by

Ekaterina Skulskaya | Jun 03, 2014

Key points:

- Adani Abbot Point Terminal Pty Ltd (AAPT) launched an initial bond offer on 19 May 2014 through FIIG Securities Limited (FIIG), seeking to raise up to A$100m from wholesale investors. The offer was closed on the 21 May 2014, oversubscribed.

- The new bond started trading in the secondary market on Friday last week.

- The A$100m bond pays a fixed coupon of 6.10% p.a. and has a final maturity of six years. It is currently trading at a 5.9% yield to maturity.

Adani Group is one of India’s leading business houses and one of the largest Indian investors in Australia with interests in mining and associated infrastructure. One of Adani Group's interests in Australia is the Abbot Point Coal Terminal, the most northerly bulk coal port on the east coast of Australia. AAPT subleases the land and fixtures for the Terminal from a Holding Trust (Mundra Port Holdings Trust ("MPHT")) which holds a 99 year lease from the Queensland Government.

Both MPHT and AAPT are ultimately owned by Adani. AAPT enjoys long term contracts to handle coal from mines whose ultimate parents are some of the world's biggest mining companies, many of which are investment grade. Please click here for the detailed research report.

The bonds pay a fixed coupon of 6.10% p.a and is currently offered at a slight premium of around $101, representing a 5.9% yield to maturity. The bonds have a final maturity date of 29 May 2020. FIIG was the Sole Lead Arranger for this transaction with the bonds available only to wholesale investors and initially in minimum subscription amounts of $50,000. However, now that trading has commenced the bonds can be transacted in $10,000 face value minimum parcels.

These AAPT bonds represent the ninth issue FIIG has brought to our clients and we will to continue to bring exclusive offers in the fixed income asset class going forward.

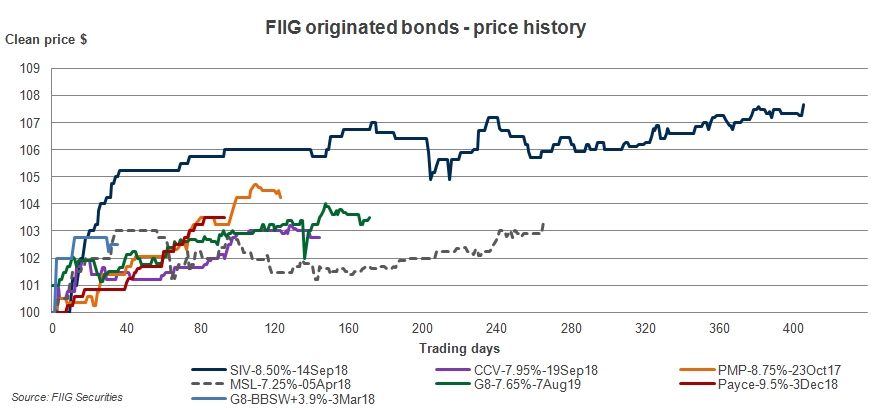

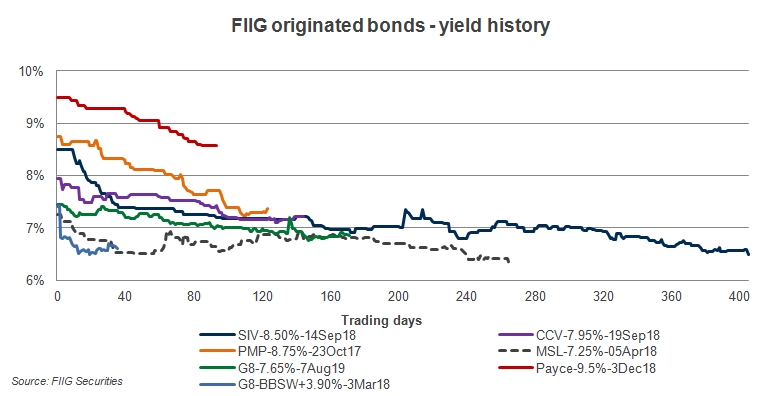

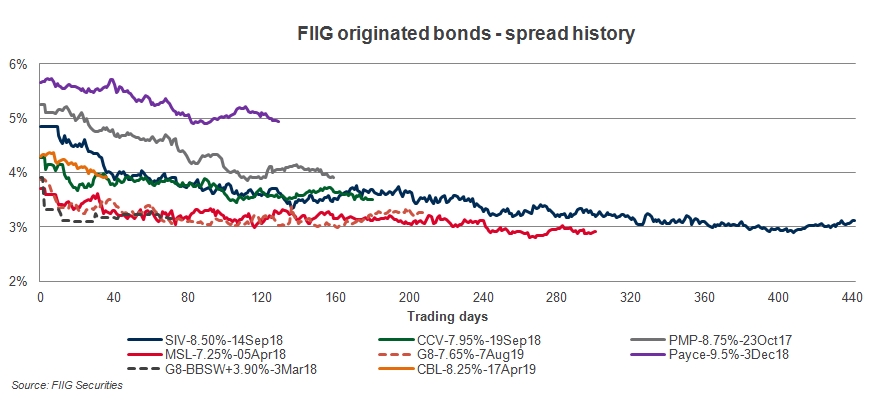

The following charts demonstrate the price, yield and spread performance of the eight previous FIIG-led deals from inception to 2 June 2014, as a function of trading days since issue.

Figure 1

Figure 2

Figure 3

For further information regarding this issue or to inquire about secondary trading of the AAPT bonds, please contact your FIIG representative. FIIG will receive fees from the Issuer of the AAPT bonds.