by

Justin McCarthy | Aug 13, 2013

AXA SA (AXA) has reported yet another solid result for the 1H13 results (to 30 June 2013).

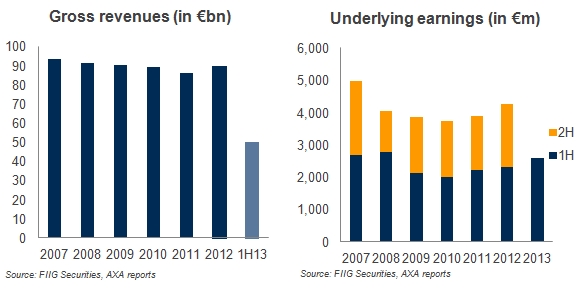

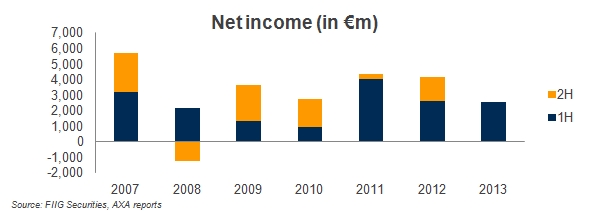

Net profit after tax was €2.5bn for 1H13, down 3% from 1H12. However, underlying earnings were strong at €2.6bn, up 14% over the same period. As the charts below demonstrate, AXA’s underlying profitability has remained remarkably stable, albeit with little growth, since the GFC and still below 2007 pre-GFC levels.

Key figures from the 1H13 result included:

- Total revenue up 3% to €50bn

- Underlying earnings up 14% to €2.6bn

- Net profit after tax of €2.5bn, down 3%

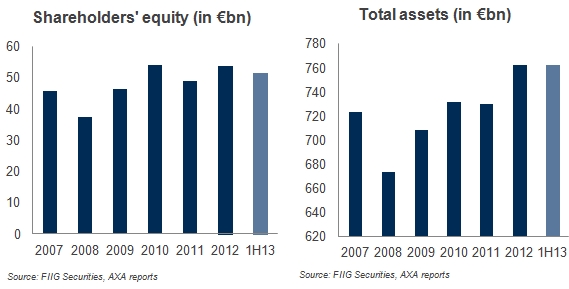

- Total equity of €51.5bn, down from €53.7bn as at FY12 mainly due to a reduction in the value of hold to maturity fixed income investments of €2.5bn, as yields rose over the half year. These “fair value” adjustments are reflected in shareholders equity rather than the P&L. Currency fluctuations also accounted for a €1.0bn reduction in equity over the six months. Net profit added €2.5bn less €1.7bn paid out in dividends

- Total assets up were stable at €762bn

- Solvency I ratio remains strong but was down from 233% at FY12 to 218% due to revaluation and currency impacts detailed above. AXA holds €29bn in excess capital over regulatory requirements

- Gearing ratio was stable at 26% with a target of 25% by 2015. Very strong interest cover of11.6x versus 9.3x for FY12

The following charts plot a number of these key measures over the past six and a half years.

Notwithstanding the solid operational performance, the focus for AXA debt investors remains the balance sheet and in particular the large €664bn investment portfolio (or €476bn after allowing for unit-linked contracts that are not the risk of AXA per se).

As with broader investment markets, the performance of AXA’s investment portfolio has been solid over the last six months, although as reported above there has been a reduction in the unrealised gains on investments of €2.5bn, accounted through shareholders equity. Rising bond yields on the back of expected QE3 “tapering” have reduced the value of (non-cash) unrealised gains in the predominately fixed income/government bond investment portfolio.

A material increase in outright interest rates and bond yields does pose a risk for further non-cash reductions in value. However, strong shareholder’s equity levels and Solvency I ratio do provide comfort. Further, such an increase in yields would see short term pain but long term gain via higher investment earnings.

Despite the benign past six to 12 months, AXA remains exposed to European macroeconomic risks, particular via large holdings of sovereign, bank and corporate bonds from Europe and especially Italy and Spain.

If US and/or European growth continues to remain sluggish (and by implication interest rates and long term yields remain very low), there is also a risk that the carrying value and goodwill of a number of businesses may need to be reduced. Such action could result in a loss and a reduction in the total equity buffer in the balance sheet. Inflation and/or rising interest rates could also pressure fixed income valuations and lead to downward adjustments taken via shareholder’s equity.

AXA will perform best if the markets are somewhere in-between these two extremes.

Conclusion

AXA’s results and balance sheet remain sound, with yet another half year of relatively stable profitability. But as has been the case since the GFC, the risk for AXA remains the macroeconomic environment.

We will continue to monitor the economic developments and their impacts on valuations and investment holdings. It is these aspects as opposed to the general day to day insurance operations that presently hold most of the credit risk.

As such we expect AXA to continue to trade in line with sentiment related to European economic conditions (or “risk off” versus “risk on”) in the medium term.

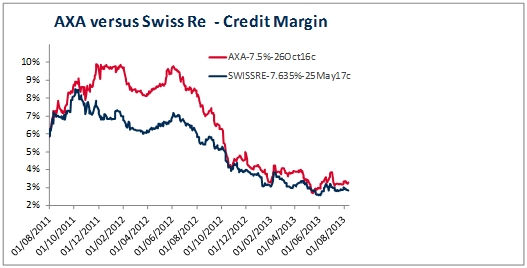

In relation to the AXA Tier 1 hybrid securities, we believe that the price (or credit spread) has outrun the fundamentals. Reward does not fully compensate for the risk.

Growing uncertainty with respect to future regulation of AXA under Solvency II, and the implications for calling step-up securities such as the AXA Tier 1 hybrid securities, saw us revise downward our probability of call for AXA Tier 1 hybrid securities in late 2012. Whilst we still believe they will more than likely call on reputational grounds, the expected regulatory incentives we were looking for under Solvency II may not eventuate. Many commentators are now suggesting Solvency II may not come into force until 2018, well and truly after the first call date of October 2016 for the A$ AXA Tier 1 hybrid.

Against this background, the price of the AXA Tier 1 hybrid securities has rallied extremely hard over the past year with all “high beta” credits and we suggest clients take profits and reduce their exposure to AXA.

From a risk/reward basis, we have a significant preference for Swiss Re Tier 1 hybrids which are rated four notches high that the AXA equivalent. The following chart demonstrates the spread differential over the past two years between the two fixed rate A$ Tier 1 hybrid securities with the present situation showing just a 39bp difference despite the significant gap in risk.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Both AXA and Swiss Re Tier 1 hybrid securities are only available to wholesale investors.