Inflation due out, professional fund managers buying at record levels

The Australian Bureau of Statistics (ABS) is due to release the 1Q15 inflation figures (CPI) 22 April and ahead of this there has been a noteworthy milestone in the inflation linked bond market. For the first time ever, inflation linked bonds issued by the Australian Commonwealth Government sold at tender on Tuesday last week, for an average (real) yield below zero. For more details on this please see the article, Less than zero: a market milestone you shouldn’t miss, by Elizabeth Moran. The vast majority of purchasers of government inflation linked bonds are professional fund managers and the oversubscription for the most recent government ILBs is a clear indication that those managers expect inflation over a longer timeframe to increase, even though the average economist expectation for the upcoming figure is a very low 1.3% (year-on-year) figure. This is consistent with repeated verbiage from the Reserve Bank of Australia (RBA) that they are comfortable that core inflation will remain within the 2.0%-3.0% band over a longer period.

The continued fall in the AUD (from an average of 0.846 in 4Q14 to 0.790 in 1Q15, or a 6.6% drop in the quarter) and a recovering oil price should both contribute to rising inflation. Furthermore, a strong employment figure last week of +37,700 coupled with a significant positive revision to last month’s figure (+42,000 vs previously reported +15,600) provides further support for the case of improving inflation.

On balance, it makes sense that professional fund managers are purchasing inflation linked bonds at a record pace, but there is little room for error in the Commonwealth bonds if inflation continues to fall over the short term.

Corporate inflation linked bonds offer good relative value

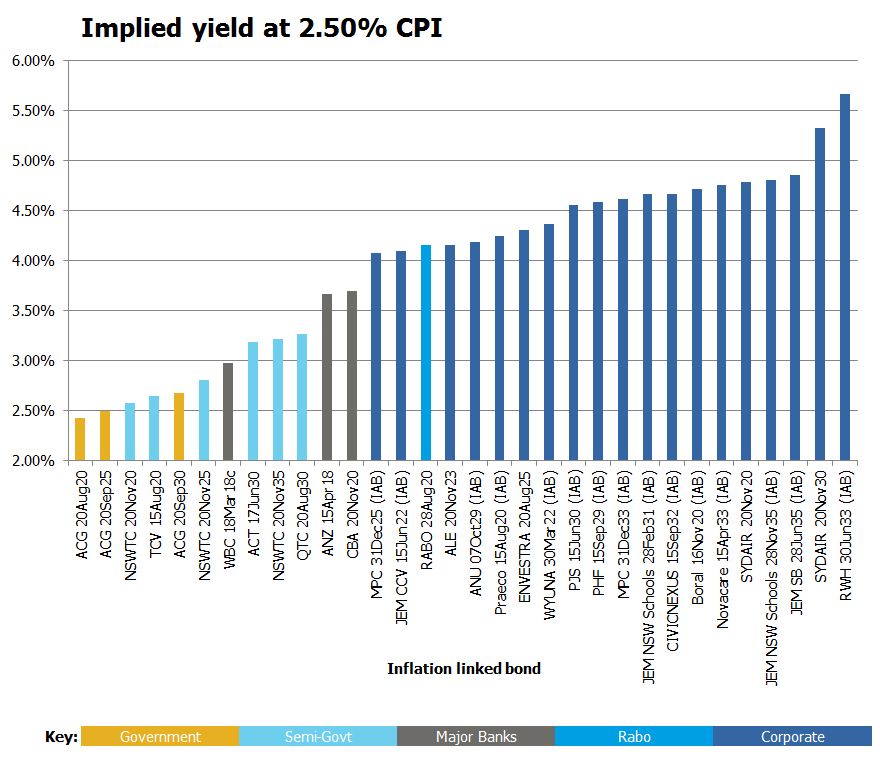

The market for corporate inflation linked bonds, nearly all of which are investment grade and linked to infrastructure, remains comparably attractive. As is evidence in the chart below, there is a clear differential when comparing the implied yields on corporate inflation linked bonds with those issued by the Commonwealth government, Australian states, and major banks.

Note: yields current as at 16 April 2015 and subject to change.

Source: FIIG Securities, Bloomberg

Conclusion

The graph leads me to conclude that, even though corporate inflation linked bonds have performed very well over the past year, they still offer compelling value when compared to their government, state, and banking sector peers - and with the funds management industry clearly comfortable with negative yields on those instruments, investment grade corporate yields between 150 and 300 basis points higher deserve further attention.

If your portfolio is underweight inflation linked bonds, it may be worthwhile to consider increasing the allocation to these products. More importantly, if your portfolio includes the much lower yielding government, state, or bank inflation linked bonds, returns can be significantly enhanced by switching this exposure into corporate inflation linked products.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.