Sensationalist headlines about Australia’s property market sell papers. The Economist has been talking about this bubble since 2001, when they compared (from Washington DC) various statistics about housing markets from around the world, and concluded that Australian property was the most over-inflated in the world.

On the other hand, nearly every bank economist in Australia insists this is not the case and they all have the charts to prove it too. Below we summarise the two opposing cases, and then look at what a bubble might look like in the extreme outside case.

Is Australian Residential Property Overvalued? The case for and the case against

Case against the bubble: Supply not keeping up with demand

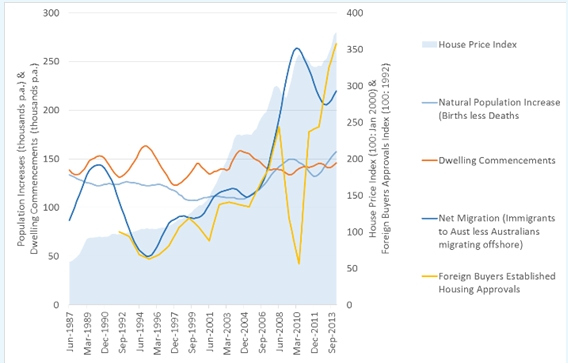

House prices, Australia 1987-2014, compared to changes in supply and demand

(Source: ABS, FIRM, RBA)

No one factor can be blamed for the housing market price increases, rather it is four compounding forces:

- Net migration has doubled

Net migration has been more than double the long term average since 2005 - Foreign investment has also doubled

While the numbers are small , foreign investment has more than doubled since 2005 - Natural population increase

Not as dramatic, but the annual increase in population due to births less deaths shifted to new records from 2005 - Supply inflexibility

New dwelling starts haven’t increased since the 1980s

Case against the bubble: Fundamentals out of whack

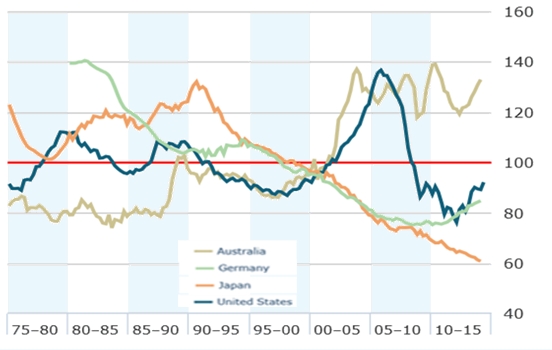

Price/rent index, various countries, 1975-2014

(the higher the ratio, the more expensive the capital values compared to rental income)

(Source: The Economist)

The case against relies more on the idea that Australian housing should comply with some global benchmarks such as the ratio of prices to household incomes (as shown above); or rental yields, adjusted for inflation. Regardless of which of these fundamental ratios are used, Australia comes across as one of the most expensive housing markets in the world:

- Rental yield vs long-term averages

Only Britain and Canada are further from long term averages than Australia. China is far below Australia on this measure. - Inflation adjusted price increases

“Real” prices in Australia are up 2.8 times since 1975, compared to Canada, NZ, France and the UK at 2.2-2.3 times; the US at 1.3 times and then Japan and Germany at 1.0 times (that is no change in 40 years).

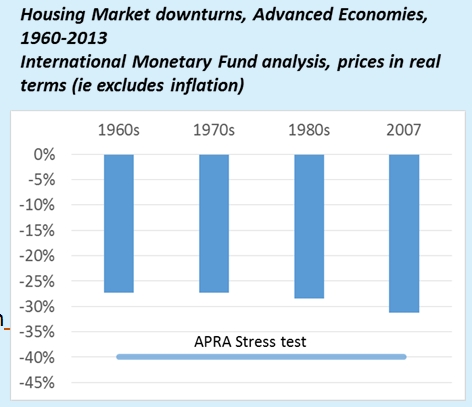

If Australian housing did fall, what could we expect?

As Australia hasn’t had a major housing price correction for decades, we need to look to other advanced economies for some examples.

The IMF did a study of housing market corrections in advanced economies (US, UK, Canada, Europe, Australia and NZ) over the past 50 years*. The average correction when markets did correct was around 25-30%, after considering inflation (around 15-25% in normal terms). This would take prices back to 2009, suggesting it’s not an unrealistic fall, just unprecedented for Australia.

APRA, the Australian banking regulator, used a 40% drop in home values in its a recent stress test of Australian banks. That’s quite extreme, in line with Dublin’s crash in 2008 in fact.

*This measure is the average fall in markets where housing prices corrected. For example, in 2007, markets in the US, UK, Netherlands, Spain, Italy and France fell by an average of 31.2%. It is in “real” terms, that is, it excludes inflation. A 31.2% real price fall means a fall in value of around 21.2% when inflation is added back, i.e. a house worth $1,000,000 in 2007 would be worth $788,000 in 2012 according to this data, but because of inflation between 2007 and 2012, the purchasing power of this house value would be $100,000 lower again.

So what’s the answer? Of course no-one really knows. So all you can do is make sure that you are prepared, that is not over exposed to the risk of there being a bubble, while not over reacting, putting all your cash in the bank and thereby reducing your income too far1.

Early in 2015, we will be publishing a review of the implications of the outlook for property and of the implications for all asset classes should this extreme scenario occur. The purpose of this is not to suggest this is our expected case – far from it in fact – but to help investors to plan their investment strategy to ensure they will be prepared if there is such an event in Australia, like that seen in the US or Europe.

There is a middle ground between owning property and taking all of the downside risk, and shifting to bank deposits where you have no downside but very low income. The middle ground in the case of property is “mortgage backed securities” such as Residential Mortgage Backed Securities (“RMBS”).

Just as many SMSF investors are shifting some of their equity positions into bonds in the same companies to lower capital risk and increase income, they are also investing in property backed debt securities such as RMBS to reduce their exposure to the risk of a downturn in Australian property.

FIIG has access to several lines of RMBS issues offering yields from 3-4% p.a. for the very conservative issues to as much as 9-10% p.a. for much riskier issues. Investments are available from $50,000, but only available to wholesale investors.

1In forming your own views, the above is a very brief summary of the key arguments. You might also want to turn to those without vested interests. The IMF (International Monetary Fund) has launched its “Global Housing Watch” which provides some useful insights (http://www.imf.org/external/research/housing/). They provide the balanced view that data above historic averages does not portend a crash, but then warn against complacency as housing price falls are responsible for two-thirds of banking crises.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.