by

Elizabeth Moran | Apr 29, 2014

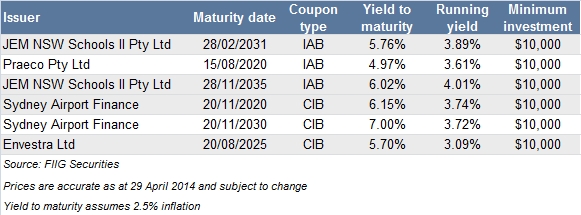

There are two types of inflation linked bonds (ILBs): capital indexed bonds (CIBs) and indexed annuity bonds (IABs). Investors new to fixed income are unlikely to have sufficient inflation protection, so investing in inflation linked bonds is often a good place to start.

The two types of bonds work in different ways and one may be more suitable to your goals than the other. We often find the CIBs are more suitable to investors in the accumulation phase as they are seeking to meet longer term expenses. However the IABs, which return both interest and principal quarterly, find favour with investors in retirement that need the ongoing cashflow.

Capital indexed bonds (CIBs)

The most common ILB are CIBs where variations in inflation during the life of the bond are added and subtracted to the capital price of the bond, which results in what is known as ‘the adjusted capital price’.

A simple example would be as follows:

If a CIB had three years until it matured and inflation was 3% per year for the three year period, the capital price would rise from $100 to $103 in year one, where the increase in inflation is recorded on a quarterly basis, so as to coincide with the CPI release date. Then, in year two the adjusted capital price would be $103 + $3.09 = $106.09 and in year three $106.09+ $3.18 = $109.27 (Note: All calculations are rounded to two decimal points). The issuer would therefore pay the bondholder $109.27 at the maturity of the bond.

CIBs have a fixed coupon that is applied to the increasing adjusted capital price. So while the fixed rate does not change throughout the life of the bond, the effective cash income increases with the underlying increase in adjusted capital price and equally will fall during deflation. Alternatively, when expressed as an annual dollar figureit would rise and in this case be $4.37 (that is 4% x $109.27) at the end of year three.

Hence, the investor receives income in two ways as illustrated in the following example:

- If inflation rises, so does the adjusted capital price. If inflation was 3% in year one, the index factor increases the value of the bond by 3% which the investor can either hold in the portfolio or “cash-in” by selling down a small part of the investment.

- The coupon return, which varies both depending on the adjusted capital price/value and like normal coupon margins is also dependent on the credit quality of the issuer. Australian government ILBs will, all else being equal, have low coupon margins whereas higher risk corporate issuers will offer higher coupon margins. There are ILBs available to satisfy a range of risk/reward appetites.

The total return per annum (p.a.) in this case would be the sum of the increase in adjusted capital price of 3%, plus the real yield (fixed coupon) of 4%; providing a total return of around 7% p.a. excluding compounding affects, for the first year. By the start of the second year, the principal value, as reflected in the adjusted capital price, would move up from $100.00 to $103.00, and the coupon would be 4% times the new adjusted capital price of $103.00 resulting in a cash coupon of $4.12. In other words, both principal and interest increase with inflation.

Indexed annuities bonds (IABs)

IABs return both principal and interest at each preset payment date over the life of the bond until the maturity date (instead of one lump sum at maturity like the CIB). This is an annuity but the annuity is ‘indexed’ to inflation.

Just like paying a mortgage loan back to a bank, IAB investors take on the role of the bank and loan money to the issuer of the bond. Investors can then expect interest and principal repayments from the IAB issuer over the life of the bond. In the absence of any indexation (inflation), each payment would be equal, consisting of part principal and part interest. This amount is also referred to as the base payment or ‘base annuity’. The base payments are indexed (by inflation) over the life of the bond. Assuming that inflation is positive, there is a steady increase in the payments over the term to maturity.

IABs offer investors a cash stream that will increase with inflation, so are perfect for investors in retirement as well as investors seeking a known cashflow over time.

For more information, please call your local dealer.