Last week Infrastructure New South Wales (INSW), a body established under the Infrastructure NSW Act 2011 to prepare a 20 year State Infrastructure Strategy, released its report “First Things First – The State Infrastructure Strategy 2012-2032”. The report, and the body, was designed to take a helicopter view of the infrastructure requirements of the state, prioritising competing demands across government departments to ensure the state achieved ‘bang for their buck’ in ongoing infrastructure spend. The body has also sought to align priorities with those of the equivalent Federal body Infrastructure Australia in order to maximise Federal funding for appropriate infrastructure projects.

The winners

Whist the report is wide ranging, covering all forms of infrastructure including social infrastructure, there are clear winners and losers coming out of the report. The winners, certainly in the first 10 years of the strategy, are Sydney’s (and NSWs) international gateways, Sydney Airport and Port Botany.

With INSW forecasting passenger trips to Sydney Airport to almost double to 79m in 2029 from a current level of 40m and Port Botany container trade in increase to 7m TEU by 2032 from 2m TEU currently (a TEU is the unit of volume used by the container freight industry, Twenty-foot Equivalent Unit, akin to a standard-sized container), a significant focus of the report is on improving the flow of this potential increase in traffic.

INSW noted that both Port Botany and Sydney Airport had considerable scope to increase through volumes with existing assets, and in fact meet these significant growth expectations from existing capital programmes. As such, the report focused on the ‘landside’ needs to meet these volume increases, INSW noting;

The most pressing infrastructure, Sydney’s gateways, is to ensure efficient landside transportation, rather than developing new capacity.

Whilst there were certainly other ‘winners’ coming out of this report, including:

- Rural rail trade routes, where infrastructure improvements should drive increased speeds and volumes of bulk rail transport throughout the state

- CBD bus users, where a tunnel system similar to the one in Brisbane should take buses off the streets allowing more efficient movements under the CBD

- University of NSW students, who should benefit from more efficient public transport in the form of light rail to their campus

- Flood mitigation projects

- Better connection throughout the Sydney (and beyond) ring road system including the missing pieces from the motorways (the F6 and F3 connections)

Without a doubt, the real winners were Sydney Airport and Port Botany.

The losers

In a world of scarce resources, there will also be losers. Whilst there will be any number of specific projects, lobby groups and communities which will feel short changed by the report, the three headline ‘losers’ for me were:

- The proponents of a second rail crossing as proposed by Transport for NSW’s June 2012 report “Sydney Rail Future” with INSW preferring to avoid the massive costs involved in a second crossing, focussing instead on improving flows on the existing lines

- Clover Moore, Lord Mayor of Sydney and proponent of light rail on George Street, with INSW ruling out light rail on both a cost and appropriateness of function basis, making state funding for the project unlikely

- Public transport users, with the level of government subsidies to public transport highlighted as an area of concern. The flip-side being that some of the infrastructure spend advised, including the CBD bus tunnel, should improve services

- If roads were a ‘winner’ than those in the community who are against the expansion of motorways, and vehicle use must also be a ‘loser’

How is Sydney Airport a ‘winner’?

Sydney Airport and Port Botany are a major focus of the report, however there are a number of specific infrastructure projects designed specifically to improve service and volumes, to Sydney Airport. The two most direct projects and the two with the most scope to improve service to the airport are the M4 Extension and M5 East Expansion. The M4 Extension with the M4 motorway to the airport will better connect Sydney Airport to the Western suburbs via Parramatta. The expansion of the M5 East, which also services the airport, should remove congestion. These two major road projects are listed as the top priorities for the improvement of Sydney’s road network, and will have benefits beyond the service of Sydney Airport and Port Botany.

Beyond these two headline projects, there are a number of smaller projects directed at improving traffic flow to and from the airport. These include

- The removal of ‘pinch points’ including the conversion of Bouke Road and O’Riordan Street to a one-way system

- A reduction in airport station usage fees, which should see the cost of travelling by rail to the airport decrease with INSW highlighting the comparatively low level of rail usage to and from Sydney Airport compared to other international hubs. Costs of this would likely be made up elsewhere in the airport’s fee structures

- Increased bus services (and more efficient flow of busses once at the airport)

Second Sydney airport

I have previously discussed my views of a second Sydney airport in the context of Sydney Airport bondholders in The Wire article ‘Sydney’s second airport gets a run again’, and many of these arguments were raised in INSWs report.

INSW notes that there are some arguments for the development of a second airport in the Sydney basin in the late 2020’s. The report notes that under the ‘Joint Study on Aviation Capacity for the Sydney Region’ released by the Commonwealth and NSW governments in 2012 that the need for a second airport arises in 2027 under the ‘no change’ scenario. This study does not take into account improvements in efficiencies proposed by Sydney Airport, from both improved usage of assets and increased volumes from larger planes. Sydney Airport believes its growth capacity goes beyond 2030 based on incremental changes to existing facilities, aircraft capacity and operational practices.

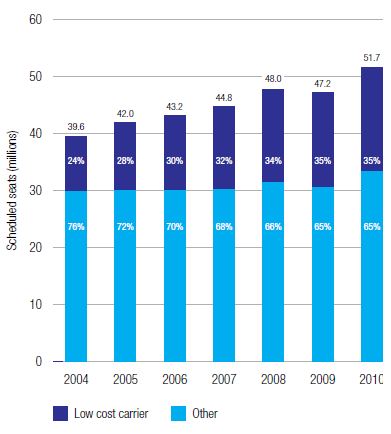

INSW notes that with a population of 2 million in Western Sydney and the increase in volumes of low cost carriers operating in Sydney Airport, shown in Figure 1 (and the propensity of low cost carrier passengers to be prepared to travel further to receive cheaper airfares as shown by Melbourne’s Avalon airport) that there is the need to prepare for the eventuality of a second airport in the Sydney basin. As such, INSW suggests the continued setting aside of land at Badgery’s Creek, the body’s preferred site for a second airport, with the RAAF base at Richmond a possible stop-gap solution during its construction.

Sydney region - Low Cost Carrier share of scheduled seat capacity 2004-10

Source: Infrastructure New South Wales; Booz & Company

Figure 1

Whilst INSW noted the possible need for a second airport in the future, no airport projects, nor connection roads, rail extensions or other ancillary infrastructure were highlighted for consideration throughout the report covering the State’s infrastructure strategy through to 2032. This is in line with the lack of any infrastructure relating to a second airport in the equivalent Federal body, Infrastructure Australia’s ‘Infrastructure Priority List’. With the second airport not listed as a priority by the bodies in place to direct the infrastructure spend of the Federal and State governments, it fails to provide an immediate risk for Sydney Airport bondholders.

Funding

The First Things First report highlights around $30bn in infrastructure projects with a significant amount of this funding to come from sources other than additional state government expenditure, in part to protect its AAA credit rating. Whilst specific values are not allocated to the sources of the funding, INSW highlights six funding strategies designed to deliver the infrastructure within the current budgetary framework:

- Tolls on new and upgraded motorway links, user pays will be a key provider of finance, and whilst recent toll roads have proved troublesome on the back of inaccurate traffic forecasts, INSW sees the brownfield nature of some of the upgrades in addition to decent basis for the development of greenfield traffic numbers on other roadways as providing some comfort to providers of equity. Not ignoring recent issues, INSW highlights that there may need to be some ‘risk-sharing’ in traffic numbers from the government side, which may take the form of ramp-up periods or other innovations

- Funding from asset sales and other windfall gains would be used to fund projects. With the current government having ruled out major electricity distribution sales (which were specifically highlighted in the INSW report as a likely source of significant funding), it is likely the O’Farrell government would seek a mandate at the next election for the sale of electricity distribution assets, with the trade-off for voters being a specific list of infrastructure projects for which the proceeds would fund

- Reduction in the current level of public transport subsidies, returning fare increases to in-line with regulatory determinations

- Limited reprioritisation or existing capital works, whilst INSW notes this would provide only limited funding, it is inevitable that any change in infrastructure strategy will provide the opportunity to switch funding from projects no longer favoured

- Commonwealth contributions for projects that align with Infrastructure Australia’s key themes, with INSW highlighting the need to achieve better funding outcomes for the state by ensuring projects align with Infrastructure Australia’s priorities

- Value capture from beneficiaries of new infrastructure, INSW noted that where there are direct benefits to third parties as a result of infrastructure spend. The government should seek to recover some of the cost of the infrastructure providing the benefit

INSW also highlighted a number of other issues present in markets currently which may help or hinder funding of significant infrastructure spend including:

- Failure of recent toll road projects and the likely reluctance of equity holders to trust investing in these projects again

- The need for the public-private partnership model to evolve, taking into account what has worked and hasn’t worked in these partnerships in the past

The issues highlighted that the NSW government are taking account of the changing circumstances in equity and debt markets which have occurred over the past five years. They also confirm the need to move on from what was achievable for the government in the past regarding major project funding and recognise the reality of the more difficult circumstances at present.

Sydney Airport bonds

Whilst we note that this is just a report, and that putting it into action (or not) is the remit of the NSW Government, we see a lot of positives for Sydney Airport. Further, we continue to see Sydney Airport inflation linked bonds as providing some of the best value in the market currently. With the Sydney Airport 2020 maturities offering inflation linked returns of CPI + 440bps and the 2030 maturities offering CPI + 475bps, long term value remains for investors in this premium infrastructure asset.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.