by

Elizabeth Moran | Dec 02, 2013

Key points:

- Bonds provide the certainty that investors need.

- Portfolios can be constructed to provide known minimum quarterly or monthly cashflows.

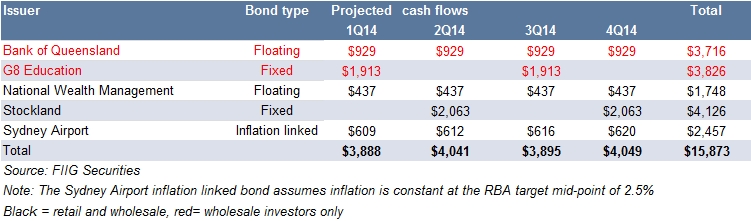

- A sample $250,000 portfolio is shown to deliver $4,000 per quarter for the next 12 months with projected total cashflows of $364,819 over its term.

So much of the investment communities’ attention is focussed on those in the accumulation phase. They have ongoing income to invest and are seeking to grow their investments to help them achieve their goals and possibly outperform. A certain amount of risk is good as it typically generates higher returns. The downside (think past oil crisis, inflation spirals, the global financial crisis, and recently the Greek sovereign debt crisis) is palatable given their income continues which can help replenish any losses.

However those in retirement or the de-cumulation phase simply cannot afford the same amount of risk in their portfolios. Any loss in capital value will translate to an ongoing loss of income which few investors can afford.

I think it’s important to work out how much of your capital you are prepared to lose, the possible downside to your investments in terms of loss of income, and what your contingency plan is to compensate. Selling assets is a usual step but then you must consider how liquid the investments are: can you sell them quickly without loss of value? And if you are selling down assets, is your remaining capital capable of generating enough income to support you? Downsizing the family home is a common but very emotional step to have to take. Most investors in de-cumulation phase cannot afford to lose any capital but continue to invest high percentages of their portfolio in growth assets that can be volatile.

Investors in retirement need to be able to plan their lives and to do that they need certainty of income. They need low risk investments with salary-like cash flows so they can pay bills and live the way they’ve been accustomed to prior to retirement.

Bonds provide the certainty that retirees need. Fixed rate bonds make half yearly interest payments and floating rate and inflation linked bonds pay quarterly interest. The constant cash flow a fixed income portfolio provides suits retirees seeking that stability. Investors that need a certain minimum quarterly or monthly income can devise a portfolio to suit their needs. To demonstrate, if we assume an investor invests $250,000 in a bond portfolio with five bonds, they can manipulate the choices they make so that the bonds provide a steady, consistent cash flow. The table shows the sample portfolio and the projected cash flow for the next year. I’ve purposely invested in bonds to provide a smooth income of circa $4,000 a quarter to demonstrate how the choices of direct investing can benefit investors.This compares to around $2,700 per quarter from the best TD rates available at present.

The first bond to mature in the portfolio is the National Wealth Management subordinated debt which matures in 2016 when your cash flow is boosted by $50,000, at which time you may choose to reinvest in another bond. Bank of Queensland then matures in 2017; G8 Education in 2019 and Stockland and Sydney Airport in 2020.

Total projected cash flow for your $250,000 investment over the next seven years is $364,819.

Investing in growth assets has its rewards but a fixed income portfolio that provides known returns provides a lot of certainty for your future.