by

Justin McCarthy | Mar 11, 2014

Key points:

- IAG has launched a new subordinated bond which is expected to price today - indicative credit margin of 280bps to 300bps (or expected yield to call of 6.5% to 6.7%) and first call in March 2019.

- Fixed and/or floating tranches possible with a minimum of $200m but expected to raise $300m to $400m.

- The new subordinated issue is viewed as great opportunity for both new money or as a switch from Swiss Re, AXA and Rabobank Tier 1 securities that we believe are now “fully priced”.

- Please contact your dealer ASAP to register interest.

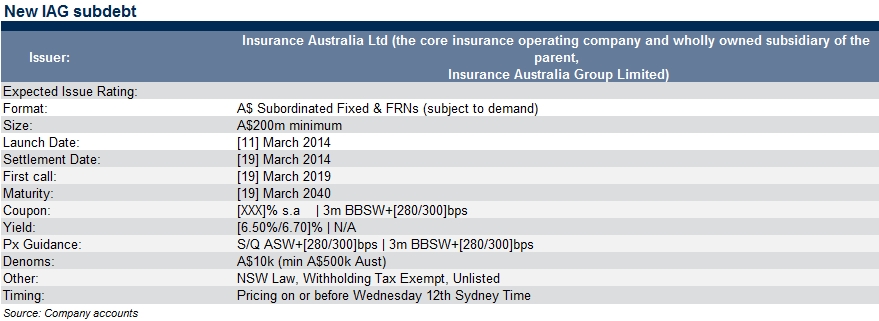

Yesterday IAG launched a new fixed and/or floating subordinated debt issue with an expected yield to call of 6.5% to 6.7%. The key details are contained in the table below:

Note that the bonds are only available to wholesale investors.

As foreshadowed in recent weeks (see Aussie insurers offer outstanding foreign currency returns), this new over the counter (OTC) subordinated debt issue, with an indicative credit margin of 280bps to 300bps, is viewed as a good opportunity for both new money and as a switch from Swiss Re, AXA and Rabobank Tier 1 securities. Further, if a floating tranche is issued, it increases the choice of high margin floating rate bonds, which until recently was sparse.

This issue follows on the heels of the Bendigo and Adelaide Bank and Westpac Bank “new style” OTC subordinated bonds in recent weeks, the latter issuing a $1bn FRN on Friday last week at a credit margin BBSW+205bps, and now trading at circa +195bps.

With an increasing appetite for “new style” subordinated debt from the institutional market we expect further issuance in the coming months. It appears that the OTC market will form the natural home for subordinated debt issuance and the ASX listed retail market the natural home for Tier 1 hybrid/perpetual securities.

Being an insurance company, there are some differences with previous bank subordinated debt issues. As is typically the case with insurance subordinated debt (both new style and old style step-ups), interest payments can be deferred, however, are cumulative (i.e. must be made up in the unlikely event they are missed).

Also the legal maturity date is longer at 26 years. The reason for this is to ensure they receive equity credit from Standard & Poor’s (i.e. can be treated as equity as opposed to debt by Standard & Poor’s in their rating calculations).

Unlike the bank issued recent subordinated deals, the IAG issue is callable by the issuer for a one year period only, being on any interest payment date between [19] March 2019 and [19] March 2020. However, investors have a valuable option to convert to IAG shares at any time after [19] March 2022 at a 1% discount to the 20 day volume weighted average price (VWAP) prior to conversion. Importantly this option is the investors, not the issuers and hence mitigates the non-call risk as long as the IAG shares are trading at 50% or more of the VWAP they were at the time of issue in March 2014. At time of writing IAG share price was circa $5.40, so investors would receive full value for conversion (plus the 1% discount) as long as the shares are trading at or above $2.70 in 2022 or beyond.

As with the Bendigo and Adelaide and Westpac OTC subordinated bonds, this new style subordinated debt issue also includes a non-viability trigger which allows APRA to convert the subordinated bonds to equity if they deem the insurer has reached the “point of non-viability”. It is this additional risk which is the main reason why these new style securities trade wider of the old style step-up securities.

Despite the additional risks we believe the margin of 280bps to 300bps is fair compensation, particularly for companies such as IAG that are deemed of high credit quality. Standard & Poor’s rates the senior debt of the issuer, Insurance Australia Limited, at AA- (stable outlook) and the subordinated bonds are expected to be rated a high A-. Note that this is two notches higher than the parent company, Insurance Australia Group Limited.

With pricing of the bonds expected to occur on Wednesday 12 March any investors interested in the new IAG subordinated debt issue are strongly advised to contact their FIIG representative as soon as possible to register interest.

All prices and yields are indicative and a guide only and subject to market availability. FIIG does not make a market in these securities. All securities mentioned are only available to wholesale investors.