by

Elizabeth Moran | Nov 28, 2012

A bond is simply a loan or an IOU from the investor to the government, bank or corporation (known as the issuer). Think of the loan you take out from the bank to buy a house. The bank expects to be repaid interest and principal. If you fail to make the payments you break the contract and the bank has rights to recover its funds.

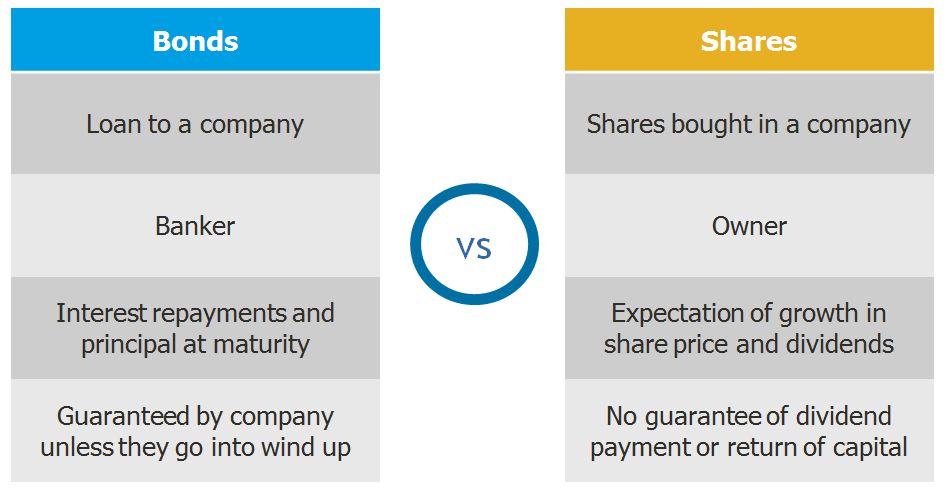

Bonds work in much the same way. The investor agrees to lend the money to the issuer who must then honour that legal obligation by paying back interest and principal. If repayments are not made on time then the entity will be in default. This is an important benefit over shares (equity), where investors own part of the company. While there is no avenue for non-payment of interest and principal to bond investors, companies can reduce or eliminate dividend payments to shareholders altogether. This feature is important for investors seeking a regular, known income (see the diagram below).

Source: FIIG Securities Limited

What are the benefits of investing in bonds?

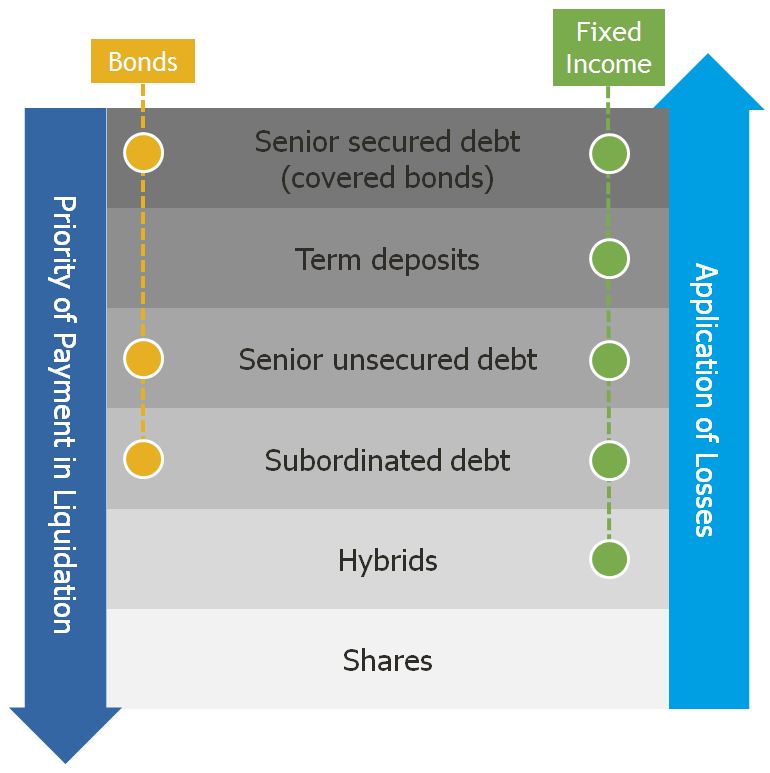

- Capital stability: Bondholders have priority over equity holders in the event of liquidation (see the corporate capital structure diagram below). Assuming the issuer of a bond remains solvent, they are contractually obliged to pay back the principal value to the bondholder.

- Regular income: Fixed income securities provide a regular income stream through coupon (interest) payments.

- Diversification: Holders of fixed income securities enjoy diversification from the two most highly cyclical asset classes: equities and property.

- Higher returns than deposits: Many investors use term deposits which are very low risk but generally earn relatively low returns. By moving slightly down the bank issuer's capital structure into bonds (senior or subordinated debt) investors can retain their exposure to the issuer but earn a higher return.

- Liability management: Typically, bond maturities vary from one to ten years and can be traded before maturity to meet commitments.

- Liquidity: Low risk, highly liquid fixed income investments like government bonds can be sold at short notice if needed. Bank and corporate bonds are typically very liquid but may not be as liquid as government bonds.

- Downturn protection: Generally, a fixed income allocation will act to protect your portfolio during a cyclical downturn, in that unless the issuer goes into wind-up, you will be assured of your interest payment (coupon) and capital repayment at maturity. Fixed rate bonds, where the rate is fixed at the time of issue (much the same as fixing your mortgage rate) provide greater protection in a cyclical downturn, where interest rates are lowered to try and stimulate the economy. Locking in a fixed return when interest rates decline (the circumstances where you would expect the share and property markets to decline) offers excellent protection to your portfolio.

What are some of the risks to investors?

There are two key risks when investing in bonds:

- Credit risk: The risk that an issuer may be unable to meet the interest or capital repayments on the bond when they fall due. Generally, the higher the credit risk of the issuer, the higher the interest rate that investors will expect in order to risk lending funds to the issuer (as demonstrated in the capital structure diagram below).

Source: FIIG Securities Limited

- Interest rate risk: The risk associated with an interest bearing asset, such as a bond, due to variability of interest rates. There is an inverse relationship between fixed interest rates and price. When interest rates fall, prices of fixed rate bonds rise and vice-a-versa. This risk is not present in floating rate notes (FRNs), which as the name implies, have the coupon or interest payments linked to a floating benchmark, typically the 90 day bank bill swap rate or BBSW.

In conclusion, bonds are safer than equities as they sit higher in the capital structure. In stressed market conditions, investments that sit low or lowest in the capital structure and are highest risk will show more volatility than the lower risk investments such as senior debt, which sits higher in the capital structure (as shown in the above diagram)..

Common terms

Issuer is the entity (or borrower) that issues the bond to raise money from investors. Issuers in the Australian bond market include the Commonwealth Government, state governments and territories, financial institutions and corporations.

Maturity is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Face value is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually par or $100.

Coupon is the rate of interest paid on a bond. Coupons can be paid annually, semi-annually or quarterly or as agreed in the terms of the bond.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG Securities Limited (‘FIIG’) provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.