by

Justin McCarthy | Aug 12, 2014

Key points

1. Bendigo and Adelaide Bank Limited (Bendigo Bank) announced its full year results to 30 June, 2014, on Monday with a headline net profit after tax of $372m, up almost 6% from the previous year.

- Despite the solid results we believe the Bendigo Bank 29 January 2024 (callable 29 January 2019) subordinated floating rate notes (FRN) issued earlier this year have rallied strongly and are now “fully priced”.

3. Investors may consider switching into higher rated, superior structure (“old style”) subordinated bonds from issuers such as National Wealth Management at similar credit margins. Alternatively, investors may consider inflation linked bonds (ILBs) such as the Sydney Airport 2020 or 2030 bonds which may provide superior performance in the current low interest rate, but relatively high inflation rate environment which benefits ILBs over FRNs.

Bendigo and Adelaide Bank Limited (Bendigo Bank) announced its full year results to 30 June, 2014, on Monday.

The full investor presentation can be viewed by clicking here

Bendigo Bank reported a solid net profit after tax of $372m, up 5.7% from a year earlier. Underlying cash earnings (which ignore one-off items) were up almost 10% on the previous year at $382m and both beat market consensus estimates.

The key features of the results were as follows:

- The bank increased its net interest margin by 5bps from 2.21% to 2.26%, a notable achievement in an increasingly competitive lending market. This was achieved with a combination of considered loan growth (6% versus system growth of 7.25% in 2H14) and cheaper funding as margins on term deposits and securitisations fell.

- Bendigo Bank in particular has been a beneficiary of lower competition in the deposit market, with approximately 80% of its total funding in the form of deposits versus around 60% for the ‘Four Majors’.

- The recently announced settlement of the disputed Great Southern managed investment scheme loans (subject to court approval) is also viewed as a positive development.

- Common equity Tier 1 ratio (CET1) improved from 7.82% to 8.73% from 30 June, 2013, to 30 June, 2014, due to $380m of equity and $300m of subordinated debt raised after the announcement of the Rural Finance Corporation of Victoria acquisition. However, with the acquisition settling on 1 July 2014 and the assets coming onto the balance sheet, the pro-forma CET1 is more accurately displayed at approximately 8.02%.

- While the bank was impacted by some large one-off bad debts, particularly in the rural/cattle farming sector in 1H14, asset quality is considered sound and well provisioned. Further, non-performing loans as measured by the percentage of loans in arrears past 90 days, is trending downwards.

Relative value summary

Overall, the solid Bendigo Bank FY14 result reflected the improving market for retail banks, particularly lower deposit and securitisation funding costs. The improvement in net interest margins and restrained loan growth, in an increasingly competitive residential home loan market, provide comfort. As does the statement made by Managing Director Mike Hirst in the results release that “we do not pursue growth for growth’s sake.”

Notwithstanding the positive result, the Bendigo Bank 29 January 2024 (callable 29 January 2019) subordinated floating rate note (FRN or bond) has rallied strongly since it was launched just over six months ago and is now considered “fully priced”.

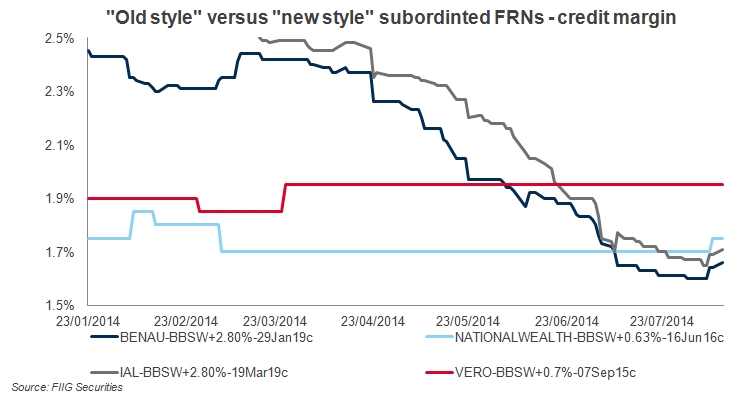

As the chart below of credit margin on a selection of subordinated bonds demonstrates, the market has seemingly forgotten about the “old style” subordinated debt of issuers such as National Wealth Management Holdings (a wholly owned subsidiary of NAB and parent of MLC) and Vero Insurance (a wholly owned subsidiary of the Suncorp Group). The subordinated bonds of these issuers are superior to the “new style” subordinated bonds of Bendigo Bank and to a lesser extent Insurance Australia Limited (IAL), a wholly owned subsidiary of IAG Limited, across three important credit measures:

- The National Wealth Management Holdings 16 June 2026 (16 June 2016 call) and Vero Insurance 7 September 2025 (7 September 2015 call) subordinated bonds have significantly shorter time to call date than the Bendigo Bank and IAL (19 March 2019 call) subordinated bonds, assuming all are called at first opportunity. The longer the term, the greater the credit risks.

- National Wealth Management Holdings and Vero Insurance are stronger credits that Bendigo and arguably IAL.

- Both the National Wealth Management Holdings and Vero Insurance subordinated bonds are “old style” step-up securities which are superior in structure to the “new style” Basel III-complaint subordinated bonds of Bendigo Bank and IAL. The latter are exposed to non-viability clauses and are also deemed to have materially higher call risk. (For further information on the additional risk of “New style" Basel III-compliant bank subordinated bonds click here)

Given these three important factors, the “old style” subordinated bonds should be trading at a credit margin below that of the smaller, higher risk Bendigo Bank subordinated bond. The strong rally in Bendigo Bank issue and inactivity in the National Wealth Management Holdings and Vero Insurance subordinated bonds has created an opportunity to reduce risk but maintain a similar credit margin. Further, there is market chatter of further “new style” subordinated debt issuance from a regional bank in the near term which could see some funds sell out of the well performed Bendigo Bank issue into the new, higher yielding offer.

The National Wealth Management Holdings 16 June 2016 call subordinated FRN in particular looks attractive on a risk reward basis given the similar credit margin but shorter term to call and superior credit quality, as an integral component of the broader NAB Group. While the Vero Insurance subordinated bond shows a higher margin, it has just over one year to run to call date and can be difficult to source.

Alternatively, investors may consider moving to inflation linked bonds (ILBs) such as the Sydney Airport 2020 or 2030 bonds which may provide superior performance in the current low interest rate, but relatively high inflation rate, environment which benefits ILBs over FRNs. The Sydney Airport 2020s are currently offered at an indicative annual return (or yield to maturity) of 5.70% and the 2030s at 6.31% (assuming an inflation rate of 2.5%). This compares to a current annual return (to call) on the Bendigo Bank 29 January 2024 (callable 29 January 2019) subordinated bond of under 5.0%.

The National Wealth Management Holdings 16 June 2016 call and Vero Insurance 7 September 2015 call subordinated bonds are both available to retail and wholesale investors in minimum (face value) parcels sizes of $10,000.

The Sydney Airport 2020 and 2030 ILBs are also available to retail and wholesale clients in minimum (face value) parcels sizes of $13,161 and $12,346 respectively.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.