by

William Arnold | Nov 11, 2014

Unrated and high yield bonds offer a significant opportunity for Australian investors, but like always, higher return means higher risk. While bank deposits currently pay interest rates of little more than 3% per annum and rated bonds 6% or less, unrated bonds from quality Australian issuers can yield anywhere between 5.5% to 9.5% and if capital gains are included have typically had annual holding period returns in excess of 10% in recent years. High yield investments however come with higher risks than traditional investment grade bonds, notably greater volatility, the possibility of lower liquidity in a stressed market and a higher risk of default. To compensate for such risk, investors generally can expect at least 150 to 300 basis points greater yield in high yield bonds compared to investment grade bonds at any given time.

Investors can endeavour to manage the risks in high yield bonds by diversifying their holdings across issuers, industries and regions, and by monitoring each issuer’s financial health. Further to this, high yield bonds typically have a lower correlation to investment grade fixed income sectors, such as Treasuries and highly rated corporate debt, which means that adding high yield securities to a broad fixed income portfolio may enhance portfolio diversification. Diversification does not insure against loss, but it can help decrease overall portfolio risk and improve the consistency of returns.

Prior to making any investment decision, it is important to understand the risks well and be comfortable that you are being adequately rewarded. The risk analysis process includes issuer and bond specific analysis, and well as broader market considerations.

The process is similar to one that the rating agencies undertake which is to approximate the probability of default and loss given default. Additional considerations of market value, interest rate (duration) and liquidity risk are also important. And as with any good investment portfolio, diversity is key.

Fundamental credit analysis

Credit risk is the risk you won’t receive interest and principal when it's due. Credit analysis follows a “top down” approach starting with the environment in which the company operates, then the business itself and finally the specific bonds or securities. Analysis is both qualitative and quantitative and includes assessing:

- Country of domicile: legal, political and economic conditions

- The industry: business cycles, changes in consumer preferences, changes in technology, barriers to entry, competition and regulation

- Business risks: competitive position/market position, business stability, regulation and diversity

- Management: corporate strategy, risk tolerance, funding and dividend policies, corporate governance and track record

- Financial analysis: understanding debt obligations and the issuer’s ability to repay them as well as the issuer’s ability to withstand financial shocks. Access to liquidity and funding (both debt and equity) and in particular how the company will refinance the high yield bond in questions, are key considerations

Bond structure

It is important to understand where the investment ranks in the capital structure and whether it has any priority claim to cashflows or assets (and the extent and type of assets). Items to consider include:

- Seniority in company capital structure and “pecking order” in a winding up

- Where the issuing company is placed within a Group structure. The closer the lender/bond is to the assets, the better. If bond investors must rely on the up-streaming of dividends from a subsidiary for repayment of interest and principal, this is a weaker position than the issuing entity owning those cash generating assets itself. This is termed “structural subordination”

- Are there any Guarantors? This will typically be present when the bond is issued from an entity that does not hold the majority of the Group’s assets

- Change of control investor put option

- Mandatory pay conditions

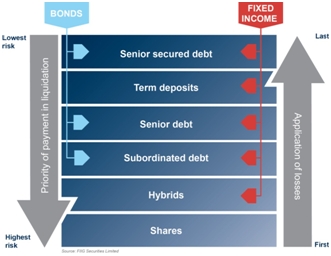

The following chart illustrates the capital structure and the priority of payment or application of loss. The point in the capital structure and extent of prior ranking debt (and/or creditors) has a significant bearing on the likely loss in a default scenario. So does the type of assets a company holds with hard assets such as property generally more valuable than intangible assets such as goodwill or management rights.

Source: FIIG Securities

Bonds are issued at three different levels in the capital structure: senior secured, senior unsecured and subordinated debt. Typically, FIIG originated bonds are classed as senior unsecured debt, ranking above shareholders, or hybrid securities.

Covenant structure and bondholder protections

High yield bonds usually contain additional protection for bondholders. The following are typical covenants together with examples from FIIG-originated deals.

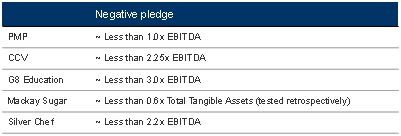

1. Negative Pledge: Restricts the level of additional secured debt that can rank ahead of the notes. This determines the extent of subordination.

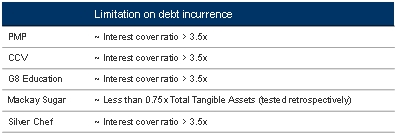

2. Limitation on new debt: Total debt that can be incurred will be subject to a pre-agreed level. As with the negative pledge covenant, this covenant is only tested if extra debt is issued and covers all levels of debt, being senior secured, senior unsecured and subordinated debt. This limitation is typically addressed via an interest coverage ratio that takes EBITDA (or occasionally EBIT depending on the industry) and divides it by the total interest on all borrowings.

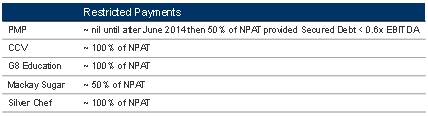

3. Restricted Payments: This covenant restricts the ability of the issuer to distribute payments outside of the group to shareholders and prohibits paying special dividends or conducting share buybacks. It also limits the level of ordinary dividends to a pre-agreed percentage of the issuer’s net profit after tax for the prior year (i.e. they can only pay what they have earned and reported).

4. Event of default: Provides investors with the right to enforce (i.e. wind-up the business) if a certain action does or doesn’t occur. Banks (secured lenders) generally do not like these as they provide investors lower in the capital structure the ability to impede the bank’s security position.

5. Non-payment of coupon and or principal: All ongoing obligations for payment of coupons and principal are pari passu with bondholders and will be an Event of Default if not paid. The senior secured lenders receive a priority payment only in the event of a wind-up.

6. Cross default: Provides senior unsecured investors protection through effectively ‘piggy backing’ off the secured (bank) debt covenant package.

7. Non-compliance with covenants: Provides investors protective measures if an issuer does not comply with pre-agreed terms.

Note that the covenant tests tend to be different for “asset backed lends” such as Mackay Sugar compared with “cash flow lends” for the other companies as detailed in the examples above.

Broader issues to consider

Liquidity: Liquidity risk arises from situations in which a party interested or in need of selling an asset cannot do so because nobody in the market wants to trade that asset at that point in time. Liquidity risk is typically reflected in unusually wide bid-ask spreads or large price movements (especially to the downside). Manifestation of liquidity risk is very different from a drop of price to zero (where the market is saying that the asset is worthless). Liquidity risk can potentially be only a problem of market participants finding each other. This is why liquidity risk is usually found to be higher in emerging markets or low-volume markets.

It is also greatest in time of high market stress, such as the GFC. Institutional investors in particular stopped buying immediately after the GFC, meaning that liquidity was very scarce and any investor needing to sell was forced to accept losses or even find that there were simply no buyers.

Risk-averse investors naturally require higher expected return as compensation for liquidity risk. As with interest rate risk (detailed below), this is less of a concern for hold to maturity investors or those who have other, more liquid assets in their portfolio that can be used should unexpected or emergency funds be required. In this regard, the importance of a diverse investment portfolio, not just by asset type but also by liquidity, is an important consideration.

Interest rates (or duration): Interest rates impact the value specifically of fixed rate bonds which fall in price when interest rates rise (and vice versa). While rising interest rates negatively affect fixed rate bonds, the price will drift towards par as the bond approaches maturity. So for investors intending to buy and hold to maturity, this is of less concern. They still have the certainty of fixed coupon payments and the return of their capital at maturity.

Early call options: Most FIIG-originated bonds give the issuer an option to redeem (or “call”) at specified dates prior to maturity, a possibility that investors should be aware of when assessing the relative value of the various bonds. For full information on this please see ”FIIG-originated bonds and early call options - how to assess the value”.

Market risk: Unexpected conditions (i.e. economic, political) can have a negative impact on the returns of all investments within a particular market. General movements in local and international stock and credit markets, prevailing and anticipated economic conditions, investor sentiment, interest rates and exchange rates could all affect the market value of investments.

Diversification: Failure to adequately diversify between companies, industries and asset sectors can significantly increase risk. Correlation increases risk while diversification reduces risk. When looking to the unrated, high yield bond market where the various risks are higher, the importance of diversification is magnified. A balanced portfolio should have an allocation to cash, high quality investment grade bonds and a smaller, more diverse allocation to unrated high yield bonds (and other assets as circumstances require).

One of the keys to high yield bond investing is diversity: across issuers, sectors and the various other risks. Professional high yield fund managers will spread the risk across many bonds so that a potential value or liquidity issue or even default from a particular bond is small in the context of the overall investment portfolio. Moreover, any loss should be more than offset by the excess returns made on the remaining performing bonds in the portfolio.

Conclusion

High yield bonds are obviously attractive and can have a place in an investment portfolio if the risk/reward payoff is suitable for your circumstances. When FIIG originates a bond, it conducts due diligence, and structures the investment seeking to match the return to the risks involved, and the market’s demand for the investment. While not every deal is suitable for every investor, it is beneficial to have access to these investments just like investors in other countries where bonds are an integral part of most portfolios.

Diversity is also of utmost importance as risk profile increases and investors must consider this not just by asset type but also by industry sector, issuer, interest rate/payment type (fixed, floating or inflation linked), liquidity, capital structure and various other measures.

Note: FIIG-originated bonds are only available to wholesale investors at first issue. Silver Chef, Mackay Sugar, Cash Converters, G8 Education fixed rate bonds and PMP are now available to retail investors.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.