by

Dr. Stephen Nash | Aug 06, 2013

Many SMSFs target a return over and above inflation and this is known as a “real return”. Beating a 4% real return, has been tough using shares and bonds without a link to inflation. Yet it is about to get even harder, as growth stays low. Also, with a cash rate at around 2.50%, or lower, the real rate on term deposits will not come anywhere near the currently generous real rates on corporate inflation linked bonds (ILBs). We say “currently”, as these high real returns should be eroded in the low interest rate environment in 2014.

We agree with both Treasury and the RBA that low growth is likely for at least the next 18 months, which means that cash rates will stay low as will term deposit rates. If rates remain low, then investors need to realise competition for any assets paying attractive yields will be intense, and with real returns over 4%, corporate ILBs are an excellent option.

As a way of demonstrating the value in corporate ILBs, we show that beating 4% real, with 50% equities and 50% bonds can be done, but most of the time, that allocation fails to beat a 4% real rate of return; something that is achievable with corporate ILBs. While you could beat inflation through term deposits in the past, that avenue is fast closing, as the RBA cash rate is lowered, and is expected to stay low for an extended period.

In order to beat 4% real, investors need take on more risk, relative to inflation, so as to increase real yield. However, a simpler, more effective way to ensure a high real return is to invest in corporate inflation linked bonds.

This article analyses the following three topics:

- The performance of a 50% equity portfolio and 50% bond portfolio, relative to 4% over inflation

- An analysis of how often the 50/50 portfolio beats 4% over inflation

- What happened in the US when cash rates fell below 2.50%

1. 50% equity -50% bond portfolio less 4% real

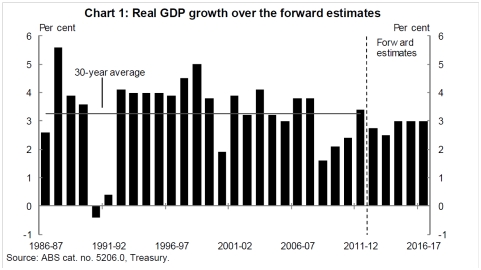

As we have seen in prior articles, the use of longer dated bonds, which are more risky when considered in isolation, reduces overall portfolio risk. While this might seem counterintuitive, the results are evident because of the way interest rates tend to follow the fortunes of the economy. When perceptions of growth are buoyant, equities perform well, and fixed rate bond prices fall, as the market anticipates higher cash rates from the RBA. However, the opposite is also the case, and this is very relevant at this point, where the economy is struggling to meet trend growth, as the recent economic update from the Treasury indicated, where growth is expected to stay low out until 2016-17, as shown in Figure 1.

Source: Economic Statement, August 2013, Statement by the honourable Chris Bowen MP, Treasurer of the Commonwealth of Australia, and Senator the Honourable Penny Wong, Minister for Finance and Deregulation of the Commonwealth of Australia, p.22).

Figure 1

Treasury are not alone in the sober view of the economy as the RBA Governor has reminded us recently, where he focussed in on consumer behaviour after the credit and resources “booms” have now ended. A decline in non-financial asset price growth, among other things, has made the consumer more conservative and less likely to borrow. This means that while monetary policy might well be viewed as “very accommodative” from a historical perspective, it is not that accommodative, when the change in consumer behaviour is taken into account, especially the significant rise in the medium term rate of saving. As the Governor indicated,

In the third phase of the ‘mining boom’ and post the credit boom, our economic challenges are changing in nature. In the next few years our task will involve supporting, so far as it is in our power, a change in the sources of demand that affect the economy. As resources sector investment declines, other sources of demand need to strengthen, but in a way that is sustainable. The fact that consumption is likely to provide only a modest impetus to any acceleration in domestic demand suggests that other areas will be important. As I noted earlier, at least some of the conditions are in place for stronger trends in dwelling investment and, in time, non-resources business capital expenditure. And exports of resources will continue to pick up strongly (Economic Policy after the Booms, Glenn Stevens, Governor, Address to The Anika Foundation Luncheon, Supported by Australian Business Economists and Macquarie Bank, Sydney - 30 July 2013).

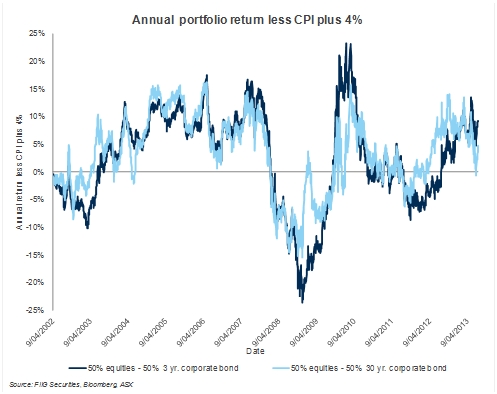

In other words, a struggle to stimulate the non-resources sector of the economy is upon us, and this, among other things, is why another easing of monetary policy is on the cards, before the end of the calendar year, as widely expected by financial markets. So, the government, not to mention the RBA, have a fairly sober view of the next few years, in terms of economic growth, and that makes sense, given the Chinese slowdown and the transition from mining led growth to non-mining led growth. In making the transition, back to non-mining growth, the economy is struggling with a very high Australian currency, and sluggish global demand. This means, among other things, that the “good times” as seen in Figure 2 below, where portfolio returns beat 4% over inflation, are probably less likely, going forward. Specifically, growth, above 4% real, is mainly generated by optimistic expectations about the future; expectations that neither the Treasury, nor we, subscribe.

Figure 2

In other words, we may be entering a period where a portfolio of 50% bonds and 50% equities swings below the 0% mark, where the portfolio fails to beat what is easily available in the corporate ILB market; 4% above inflation. As the next section shows, the 50% equity /50% bonds portfolio fails to beat the 4% target regularly.

2. Frequency analysis

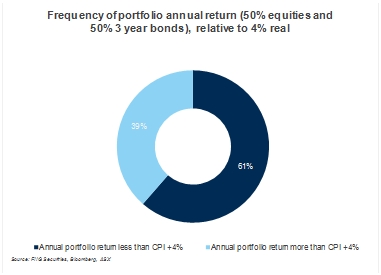

If we do a frequency analysis, of the percentage of times the portfolio beats 4% over inflation, using daily data from April 2002 to July 2013, the results are interesting. As Figure 2 shows, the 50% equity / 50% bond portfolio underperforms 4% over inflation 61% of the time, and without excessive growth in the next few years, we expect further underperformance.

Figure 3

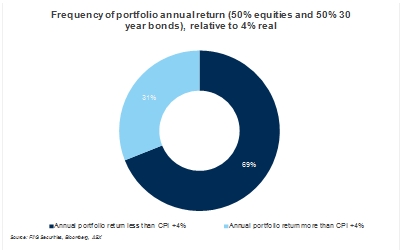

Now, if we do the same analysis, using a longer bond, the picture is much the same, if a little worse, as shown in Figure 3.

Figure 4

In other words, beating 4% over inflation is not that easy, even by taking a lot of risk, relative to inflation. Now, if it remains tough to beat 4% inflation in “normal” times, then one wonders how difficult it will be, going forward, with every central bank in the developed world offering about as much stimulation as possible. It is to that global experience with low cash rates, to which we now turn.

3. Evidence from other countries

If monetary policy continues lower for longer, as we expect, then you should consider what has occurred in other markets, when rates have been lowered, such as the United States, where the equivalent to the Australian cash rate, is the Federal Funds rate, or “Fed Funds”, as the market calls it. More specifically, the Fed Funds rate is the interest rate used by institutions to trade balances, between themselves on an uncollateralised basis, which are held at the Federal Reserve of the United States.

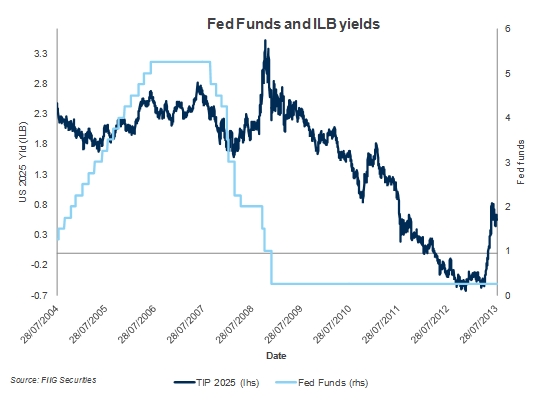

In Figure 4 we look at the Fed Funds rate and the 2025 ILB, where we can see that the lower Fed Funds rate led to a decline in ILB yields, as perceptions of inflation moderated. More specifically, if you look at all the enclosed data, and divide it into cases where Fed funds were above 2.50%, and below 2.50%, then you can see that ILB yields fell, substantially, on average, from 2.19% to 1.24%

Figure 4

Rates have risen of late, on the expectation that inflation is going back up, yet the rise is taken into account in our numbers, and the fact remains that low cash rates exist, not in isolation, but because inflation and growth are low. Many global central banks, from the Fed, to the European Central Bank, to the Bank of England, have all indicated that the recent rise in long term rates is excessive, or “unwarranted”. In other words, they see that current low short rates will remain in place for long enough to see those longer rates fall, once again.

Now, in Australia the outlook is similar to the US, where low rates are expected to exist for an extended period. Here we have a low outlook for growth and inflation, as Treasury and the RBA both indicate, and our cash rate should stabilise around the 2.50% level for 2014, unless there is an unforseen problem, which might make it average something like 2.25% or lower. In this environment, competition for real yields will be intense, where we will effectively repeat the US experience; low growth and low inflation basically equate to lower ILB yields and corresponding higher prices.

Conclusion

We often emphasise risk in our discussion, over return. In this article we look at return and compare the return on a portfolio of 50% equities and 50% bonds, to a return of 4% over inflation. We find that beating 4% over inflation is not that easy, and that beating this target, even with 50% equities depends on the assessment of growth. Both Treasury and the RBA are quite conservative on these forecasts, and we agree. If the assessment for growth is not optimistic, then the chance of beating 4% over inflation is slim. Moreover, if we consider what other countries have experienced, then ILB yields are moving lower and prices higher. If you put real ILB returns in the context of current term deposit rates, where a good rate is 4% fixed and effective real return is 4% less inflation of say 2.5% to give a real return of around 1.5%, corporate ILBs offer outstanding relative value. Examples include both the Sydney Airport 2020 and 2030 ILBs currently showing real yields of 4.25% and 4.60% respectively. Other high real yield ILBs include: Envestra at 3.70%, Electranet at 2.65% and Ale at 3.15%.

If investors remains complacent, thinking that term deposits will provide adequate real return, over the next 18 months, then one is effectively assuming a “normalisation” of rates; something that we think is unlikely. Rather, we think low rates are here for some time, and investors now need to adapt to the changing environment, in order to survive, from a real return point of view.

For more information please call your local dealer. All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.