by

Ekaterina Skulskaya | Jan 28, 2014

Key points:

- According to Bloomberg data, a total of A$79.5n debt was issued domestically in 2013.

- As the US continued to offer cheap funding opportunities, significant issuance of US$101.59bn (US$116.82bn for FY 12) in public and private placement deals were achieved; 1.3 times more than that issued in the domestic market

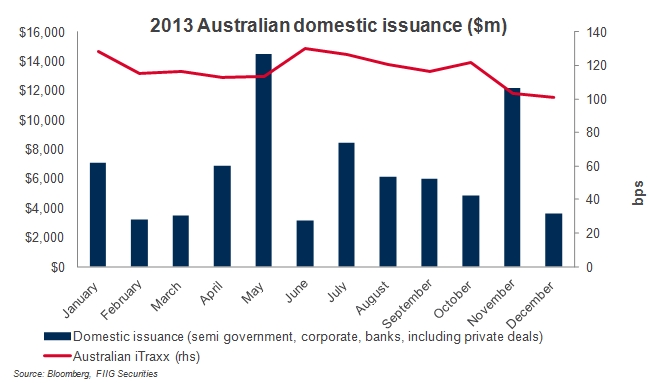

Issuance activity in the debt capital markets varied throughout the year with 2Q13 contributing the most to volumes. According to Bloomberg data, a total of A$79.5n debt was issued domestically in 2013 (by Australian entities in AUD currency), including Australian government and private placements. Domestic issuance was lower than 2012 and totalled A$79.5bn compared to A$87.4bn in 2012. The lowest volume was recorded in June (A$3.132bn) when credit spreads (Australian iTraxx Index) were highest, as depicted by the red line in Figure 1. Issuance remained modest throughout 3Q13 until sentiment in financial markets improved and the Australian iTraxx tightened to around 100bps. The last quarter finished on a high note, recording the second biggest value of deals (A$20.59bn) for the year. November 2013 recorded the second largest monthly issuance volume of A$12.15bn for the year, A$2.36bn less than May 2013 (see Figure 1).

Figure 1

Activity in the RMBS market was better in 2013 compared to 2012 and 2011. Overall, 2013 RMBS issuance totalled A$25.96bn (Australian tranches only) well ahead of 2012 with A$15.49bn and 2011 with A$22.08bn issued. 3Q13 recorded the largest volume of RMBS on issue (A$9.21bn) in the market in 8 transactions. The biggest issuers for 2013 were Commonwealth Bank of Australia (Medallion Trust) with A$5.75bn, Westpac Banking Corporation (WST) with A$4.35bn, Macquarie (PUMA) with A$1.25bn, Resimac (Resi) with A$1.22bn and Apollo Trust with A$1.15bn.

Australian financial institutions and corporations remained active in offshore markets. According to Bloomberg, international bond sales in major currencies were lower throughout the year with a total of A$132bn compared to A$149bn in 2012 (see Table 1). As the US continued to offer cheap funding opportunities, significant issuance of US$101.59bn (A$116.82bn) in public and private placement deals were achieved; 1.3 times more than that issued in the domestic market. Among the largest USD dollar denominated issuers were Commonwealth Bank of Australia (CBA) with A$16bn, Macquarie with A$8.99bn, Australia and New Zealand Banking Group (ANZ) with A$7.36bn and BHP Billiton with A$5.36bn. However, Euro and GBP issuances were well below US$ issuances with A$25.58n and A$6.22bn volumes respectively throughout the year. The biggest issuers of Euro denominated bonds were: ANZ which raised A$3.84bn, National Australia Bank (NAB) with A$4.04bn, Commonwealth Bank of Australia (CBA) with A$1.92bn and Macquarie with A$1.04bn. Twelve deals were issued by Australian companies in Great British pounds totalling equivalent A$6.22bn. CBA was the largest issuer with A$1.701bn; NAB and ANZ followed the lead with A$1.62bn and A$1.21bn respectively (see Table 1).

Table 1