by

Justin McCarthy | Oct 17, 2012

In the first part of a series on call risk we look at the basics of capital structure (including the unique risks of subordinated debt and Tier 1/hybrid securities), call risk, the performance of the AUD Tier 1 securities over the past year and what it means for diversity and rebalancing of portfolios.

In subsequent weeks we will analyse some of these topics in greater detail as well as exploring the decision points on whether an issuer will call or not, what happens when an issuer doesn’t call (including some examples from Europe during the GFC), the regulatory aspects that impact the call decision (including Basel III and Solvency II) and the recent history of calls in Australia versus Europe.

The capital structure

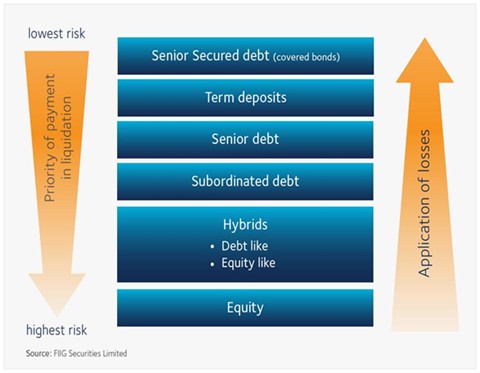

Regular readers will have seen the bank capital structure diagram shown in Figure 1 below many times but for those who have not seen it before, it is a graphical representation of the priority of payments in liquidation.

Figure 1

It is important to note that subordinated debt (also known as lower Tier 2 debt) and Tier 1 securities are regulatory capital instruments. Their primary purpose is not as a source of funding but rather to add to the capital position of a bank or insurance company which can be used to absorb losses in a crisis scenario.

As investors move down the capital structure the risk increases in terms of ranking in a liquidation scenario. However, there are some additional risks that are present with subordinated debt and Tier 1/hybrid securities as detailed below:

- Extension of maturity date (or call risk) - senior secured/covered bonds, term deposits and senior unsecured bonds all have defined maturity dates. If the issuer does not pay the investor the full face value back upon that maturity date it is an event of default. These securities do not have call risk. However, subordinated debt can be extended, typically by a further five years with banks and ten years with insurers. Tier 1 securities are perpetual (as are equities) and if not called can go on in perpetuity

- Deferral/cancellation of interest payments – for banks, a non-payment of any scheduled interest payment on senior secured/covered bonds, term deposits, senior unsecured bonds or lower Tier 2 subordinated debt is an event of default. Typically it is the same for insurers with the exception that interest on subordinated debt can be deferred but capitalised to be paid later for a period of up to five years (i.e. cumulative). Both bank and insurance Tier 1 securities can have interest suspended or cancelled indefinitely, but if this occurs the issuer cannot pay dividends on its ordinary shares (called a “dividend stopper”)

- Coercive exchange and coercive rollover – there have been a number of examples overseas of financial institutions as well as corporations such as Goodman in Australia that have essentially forced investors into selling out at less than face value (coercive exchange) or switching into a new security at below market interest rates (coercive rollover)

- Rule changes by the sovereign if the institution is nationalised – something we will cover with examples in coming weeks

While much of the discussion that follows (and in subsequent weeks) will centre on the call risk, it is also important to remember that non-payment of coupons on Tier 1 securities can occur, most likely in combination with non-call, and would more than likely result in a significant reduction in Tier 1 security prices.

Call/extension of maturity risk

The term call risk refers to the risk that an issuer will decide not to call or redeem a security at the first possible call date. In doing so the issuer has extended the term of the maturity. In the vast majority of subordinated bonds and Tier 1 securities that trade in the over the counter (OTC) and listed market, the investor has no say in the call decision. Rather, the power is with the issuer.

Call risk essentially means that the time until redemption where the investor gets back the face value is extended.

In the case of bank subordinated debt which is typically structured as a ten year legal maturity with a non-call period of five years (or “10 year non-call 5”), this means the maturity can be extended up to a further five years at which time the subordinated bond researches its legal final maturity date (with the issuer maintaining the discretion or choice to redeem at any quarterly interest payment date between the first call date after five years and the legal final maturity date of ten years).

Insurance company issued subordinated debt is typically “20 year non-call 10”, meaning that the extension period can be up to an additional ten years. However, some of the more recent insurance subordinated debt issues have seen even longer legal final maturity dates of 20, 30 and even 50 years.

Many investors are not aware of a common difference between bank subordinated debt and insurance subordinated debt is that the former requires all interest payments to be met, otherwise it is an event of default (with some minor timing exceptions allowed in the more recent ASX listed subordinated issues), whereas many insurance subordinated debt issues allow for interest deferrals for a period of up to five years but with missed interest payments “cumulative” and as such must eventually be made up.

However, it is the Tier 1/hybrid securities of both banks and insurers which typically have the greatest call risk in that if not called they are perpetual ( have no defined maturity date), but again the issuer has the discretion to call on any subsequent interest payment date. In addition, interest payments on Tier 1/hybrid securities are discretionary. The issuer can decide not to pay them indefinitely; however, they will then be prevented from paying a dividend on ordinary shares which is often classified as a “dividend stopper”.

The main consequence of call risk is that if not called at first opportunity the market will reprice these securities downward due to a longer term to maturity, uncertainty over when investors will receive their money and a perceived or actual increase in call risk. If interest payments are delayed/cancelled this will also have a strong negative impact.

The inputs into the call decision will be covered in subsequent weeks, as well as some real life examples from Europe during the GFC and scenarios of what might occur to prices if these securities were not called.

At this point it is important to note that we are not changing our positive assessment of the call risk on many of the subordinated debt and Tier 1/hybrid issues we analyse. Rather this series of articles seeks to give readers a greater insight into the decision process, risks and some scenario or “what if” analysis to help assess what could occur in the event of a non-call.

Recent Tier 1/hybrid performance

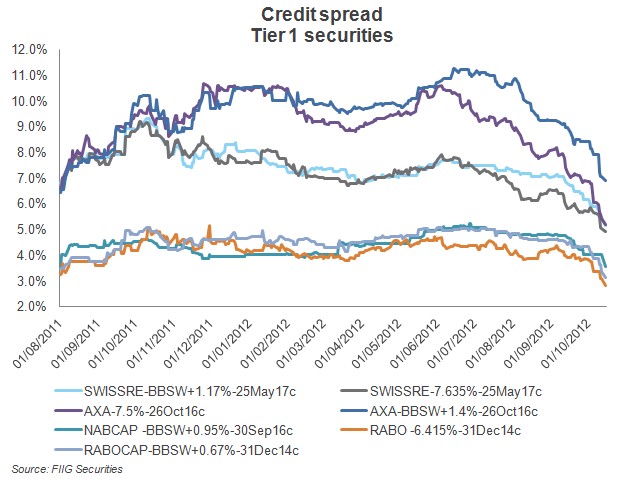

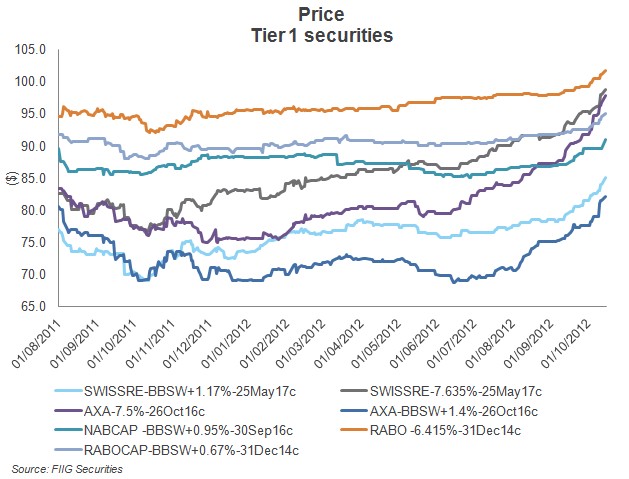

The following charts plot the credit spread (Figure 2) and then the price (Figure 3) for the seven Tier 1 AUD securities in the OTC market since 1 August last year. It is clear all seven securities have out-performed over recent months as credit spreads have narrowed but particularly the fixed rate securities which have the added benefit from falling official interest rates and lower outright yields pushing prices higher. All have also benefitted from a lower assessment of call risk by the market.

And it is worth remembering that while Tier 1 securities do come in at the higher risk end of the fixed income spectrum, all of the securities listed here are rated investment grade and many in the single A range. The investments are considered considerably less risky that equities. In other words these Tier 1 securities are from some of the world’s best financial institutions and are relatively low risk when considered across all asset classes.

Figure 2

Figure 3

The standout performers as mentioned have been the fixed rate securities and in particular the AXA SA 7.5% fixed Tier 1 security which has rallied some $22 since the start of the year and around $15 since the end of June 2012. This means if you held a minimum parcel size of $100,000 face value of that bond at the start of the year, you would have seen a paper profit of $22,000 or just under 30%.

As I am the research analyst that covers both Swiss Re and AXA SA, I believe that Swiss Re is currently a far superior credit risk than AXA SA. With a three notch rating differential by Standard and Poor’s (and negative outlook on AXA SA that could see that gap increase), the credit spread of AXA SA has come too close to the higher rated Swiss Re. What does that mean? In simple terms, look to switch out of AXA SA into Swiss Re to improve the risk profile of your portfolio at a minimum cost, but keep in mind diversification and rebalancing.

As the AXA SA example above highlights, there can be some significant changes in market values and portfolio allocations over time. Investors must continually re-assess the risk and reward (which includes exposure to call risk in their portfolio).

In coming weeks we will cover rebalancing and diversification in greater detail but the crux of the argument is that investors should look at the market weight of the various investments in their fixed income (and overall) portfolio and rebalance to take account for changes.

Specifically when looking at the Tier 1 (and subordinated debt) securities in an existing portfolio, investors should calculate the new percentage exposures and having regard to some of the very strong recent performance and available exit prices close to par, may consider taking profits and switching to securities higher up the capital structure. Conversely, investors may be happy to hold to expected maturity or believe further gains are possible. The important point is to regularly reassess and if appropriate, rebalance.

We will continue this series looking at call risk in coming weeks.