by

Justin McCarthy | Mar 15, 2013

AXA SA (AXA) reported their full year results (to 31 December 2012) on 21 February 2013.

Net profit after tax for FY12 was down 4% year on year to €4.2bn but if exceptional gains are excluded from the FY11 results, the underlying earnings actually improved.

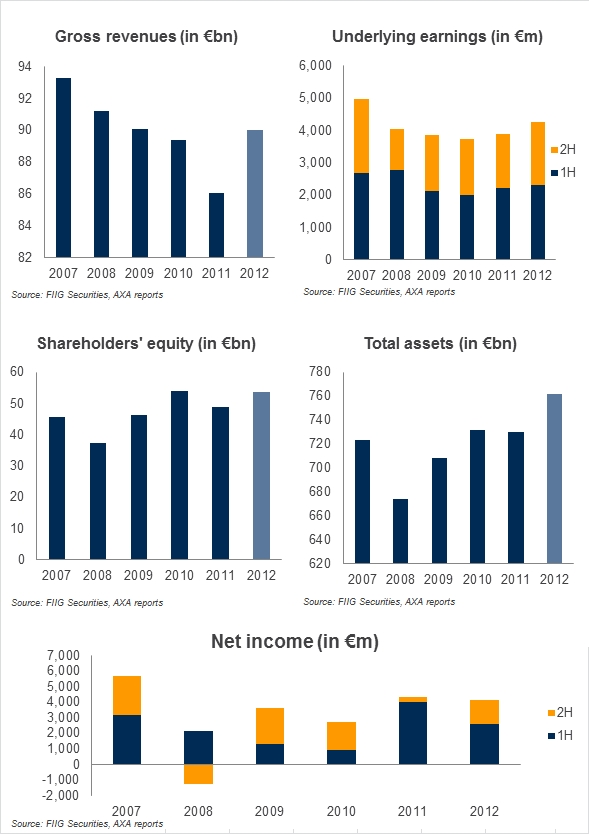

Key figures from the FY12 result included:

- Total revenue up 5% to €90.1bn

- Underlying earnings up 9% to €4.3bn

- Net income of €4.2bn, down 4%, mainly due to the non-recurrence of €1.4bn exceptional favourable items in 2011

- Total equity of €53.7bn, up from €48.8bn as at FY11

- Total assets up €34.6bn to €761.8bn

- Solvency I ratio up significantly at 233% compared to 188%

- Gearing ratio of 26%, down from 27% at FY11

- Increased dividend by 4% to €0.72 per share

The following charts plot a number of these key measures over the past six years and demonstrate the relatively stable nature of AXA’s underlying business.

Whilst the profit performance has been solid, in the current environment it is the balance sheet and the large investment portfolio that is of far greater importance, particularly so for debtholders. The growth in equity and Solvency I ratio provides comfort and the balance sheet in general is considered robust. However, as previously written, AXA remains exposed to European macroeconomic risks, particular via large holdings of sovereign, bank and corporate bonds from Europe and the PIIGS in particular.

If US and/or European growth continues to remain sluggish (and by implication interest rates and long term yields remain very low), there is also a risk that the carrying value and goodwill of a number of businesses may need to be reduced. Such action could result in a half year loss and a reduction in the total equity buffer in the balance sheet.

We will continue to monitor the economic developments and their impacts on valuations and investment holdings. It is these aspects as opposed to the general day to day insurance operations that presently hold most of the credit risk. As such we expect AXA to continue to trade in line with sentiment related to European economic conditions (or “risk off” versus “risk on”) in the medium term.

Conclusion

Whilst the FY12 results and balance sheet remain sound, the risk for AXA remains the macroeconomic environment.

In relation to the AXA Tier 1 hybrid securities, we believe that the price (or credit spread) has outrun the fundamentals. In other words the reward is less that the risk.

Further, recent developments that have seen a growing uncertainty with respect to future regulation of AXA under Solvency II, and the implications for calling step-up securities such as the AXA Tier 1 hybrid securities. Due to this uncertainty, we have recently revised downward our probability of call for AXA Tier 1 hybrid securities. Whilst we still believe they will more than likely call on reputational grounds, the expected regulatory incentives we were looking for under Solvency II may not eventuate.

Against this background, the price of the AXA Tier 1 hybrid securities has rallied extremely hard over the past seven months and we suggest clients take some profits and reduce their exposure to AXA.

As we wrote at the conclusion of the Swiss Re results review:

“We view Swiss Re as a far superior credit than AXA SA and at the time of writing believe Swiss Re should trade at least 150bps tighter than the equivalent AXA SA Tier 1 securities (which are now rated four notches lower than Swiss Re). The differential is currently circa 50bps for the fixed rate securities and circa 75bps for the floating securities. Given the current differential we would recommend that clients reduce weighting to AXA SA and consider an overweight position in Swiss Re, subject to the level of other financial and callable exposure in their overall portfolio.”

An updated research report on the 2012 full year results will be available to wholesale clients on our website in the coming days.