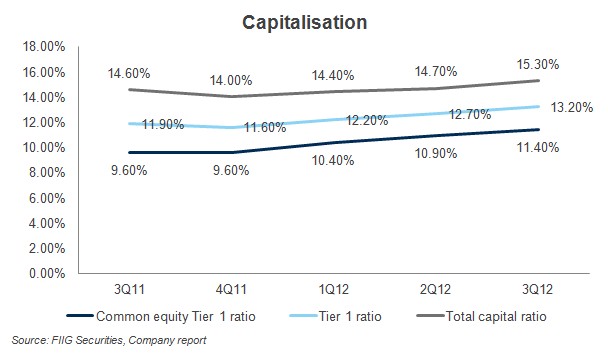

Basel III fully loaded Core Tire 1 ratio improved 60bps to 9.5%, or 11.4% under Basel 2.5. QoQ improvement comes half (+30bps) from retained earnings and lower Risk Weighted Assets (RWA) and half (+30bps) from the revaluation of available for sale bonds.

Several questions were raised on the earnings call on whether the Board is considering increasing the dividend payout or doing a share buyback given BNP has now overcome its 9% target and sits on a comfortable capital surplus. Management continues to argue that it is too early to decide on a potentially higher dividend or on a potential share buyback until more clarity is available around Basel III rules and requirements. However it wouldn’t be surprising if they proceed with such action given the solid capital position.

Funding & liquidity

BNP has completed €34bn of funding compared to the FY12 target of €20bn. BNP has therefore already funded €14bn of its 2013 needs, which probably represents the bulk of the FY13 funding plan. BNP’s liquid asset buffer, which corresponds to the liquid asset reserve immediately available after haircuts (unencumbered assets eligible to central banks and deposits with central banks), improved by €39bn to €239bn in 3Q12. It now amounts to 114% of BNP’s short-term funding needs compared 98% at 2Q12.

Given the bank’s good funding and liquidity position, BNP may decide to reimburse part of the LTRO money. Given the negative P&L impact, BNP may decide to use the first repayment window in 1Q13. The question was raised to the CFO in the earnings call. He showed a cautious stance, arguing that they took the LTRO money out of prudence and not in order to do a carry trade, and that they will review in January whether they keep this money or not, which will depend on the environment at that time.

BNP has fixed and floating rate senior bonds maturing in 2014, 2015 and 2016 offering attractive returns for senior debt of the largest French bank in a solid position.

For more information on the bonds and prices, please contact your local dealer.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.