On 25 September, RBA published its semi-annual Financial Stability Review where the central bank discussed the fact that households still preferred to accumulate savings and pay down debt faster than required.

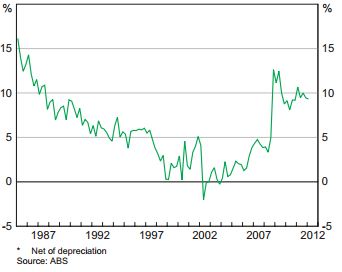

As interest rates have fallen, many borrowers kept the same repayments on their mortgages. Some households, especially owner-occupied, have also chosen to make substantial prepayments in part due to the non-deductibility of interest. At the same time, they continued to accumulate savings (Figure 1), which contributed to the large share of households with mortgage prepayments buffers.

Household saving

Per cent of household disposable income

Figure 1

Roughly half of borrowers are ahead of schedule on their mortgages, thus creating a buffer on loan repayments if their incomes were to fall. This number is high based on an international scale and is broadly similar to Canada (which is also enjoying the benefits of a mining boom).

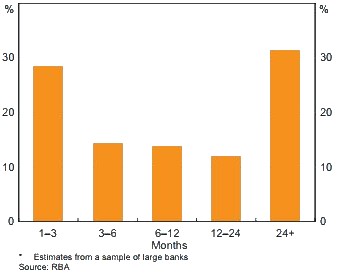

On an aggregate basis, mortgage buffer is estimated to be around 10% of the outstanding stock of housing loans, or around one and half years’ worth of scheduled repayments based on the current interest rates. Out of this number, RBA data suggests that around 15% are ahead by two years or more, 45% have a buffer of about six months, 15% have a buffer of between six months and a year (Figure 2).

Mortgage buffers

Share of ahead of schedule borrowers, 2012

Figure 2

On an age and income basis, the review suggests that households with a larger buffers tent to be older and with higher incomes, which enabled them to accumulate those buffers. On the other hand, young households have smaller or no buffer as their loans most likely have been just recently established and at higher house prices.

By RBA definition, households’ that are not ahead in mortgage repayments are not experiencing any financial distress and on schedule with repayments, while only a small share of borrowers is in arrears.

Overall, the RBA paper noted that the household sector has continued to display a prudent approach towards its finance, as many borrowers prefer to save and pay down existing debt quicker than required. This contributed to the household credit growth to be more in line with income growth over recent years. Ongoing balance sheet consolidation of households will ensure financial stability and make indebted households better prepared to handle any potential income shocks and financial distress.