Citigroup reported an 88% decrease in net income compared the prior year of US$468m. Excluding one off items, the company generated approximately US$4.3bn in pre-tax earnings compared with US$3.4bn the previous year. Revenue was driven by higher reserve releases, solid revenue through the fixed income business and improvements in mortgage origination in North America.

Profitability

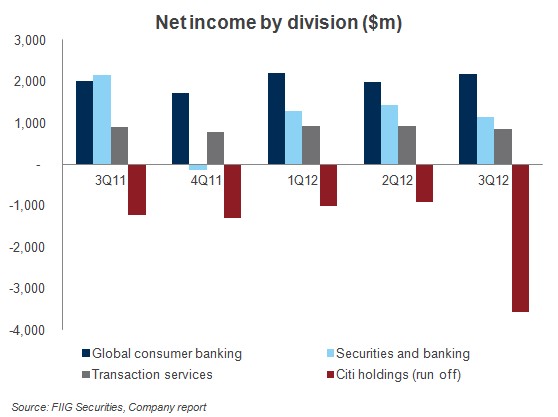

Citigroup reported an 88% decrease in net income compared to the prior year of US$468m. This includes negative US$776m in debt value adjustments resulting from the improvement in Citi’s credit spreads (compared to a positive US$1.9bn in the prior year period). The results also included a pre-tax loss of US$4.7bn from the sale of Citi’s remaining interest in the Morgan Stanley Smith Barney joint venture. The bank had held its 49% stake on its books at US$11.3bn however the agreed price values stake at only US$6.6bn, necessitating the $4.7bn writedown.

Excluding one-off items, the company generated approximately US$4.3bn in pre-tax earnings compared with US$3.4bn the previous year. The third-quarter results benefited from roughly US$1.5bn in reserve releases, versus US$1.4bn the previous year. Revenue for Citi’s core businesses were solid largely because of stronger revenue in its fixed income markets business, given new support mechanisms in the Eurozone and favourable year over year comparisons. Higher mortgage origination revenues resulted in a 6% revenue gain in Citi's North America consumer banking business.

Excluding currency translation, revenue rose 3% in Citicorp's international consumer business, largely because of solid results in Latin America, partially offset by a decline in revenue in Asia. The net interest margin (NIM) increased 5bps to 2.86% as lower funding costs more than offset spread pressure on loans.

Credit quality/provisions

Losses in Citi Holdings, the unit that houses run-off assets, continues to weigh on results recording a loss of US$3.56bn compared US$1.22bn the previous year. Net credit losses were up 11.3% from 2Q12 to about US$4bn. Late-stage delinquency trends were generally favourable, particularly in North American mortgages.

PIIGS exposure remains manageable, but a worsening of the European crisis could still have a notable impact.

Capital

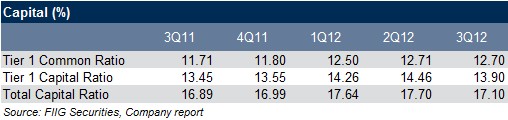

Citi's Tier 1 common capital ratio was stable at 12.7% and the bank estimates its Tier 1 Basel III common capital ratio was 8.6%, up from 7.9% the previous quarter. Citi may start to seek to return capital to shareholders so such dramatic increases are not expected looking forward.