by

Dr Stephen J Nash | Nov 14, 2012

Often investors operate under the impression that there is a linkage between the CPI and equity returns. This piece questions this impression, both using Australian data and US data, along with referring to the available literature. Given the findings, the role of inexpensive inflation insurance, through inflation linked bonds, is considered.

Historic inflation

Underlying inflation has been contained within the annual Reserve Bank target band of between 2% to 3% in recent years, especially since 1993. However in the past there have been inflation spikes. Beginning in 1974 through to 1977, annual inflation was over 10% and reached a peak in the March 1974 quarter of 17.6%. In the period from 1980 to 1984, inflation again hovered near or over 10% (see Figure 1). One of the major threats to purchasing power is inflation, and while the RBA may control underlying inflation, headline inflation can still be quite elevated which damages purchasing power. The need to hedge, or insure, against inflation is particularly important for those investors at or near retirement and are dependent on their savings to live. Importantly, the only direct hedge, or insurance against, and thus protection from inflation are inflation linked bonds.

Looking forward, Australian CPI

If you thought that worrying about inflation was “old hat”, then think again. As Figure 1 indicates, while headline inflation has moderated of late, it is still a significant force that erodes investment principal and interest and needs careful consideration in setting investment asset allocation. Recently, the headline CPI as impacted by the carbon price, and is expected to be over 3% by June 2013, at a time when the prospects for growth are questionable.

Figure 1

The CPI measures quarterly changes in the price of a 'basket' of goods and services which account for a high proportion of expenditure by the CPI population group; that is metropolitan households. This 'basket' covers a wide range of goods and services, arranged in eleven groups.

Hope of link between the CPI and equity prices

As this CPI basket measures output prices from the broad economy, one might expect that it would rise and fall, based on the presence or absence of supply constraints throughout the economy. So, if the economy is doing well, then supply constraints will increase, which will boost the CPI. Similarly, at the same time when the economy is doing well, equity prices would also rise. This would imply that as the CPI rises so too would equity prices, meaning that equity returns provide insurance against inflation. Also, the opposite would also be the case, so that when supply exceeds demand, and the CPI falls, so too would equity prices fall. Hence, one would expect a fairly high correlation between the CPI and equity prices. Correlation is a statistical technique that measures the extent to which two variables move together, or move in opposite direction, over a time series. Large positive correlations indicate that two variables are moving together strongly over time, and large negative correlations indicate that two variables are moving strongly in opposite directions.

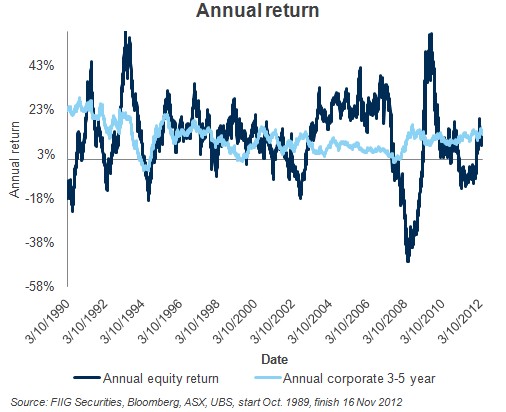

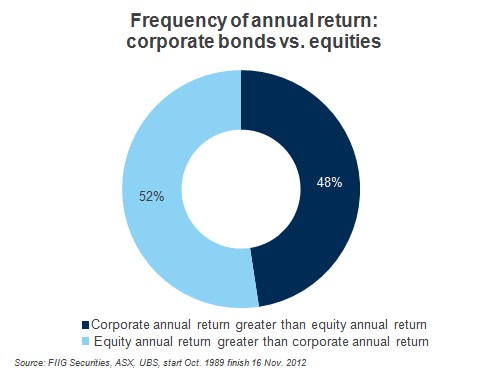

However, the general observation appears to be contrary to the hopes expressed above, where the data generally does not support a strong positive correlation, between equity returns and the CPI in the short or the medium term (1). One of the main reasons that the relationship does not hold is that equity returns represent expectations of future earnings, so that equity prices reflect the sum of expected return over the forthcoming investment horizon. Notice the use of the word ‘expected’. Equity prices reflect not the actual earnings in the forthcoming period, as they are unknown at the point of forecast, but expectations of those earnings. Since expectations are notoriously volatile, the annual return of equities just reflects the underlying volatility of earnings expectations, and this volatility has little, or anything, to do with variations in the level of the CPI. In order to verify the reality of volatile expectations, in Figure 2, we plot a time series of the annual CPI with annual return from Australian equities, where we use the total return from the All Ordinaries accumulation index.

Figure 2

Notice how the two series move in different ways, and how volatile equity returns remain, relative to the CPI.

We can take the analysis a little further by doing a rolling 20 period correlation, between the annual CPI and annual equity returns, which is a rolling five year analysis given that the CPI is released quarterly. In Figure 3 we plot the results of this analysis and we see that the two series are quite negatively correlated; annual CPI and annual equity returns.

Figure 3

Longer term US data

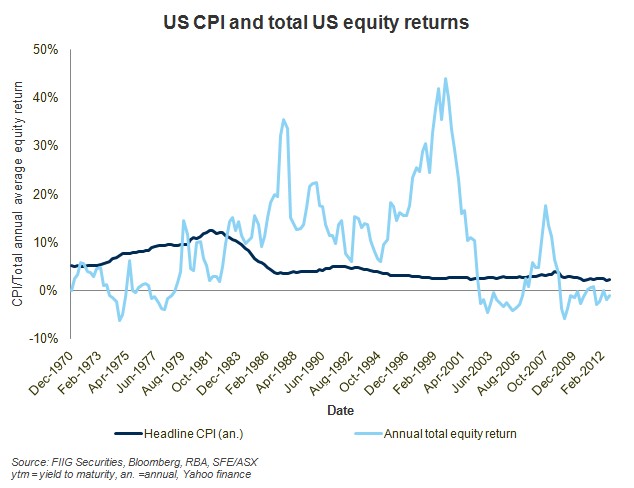

For those who think the data is limited in the above study, we refer to longer term data from the United States. Similar results are evident, as in the case of Australia, where equity returns and the CPI move in different directions.

Figure 4

Even if we average annual returns for rolling five year periods, and we also average the CPI for the same period, the relationship still is one where the two series tend to move in opposite directions over time.

Figure 5

We must agree with others in the field, that there is little evidence of a short or medium-term relationship, between equity returns and the CPI. A tentative relationship emerges over the very long term; a period that is beyond the investment horizon of most investors. As Deutsche Bank recently concluded:

To sum up - if there is any relationship to reveal at all, it appears that inflation and equity returns are actually marginally negatively correlated. This should not be particularly surprising given the poor performance of equity markets during the inflationary 1970's, and subsequent strong performance since inflation has trended lower (2).

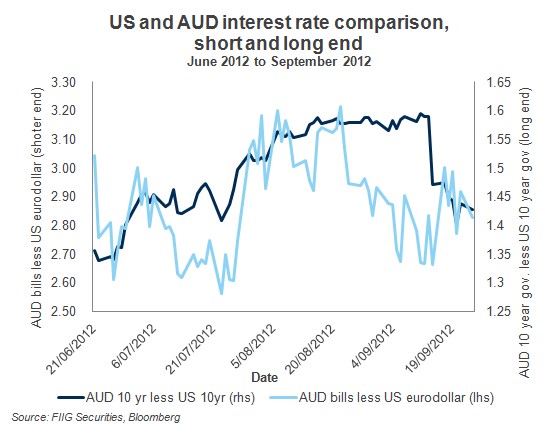

Forthcoming expectations for equities

As we have said for several months, the equity market faces significant problems mainly because the equity market built up expectations of growth from the long anticipated easing from the Federal Reserve, known as QE3. Here, the equity market built in general economic growth for the US of over 3% for an extended period. Now, the equity market needs to come back to a more realistic estimate of forward earnings as it over comes the following:

- Disappointing earnings

- A possibly large fiscal contraction

- Further credit rating agency downgrades of European sovereign issuers and corporate issuers

- Further credit problems in the European banking system

- Further disruptions from the European economy, and the prospect of a large European recession in 2013, and

- Possible credit rating agency downgrades of the US government

Given that equities do not insure against inflation in the short or medium term, and the changes for equities are large, the need for allocation to equities, at this point must come under question.

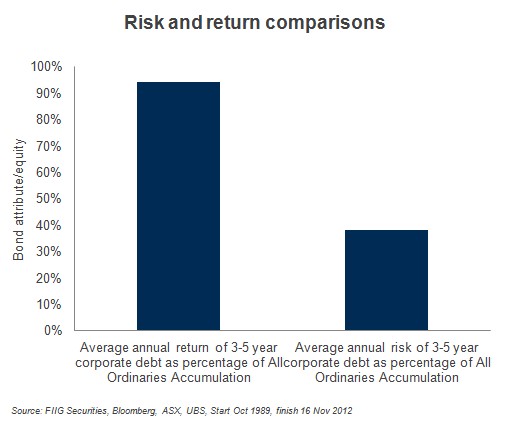

ILBs and inflation insurance

The realisation that equities poorly insure against inflation, combined with recent spikes to headline inflation from the carbon price, point to the need to find a solid form of insurance against inflation. Since inflation linked bonds (ILBs) perform this insurance in a reliable manner, they are the asset class of choice for those seeking meaningful insurance against elevated inflation. Also, ILBs are inexpensive, as many corporate ILBs are trading at levels which offer ‘real’ returns of over 4% (or 4% above inflation). Hence, one can acquire inflation insurance inexpensively, when equities have already become expensive based on optimism about QE3; an optimism that is fast fading.

Conclusion

In this piece we reviewed the history of the annual CPI, as well as the arguments that are typically put forward to justify the relationship between equity return and the CPI. Evidence was then presented which questioned this supposed relationship in the Australian context using recent data. Longer term US data was then used to support our initial findings, which were also generally consistent with the available literature. Since equity returns and the CPI are driven by very different variables, the need for true CPI hedging in the forthcoming period should become evident, especially when the forthcoming period presents so many challenges for equities.

(1) Equity Returns and Inflation: The Puzzingly Long Lags', Lothian J.R. and McCarthy C., Research in Banking and Finance, 2, pp. 149-66, See also Ahmed S. and Cardinale M. (2005),„Does inflation matter for equity returns?', Journal of Asset Management, 6, pp. 259-73.

(2) 15 (Hamilton J., Jones, B., Suvanam, G., Challa, A., (2007), Australian LDI; Liability Driven Investment Has Arrived: Part 1, Deutsche Bank, 18 May 2007, pp.4-5).