Hybrids by their nature are technical beasts. They are supposed to be a mix of equity characteristics and debt characteristics, hence the name hybrid, and are at their heart designed to appease various regulatory requirements, tax requirements and/or the requirements of the rating agencies.

The hybrids affected by the changes were specifically designed to meet S&P’s own criteria for equity enhancement and now, with these changes S&P have acted retroactively on instruments specifically designed to appease them. Under S&P’s criteria, companies (with the help of their bankers) could design their hybrid in such a way that they would receive 100% equity credit for their issue, only now S&P have changed their mind, taking away the 100% equity credit and placing some companies under rating pressure. What was previously cheap equity, is now expensive debt.

What does 100% equity credit mean?

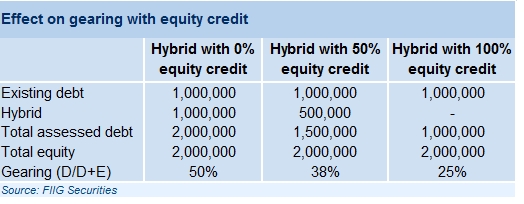

So what is the argument all about? When reviewing companies, rating agencies calculate credit ratios to help assign the rating. The most commonly known credit ratio is gearing calculated as Debt / (Debt + Equity). When a company’s hybrid is given 100% equity credit, it doesn’t count as debt in making this calculation so the gearing of the company appears lower when assigning the rating. If the hybrid is given 50% equity credit, half of its value is applied to debt in the calculation; if it is given 0% equity credit its full value is applied to debt. This is shown in the example below.

By receiving 100% equity credit for the hybrid in the example above, the company is able to effectively reduce its gearing, as calculated by the rating agency from 50% to 25%. By doing this, the company may maintain, or improve, its credit rating while still achieving its funding needs. The hybrid may also allow the company to avoid offering a dilutive equity raising to the market to otherwise meet its funding needs.

Santos which has a €1,000m hybrid which has gone from 100% equity to 0% equity – effectively applying an extra €1bn to the company’s balance sheet debt over night and its credit rating is now under pressure. Origin, which has a $900m hybrid and a €500m hybrid received 50% equity credit adding over $700m to its balance sheet debt.

The Santos issue was raised at 585bps over swap. The ASX listed Origin hybrid was issued at BBSW +400bps. Given their current ratings these companies would raise senior debt at around 200bps....these hybrids, which were once cheap equity, are now expensive debt.

Doomed to failure

Perhaps what is most surprising is that any of these issues received 100% equity value in the first place. At the time the Santos hybrid was issued I noted that S&P were loose in its application of the equity credit allowance even under its own (old) criteria (see

here ). The cumulative nature of deferred provisions in the structure was a significant ‘debt-like’ characteristic which for mine should have immediately ruled out any chance of full equity credit.

The rush of issues following the Santos precedent highlighted to the rating agency that it had gotten it wrong and forced the review which has resulted in this back flip. This is a problem of the agency’s own making.

The outcome

As a result of this change the rush of corporate hybrid issues seen last year has well and truly dried up. Under S&P’s new interpretation, to receive 100% equity credit a hybrid would need to have no maturity date and no step up. Effectively a perpetual. To get away with this structure issuers would have to pay up handsomely to investors, only those companies desperate to protect their credit rating are likely to pay the requisite interest rate.

It highlights the need for investors to fully understand the complex nature of hybrids – most are not particularly debt-like and investors looking for fixed income investments for the SMSF should tread carefully. A hybrid receiving 100% equity credit is achieving this for a reason and this should be a warning sign for investors who are thinking they are buying a ‘debt-like’ security. The losers as a result of S&Ps change in approach will not be limited to the companies and the rating agency.