by

Justin McCarthy | Feb 25, 2014

Key points:

- AXA FY13 results consistent as always with NPAT of €4.5bn

- European macroeconomic risk has subsided

- AXA Tier 1 securities seen as “fully priced” and remaining investors should consider whether to take profits, remove call risk and rebalance portfolios

AXA SA (AXA) reported their full year results to 31 December 2013 (FY13) last Friday with a headline net profit after tax (NPAT) of €4.5bn, up 10% on the previous year but slightly short of market consensus estimates of €4.7bn.

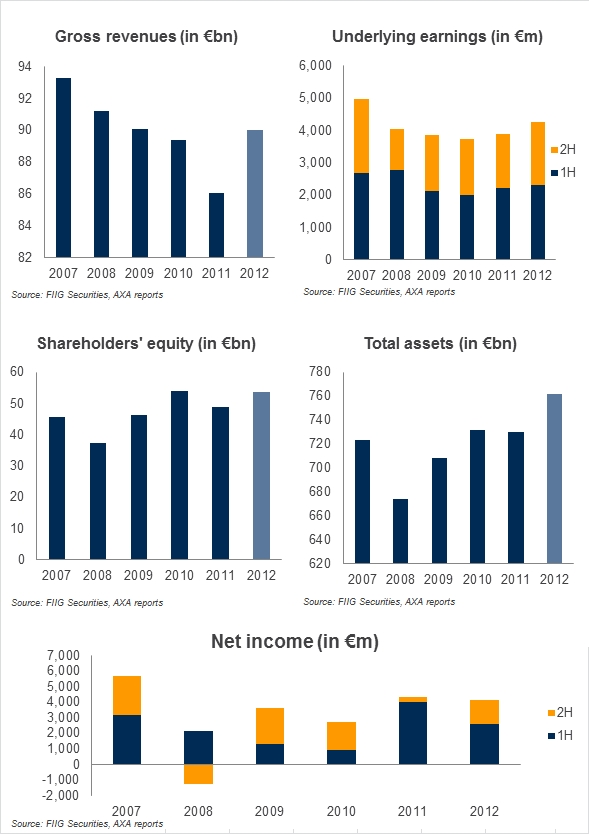

Key figures from the FY13 result included:

- Total revenue up 1% from the previous year to €91.2bn

- Underlying earnings up 14% to €4.7bn

- NPAT of €4.5bn, up 10% (but slightly short of market consensus estimates of €4.7bn)

- Total equity was down 1% to €55.3bn (compared with a current market capitalisation of €47.5bn)

- Total assets were down less than 1% to €757.4bn

- Solvency I ratio fell from 233% at FY12 to 221% at FY13

- Gearing ratio of 24%, down from 26% at FY12 and 27% at FY11. Having already reached their 2015 target for gearing to be 25% or below, the company stated that they are now targeting a gearing level of 23% - 25%

- Increased dividend by 13% to €0.81 per share following a 4% increase in dividends for FY12

The following charts plot a number of these key measures over the past six years and demonstrate the relatively stable nature of AXA’s underlying business.

Conclusion

Conclusion

While the key risk for AXA over recent years (the boarder macroeconomic environment in Europe) has subsided, we continue to believe that the Tier 1 securities (in various currencies) are fully priced, particularly the fixed rate securities that are trading at a premium.

With more stable economic conditions, the current risk/reward assessment for AXA centres on:

- Call risk (both early and late – see the article ”Credit Suisse calls Tier 1 hybrid early” , also is this week’s edition of The WIRE)

- The fact that the Tier 1 securities sit on the cusp of non-investment grade (currently BBB- stable outlook) with any downgrade, albeit not expected, likely to result in forced selling and price declines.

As a generalisation (and there will be exceptions), callable securities are best purchased at a discount and sold at a premium, as they will only ever be redeemed at par.

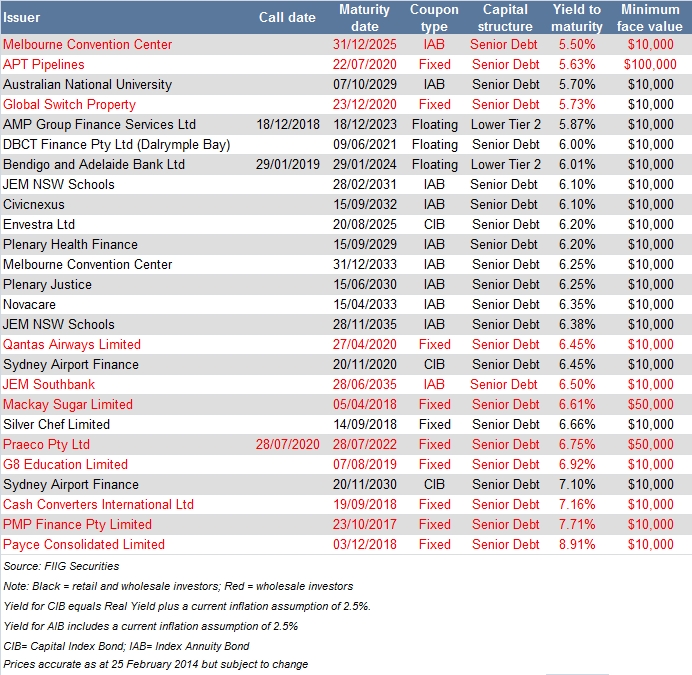

As with Swiss Re, investors should consider the balance of their portfolio with regards to AXA specifically and insurance and callable securities in general and if appropriate look to take profits, remove or reduce call risk and re-balance portfolios, remembering that many bonds are now available in parcels as small as $10,000, allowing for greater diversity of holdings.

The following table lists a number of alternative investments:

Table 1

For further information on AXA or alternative investments/portfolios, please contact your local dealer.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. AXA Tier 1 securities are only available to wholesale investors.