by

William Arnold | Oct 15, 2013

Bank of Queensland reported strong FY13 results, completing the performance turnaround from the problematic FY12. Cash earnings ($251m) was significantly up on FY12 ($31m) and statutory net profit after tax was $186m vs -$17m in FY12. The Net Interest Margin was 169bps in the year (172bp in the 2H) vs 167bps in the prior corresponding period and the cost to income ratio fell to 44.3% from 45.7%.

Impaired assets fell by 20% to $382m and the impairment expense fell to $115m (31bps of gross loans) from $400m. Loans under management rose to $35bn from $34.5bn and the exposure to Qld fell to 58% from 60%. Growth in lending was fully funded by deposit growth but the deposit/loan ratio remains below system. Housing arrears (90+ days) improved significantly to 57bps from 87bps, but remained above the majors. The total capital ratio fell to 12.2% from 13.1% but the Core Equity Tier 1 ratio improved to 8.63% (from 8.58%), the third highest in the country amongst the "big 8".

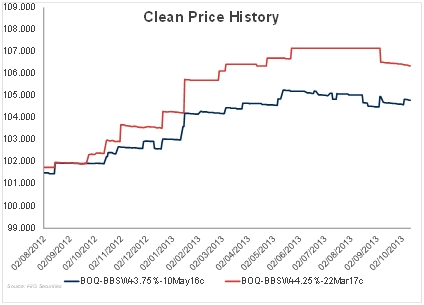

BoQ’s callable Lower Tier 2 securities (May 2016c and March 2017c) have performed well over the previous half year responding to, amongst other things, the company’s return to profit and its ratings upgrade. These securities are trading well above par and investors may want to consider taking profit and removing call risk.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.