by

Justin McCarthy | Jun 24, 2014

Last month Transfield Services Limited (ASX: TSE) raised USD $325m from global high yield bond investors with the proceeds used to restructure the company’s existing debt.

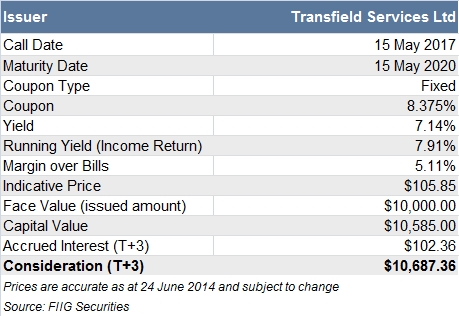

This USD bond is available to wholesale clients in minimum (face value) parcel sizes of USD $10,000 with an indicative yield to maturity of 7.14%.

Details of the bond, including indicative pricing is in the following table and a brief description of the company is provided below. (The following details are informational only and do not constitute research or a recommendation).

Company profile and recent results summary

Transfield Services Limited (ASX: TSE) is an Australian-based provider of operations, construction, maintenance and services activities in the resources, energy, industrial, infrastructure, property and defence sectors. In addition to its Australian operation, Transfield Services Limited also has a presence in New Zealand, Chile and North America.

For the six-month period ended 31 December 2013, Transfield Services Limited derived approximately 72% of its revenue from Australia, 15% from New Zealand, 11% from North America and 2% from Chile.

The company's business operations are comprised of three principal segments:

- Infrastructure Services involve infrastructure management and maintenance services in the utilities, transport and telecommunications sectors, asset and facilities management services for the Australian Defence Force, maintaining public housing for the Australian Government as well as asset construction and staff management services for the Australian Government on Nauru and Manus Island;

- Resources & Energy are involved in various activities, including maintaining coal seam gas wells in Queensland and liquefied natural gas (LNG) project, operations and maintenance services for oil refineries, consulting services, as well as maintenance and drilling in the mining sector;

- Americas includes an upstream business focusing on asset management in the shale gas sector, downstream support services on the US West Coast, road maintenance in the US and Canada, the Flint Transfield Services joint venture that provides services to the oil-sands sector, and the operations and maintenance operations in the Chilean Copper mining sector.

The company has a current market capitalisation of $535m.

Recent results summary – half year to 31 December 2013

Key features of half year result to 31 December 2013 (1H14):

- Underlying NPAT pre amortisation: $9.9m, up $3.2m from prior period

- Statutory NPAT: $4.8m

- Group revenue $1,790m

- Underlying EBITDA: $74.4m

- Underlying EBIT: $26.5m

- Total debt: $756m

- Gearing (net debt/net debt + equity): 46%

- Net debt to EBITDA (per banking arrangements): 2.9x

- Interest cover ratio (per banking arrangements): 3.9x

- No interim dividend declared

- Actively present in six major industries with more than 200 contracts

- 20-largest contracts accounted for circa 48% of total revenue in 1H14

Management have made clear their strategy for the next year:

- Convert preferred pipeline into contract wins – the company held preferred bidder status on $2.8+ billion of work expected to be announced in 2H14, with revenue contribution from FY15

- Reducing net debt and lowering gearing

- Achieve full year NPAT (pre amortisation) in the $65m - $70m range

Transfield Services Limited is rated BB (stable outlook) by Standard & Poor’s and Ba2 (stable outlook) by Moody’s, however, the above USD bond ranks behind senior secured syndicated and bilateral bank facilities of approximately $500m and has been rated B+/Ba3, reflecting the subordinated nature, relatively high level of indebtedness and minimal expected recovery in a liquidation scenario. As such, the Transfield Services Limited USD bond is considered to be at the higher end of the fixed income risk spectrum.

Please speak to your FIIG representative if you are interested in the USD Transfield Services Limited USD bond.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

The Transfield Services Limited USD bonds are only available to wholesale investors and in minimum parcel sizes from USD $10,000.

The above details are informational only and do not constitute research or a recommendation.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.