Key points:

- The year will see the potential implementation of the Murray report as the main focus for the banking sector. The two major areas to impact the banks are the recommendations to hold top quartile levels of capital internationally and higher risk weightings on residential mortgages.

If implemented as Murray intends, this will see

- increased ordinary equity as Core Equity Tier 1 (CET1) capital, and

- residential mortgages become more capital intensive for the major banks, levelling the playing field for regional banks and over the longer term a likely rebalancing towards commercial mortgages.

- For income investors, the impact will vary across the capital structure with senior bonds, subordinated debt (Tier 2) and hybrids (Alternate Tier 1) the likely winners while equity returns will diminish.

- With the Australian economy facing headwinds, the other risk factor for the banks is the high levels of exposure to the residential mortgage market so you can expect the market to keep a close eye out for any weakness. However, with rates predicted to remain low for longer and two rate cuts forecast, the housing market is likely to be supported through 2015.

- FIIG continues to prefer the old style subordinated debt and hybrids as they offer a good source of income with lower expected volatility.

Bank outlook

The banking sector’s focus in 2015 will be on the Murray reforms and the political willingness to implement them. For the four major banks, the reform has the potential to increase capital requirements and change risk weightings which could change the longer term focus of the banks’ business. The reform is now in the hands of the Treasurer who has in turn stated that it is APRA’s call as the regulator of banks.

Further submissions will be gathered by Treasury through to March 2015 which will then be provided to APRA. APRA will also take into account changes in global banking regulation on risk weightings and bank capital levels before implementing any changes. All of this indicates that there are unlikely to be any changes until late 2015/2016 and given the importance of these reforms to the banks’ businesses you can be sure the banks are lobbying APRA and the government to tone down the recommendations.

To the reform, the FSI has made the following three key recommendations relating to the banks to reduce the probability and cost of failure:

- Increase capital levels so capital ratios are unquestionably strong; this requires the major banks to raise capital so they are in the top quartile globally. This has been estimated to require around 2.2% or $20bn1 primarily common equity capital T1 (CET1)2.

- Increase the risk weightings of housing mortgages for the major banks from 18% to 25-30%. This will remove the advantage enjoyed by the major banks and will increase capital requirements for residential mortgages.

- Implement a loss absorbing and recapitalisation capacity framework in line with the emerging global framework. This is a minimum capital base that can absorb losses in times of financial distress. Currently this includes equity (CET1) and subordinated debt (T2) and hybrids (AT1) that contain capital triggers or bail in clauses3. The inquiry raised the potential for another layer of debt above T2 and below senior debt that could also have bail in clauses.

Income investors are attracted to the banking sector as it provides high levels of income particularly in the equities and hybrids.

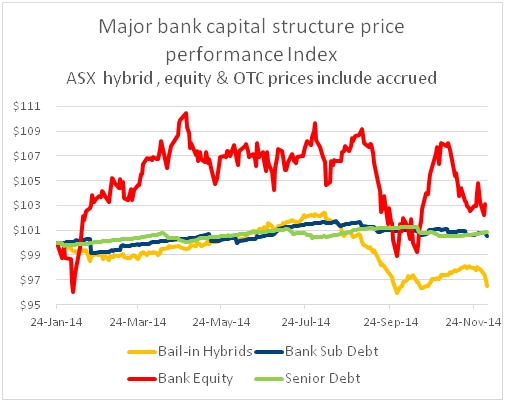

For income focussed investors it is very important to understand the potential price volatility of the investments across the capital structure. Assessing an investment based on income alone could lead to capital losses if investors are required to realise their investments. The chart below depicts the price performance of the major banks’ capital structure over the 2014 year.

Source: Bloomberg, FIIG Securities

Clearly the equity is the most volatile followed by the hybrids (bail in), sub debt (bail in) and then the senior debt4. FIIG has a preference for the old style subordinated debt and hybrids that do not contain the “bail-in” clauses as they:

- offer investors income of up 5.7% for 2-3 years,

- should experience lower volatility as they do not have “bail-in” clauses and are expected to be redeemed at the first call date5

There is a catch as the number available investments is shrinking as banks’ call at the first opportunity.

1FSI states the plausible range for CET1 is 10-11.6% versus the 75th percentile cut off of 12.2% and analysts estimate this at $20bn of additional capital (AFR 8 December) 2 FSI has recommended APRA determine the mix between CET1 which is ordinary equity and total capital which also includes T2 and AT1

3Securities convert into equity or get written off where APRA determines the bank is non-viable

4If we included the TD it would be a straight line at $100 although note that there is virtually no liquidity in a term deposit.

5as they will no longer qualify as capital for regulatory purposes

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.