by

Elizabeth Moran | Sep 10, 2013

One of the key terms for Australian fixed income investors is the Bank Bill Swap Rate or more commonly referred to as BBSW. While BBSW has many uses, for fixed income investors its main relevance is as a benchmark upon which we evaluate floating rate bonds or investments.

BBSW is simply the short term swap rate. In Australia, BBSW is the term used for interest rate swaps of six months or less and anything longer dated than six months is simply referred to as a swap rate.

A swap rate is a proxy for the rate at which banks are indifferent between receiving a fixed and a floating rate of return. It also incorporates a banking sector risk premium over and above the risk free rate (i.e. government bonds) to reflect the chances of a bank defaulting and being unable to fulfil its obligations on the swap.

Using a very simple example which ignores bank sector risk, if interest rates are currently 2.50 per cent and are expected to rise by 50 basis points (1 basis point = 0.01%, so 50bps = 0.50%) in six months and then remain unchanged, the one year swap rate would (theoretically) be the average over the year i.e. 2.50 per cent for six months plus 3.00 per cent for six months = average 2.75 per cent. The one year swap rate would be 2.75 per cent.

Usually the risk assigned to the banking sector is small (say 5bps to 15bps), however, in the midst of the Global Financial Crisis, the US equivalent of BBSW, USD LIBOR saw bank risk premiums in excess of 400bps.

Officially, BBSW is a compilation and average of market rates supplied by up to 14 domestic banks in regard to the specific maturities of bank bills. In other words, it is the rate at which banks will lend to each other (via bank bills). It is calculated for various maturities, at 10am each business day, and compiled by Australian Financial Markets Association (AFMA). The purpose of the BBSW is to provide independent and transparent reference rates for the pricing and revaluation of Australian dollar derivatives and securities.

According to AFMA, the spread in BBSW panellist contributions used after trimming the highest and lowest submissions is very small. For the first nine months of 2012, all accepted submissions were within 1 basis point. Even during the GFC over 95 per cent of days had accepted submissions within 1 basis point. AFMA has a number of checks and balances in the system to ensure integrity of BBSW.

The 90-day BBSW is often referred to as the reference rate for market interest rates and, in particular, is used as a benchmark interest rate for floating rate bonds and other floating rate financial instruments such as hybrids.

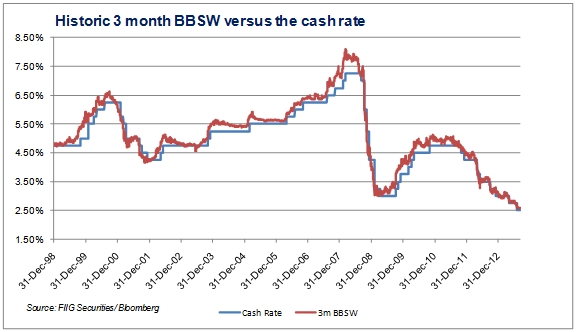

There is a strong correlation between changes in the cash rate and the impact on the BBSW, as demonstrated in the chart. It must be noted, however, that other factors, in addition to changes in the official cash rate, impact on the market rates charged by banks and other financial institutions.