by

Justin McCarthy | Nov 28, 2012

Government bonds are typically countercyclical, meaning they rise in value when equities are falling. The rationale being that when the economy is struggling, the RBA will be cutting interest rates to stimulate activity. As the vast majority of government bonds are fixed rate, when interest rates fall their prices increase and this will offset any declines from the equity allocation of your portfolio.

In recent weeks I have seen a number of press articles talking about the ways in which investors can purchase downside equity protection, from buying puts (a hedge against a declining share market) on the ASX (or SPI) to investing in exchange traded funds (ETFs) set up to increase in value when the ASX falls. Many of these articles go on to show how by paying a premium or indirectly paying a fee, investors can purchase protection. Further they show that if these strategies were in place then investors would have seen a moderate increase in value (after fees and costs) during a period where the ASX fell approximately 15%.

However, government bonds can perform the same countercyclical/equity hedging role, however, they come with a number of additional benefits as detailed below:

- Rather than having to pay a premium or outlaying cash to buy put options/downside protection, government bonds will actually pay you an income in the form of interest

- Some of the available downside protection strategies come with substantial credit risk in that the arranger/issuer must remain solvent to pay your return if the strategy has a positive payout. Government bonds are the highest quality credit risk available in the market and considered the “risk free benchmark”

- Liquidity is not assured in many of these strategies whereas government bonds are the most liquid investments available in the Australian market

- Government bonds are completely transparent with no ongoing management fees

- In many cases the actual return the government bonds have provided when equity markets have fallen have been up to double that of the downside strategies (see Table 1)

- With the typical put or downside protection options, if the equity market performs, the investor loses all of their premiums paid or capital invested. With a government bond, the worst case scenario is to hold to maturity and receive interest income along the way with a positive total return (albeit that the maturity value of $100 may be less than the original purchase price)

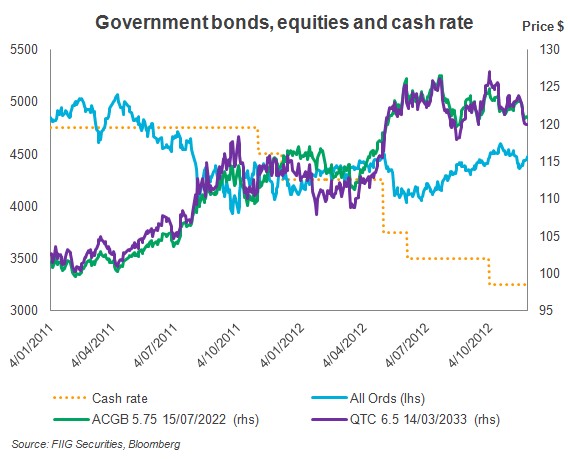

The following chart demonstrates the price performance of two government bonds (the Commonwealth Government 5.75% July 2022 and the Queensland Treasury Corporation 6.5% March 2033) since January 2011. This is contrasted to the All Ordinaries Index with the RBA cash rate also plotted. It is clear to see that the two government bonds have moved counter cyclically to the equity market, as interest rates (and longer term yields) have fallen. This is particularly evident in the period January 2011 to October 2011.

Figure 1

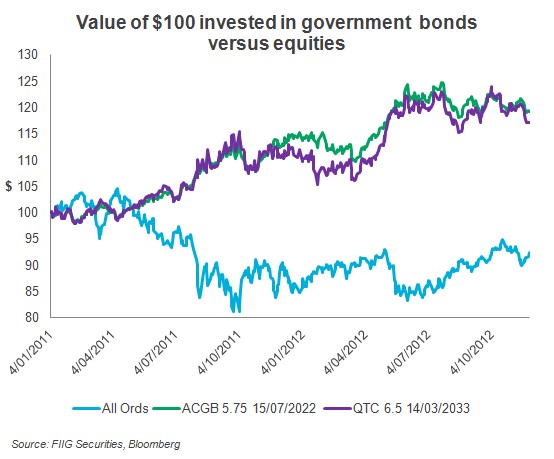

A clearer way to view it is to assess the total return of the various options since January 2011. If an investor started with $100 in each of the options, what is the capital value of each option plus what income has been received along the way?

The chart below plots the capital value of $100 invested in the All Ordinaries, Commonwealth Government 5.75% July 2022 bond and the Queensland Treasury Corporation 6.5% March 2033 bond since January 2011.

Note that this does not include income received; however, the table directly below the chart adds the income component (i.e. dividends on the All Ordinaries, assumed at 4.76% p.a. and interest on the government bonds).

Figure 2

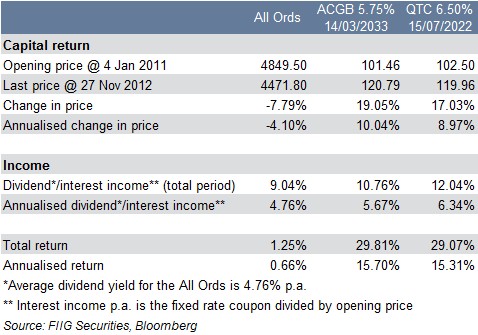

The table below demonstrates this analysis and shows the significant return that can be gained from government bonds when interest rates are falling. However, it is important to note that the opposite is true – fixed rate government bonds will fall in price when interest rates are rising, however, from a portfolio point of view, that should be accompanied by rising equity values, hence balancing out the overall portfolio return.

Table 1

The charts and table above demonstrate the significant returns that can be gained from government bonds when equities are falling (and interest rates are typically being cut to address low economic growth). This simple, safe, transparent and liquid strategy of investing in government bonds as a hedge for the equity portion of an investment portfolio will often return more than structured put options and ETFs, in both falling and rising equity markets. In essence a put option that pays you a premium.

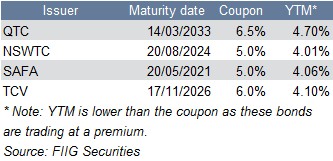

For those investors look to hedge against negative equity performance or simply those that believe that the economic climate will continue to struggle and/or interest rates will fall, the following higher yielding and longer dated state government bonds could be considered (see Table 2).

Table 2

Note that all of the above bonds are available to retail investors and in parcel sizes as small as $50,000 via FIIG.

Prices and yields are accurate as at 27 November 2012, are a guide only and subject to market availability. FIIG does not make a market in these securities.