The bank bill swap rate or BBSW is one of the key terms for Australian fixed income investors and is a benchmark for market interest rates for floating rate notes. Basically, it is the rate at which banks will lend to each other. The precise definition of BBSW as published by the Australian Financial Markets Association (AFMA) is as follows:

BBSW is the rate for a reset date at the average mid rate, for Australian dollar bills of exchange, accepted by an approved bank, having a tenor with a designated maturity, that appears on an approved information vendors service (eg. Thomson Reuters Screen BBSW page) at approximately 10.08am AEST, on the reset date.

On the other hand, the RBA cash rate is the ‘headline’ rate which financial institutions pay to borrow or charge to lend funds in the money market on an overnight basis. The Reserve Bank of Australia (RBA) sets this rate and publishes any changes on the first Tuesday of each month (except January). Historically, from 1990 until 2012, there have been only two years 1995 and 2004 when the cash rate did not move, while the 18 months from January 1995 was the longest period without change.

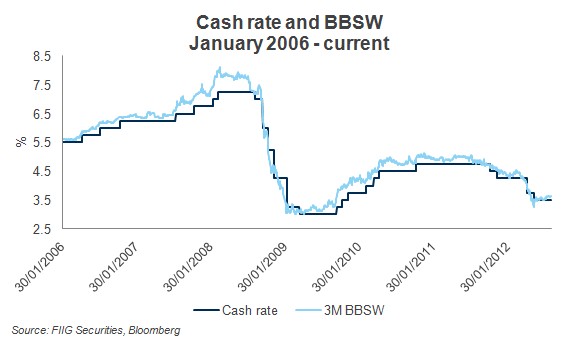

Putting the two rates together, the difference between the RBA cash rate and the BBSW is referred to as a spread or margin. Typically, the cash rate and BBSW have been highly correlated and, as a rule of thumb, BBSW is a good indicator of what RBA movements in the short term. This is typically true, however as seen in Figure 1 below, the increased banks’ nervousness and lack of credit in the market in 2007 and early 2008 saw the BBSW gapping as wide as 100bps over the cash rate.

Figure 1

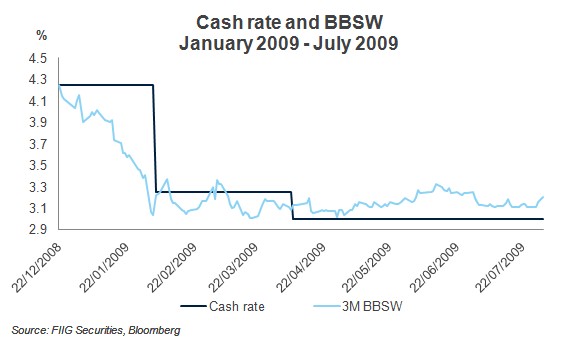

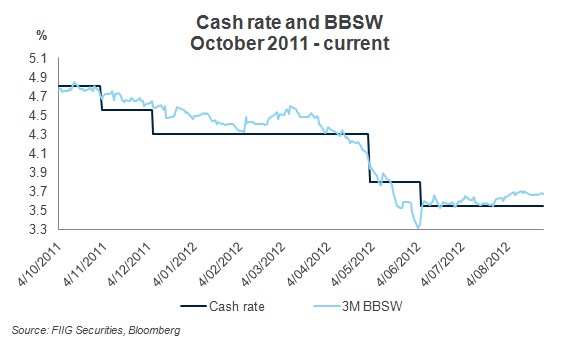

As noted above, BBSW is a good indicator of the expected cash rate ; bank bill rates take current rates into consideration as well as ‘priceing in’ any anticipated movements in the cash rate. Figures 2 and 3 illustrate the movements in the rates over two different periods.

Figure 2

Figure 3

From the two figures above it is evident that BBSW ‘reacts’ prior to any cash rate announcements, as banks extrapolate the rate value in the short term. In early 2009, RBA cut the rates by 1% (as seen in Figure 2) while the market started reflecting the expected cut in December 2008, with the margin widening as much as 122bps (1.22%) the day prior to the announcement. The same picture is painted in Figure 3 with BBSW stabilising around the current cash rate level indicating that further cash rate easing may be limited (see recent RBA minutes).

For more information on how BBSW is calculated, please click here.

For more information on Corporate Bonds

Talk to us

Call us on 1800 01 01 81

...with offices based in Sydney, Brisbane, Melbourne and Perth