by

Dr Stephen J Nash | Jan 16, 2013

Australians have been sold a lemon, regarding the definition of a “balanced” portfolio. While the financial services industry tries to suggest that 75% equities represents a “balanced” portfolio, this analysis questions this idea. Since equities have excessive volatility, a much higher bond weight is needed.

Specifically, the article defines what a “balanced” portfolio might be, using a measure borrowed from standard portfolio theory. Next, we apply this measure to two alternative asset allocations, to show that an allocation of 75% of the portfolio to equities is way too much, if you expect any semblance of “balance”, in terms of risk. A better allocation is for a lot less equities and a lot more bonds; something that is easy to implement with recent equity price appreciation.

Defining a “balanced” portfolio

Even though the term “balanced” has little to do with portfolio risk, or the annual volatility of return, and much more to do with marketing high risk portfolios to easily led investors in return for high fees, there may be a way to define a balanced portfolio from a portfolio risk perspective. Risk is important, as you have probably been inundated with marketing telling you about return, which is basically the average annualised historical return, but little about historical variation in return, or “risk”. In other words, “risk” is an important dimension to investing, which gets much attention from the institutional sector, yet little attention from non-institutional sector.

Specifically, you can look at the difference between actual portfolio risk and the simple addition of the weighted portfolio components. Instead of reinventing the wheel, let’s borrow an idea from finance theory, which measures diversification by looking at the difference between portfolio risk and the weighted average of portfolio constituents. In this case, the portfolio has two constituents; bonds, as measured by the UBS Bond Composite Index (0+yrs.) and equities, as measured by the All Ordinaries Accumulation Index. We use daily data starting in October 1989, until 31 December 2012, the maximum period available.

For example, if we have a portfolio with 25% bonds, with an annual risk of 3.60%, and 75% equities with an annual risk of 11.35%, as at 31 December 2012, then the simple weighted average risk on the portfolio is 9.410%. That is the bond risk of 3.60% multiplied by 25%, plus the equity risk of 11.35% multiplied by 75%, which adds up to roughly 9.410%.

Now, if we compare that simple addition to actual portfolio risk, of 8.110%, which we calculate by deriving the rolling annual standard deviation of return from the combination of 25% bonds and 75% equities, then we can see that the diversification benefit of holding 25% bonds is roughly equal to the difference between these two measures; the simple weighted average risk of 9.410% and the actual portfolio risk of 8.110%, or about 1.303%; we can call this the diversification statistic, or the “D statistic”, which describes the diversification that a portfolio enjoys from having two asset classes.

Hence, the portfolio benefit of having 25% bonds is that it cuts portfolio risk by about 14%, (the D statistic of about 1.303%, divided by total portfolio risk of 8.11%). This seems like a somewhat small diversification benefit, and does not seem to be a situation where the effects of one asset class are “balanced” by another asset class.

In contrast, a “balanced” portfolio should require a much higher diversification benefit, or D statistic, where the benefits from holding bonds would be much higher than this meagre 14%, for a 25% holding of bonds and a 75% holding in equities. Instead, we argue that the idea of a “balanced” portfolio would be where diversification achieves a significant reduction in risk; where the D statistic moves towards 50% of risk, not a meagre 14%. We suggest true diversification means holding enough bonds in the portfolio where risk is cut by around 50%. We can achieve that reduction in risk by holding 75% bonds and 25% equities, creating a real “balance” to the risk of equities, within the portfolio.

Example: two portfolios

Let’s consider two portfolios:

- 25% bonds and 75% equities (or what the industry accepts as a “balanced” portfolio)

- 75% bonds and 25% equities, which FIIG would describe as more like a balanced portfolio

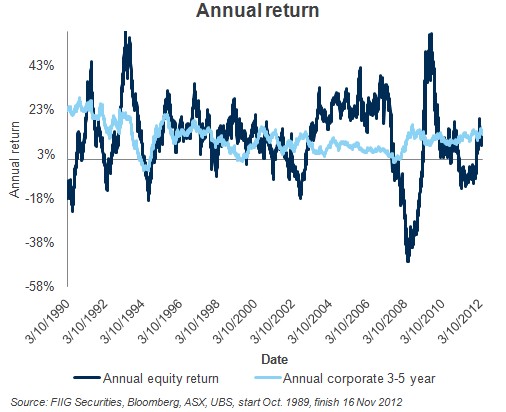

Given these allocations, we can first track the very different risk for each portfolio in Figure 1 below, where we calculate the annual rolling risk calculation for individual portfolio components and the portfolio itself.

Figure 1

Notice how the 75% bond/25% equity portfolio has much less risk in all scenarios, as shown by the dark blue line in Figure 1, while the light blue line describes the alternative portfolio; 25% bonds/75% equities. Notice, importantly, how risk spikes in times of equity crisis, and the spike in risk, is so much more dramatic in the case of the light blue line. In fact the risk at the low point (shown as the spike in March 2009) is almost four times greater than for the 75%bond/ 25% equity portfolio. This escalated risk is something to be very conscious of, if you are approaching or near retirement.

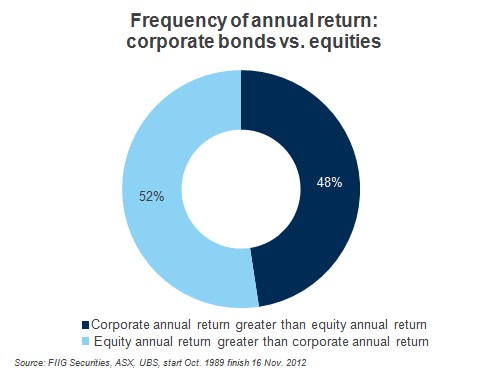

Figure 2

Notice how low the diversification benefit or “D” statistic, for the 25% bond/75% equity portfolio as shown by the light blue line in Figure 2 averages around 9%, for the entire period. However, the 75% bond/25% equity portfolio has a much higher diversification benefit, which tends to rise dramatically in times of crisis; as in the 2000 crash and the 2007 crash. On average the dark blue line, or the “diversification benefit, averages around 46%, meaning that roughly half the entire portfolio risk is cut by portfolio diversification, through bonds. This means that this weighting of bonds, or around 75% with 25% equities, brings a very large diversification benefit to a portfolio; over five times the diversification benefit that comes from the alternative portfolio of 75% equities with 25% bonds, which is around 9%. Also, when an equity crisis occurs, bond diversification benefits are much larger, when using the 75% bond/25% equity allocation.

If we look at 31 December 2012, holding 75% bonds led to a diversification benefit of over 100% of total market risk. In contrast, if we consider the 25% bond and 75% equity allocation, bonds find it difficult to really balance out equity risk, as here the total portfolio risk is cut by a meagre 20%.

Hardly a “balanced” portfolio!

Conclusion

While market commentators have lulled you into a complacent acceptance of a high equity weighting, of 75% equities or thereabouts, as being a “balanced” portfolio, this article suggests that this complacency is misplaced. Specifically, a higher bond weighting, and a lower equity weighting, is needed to provide more stable or “balanced” returns. Even though those who sell high fee equity based portfolios have a job to do, so as to maximise revenues for fund managers and others, you, as the investor, also have a job to do; construct a portfolio that will provide return without being excessively volatile.

This article has derived an estimate of portfolio diversification, or the “D” statistic. Applying this statistic, we can demonstrate how much diversification comes from different asset allocations, and a 75% allocation to equities (and 25% to bonds) fails to give enough diversification to be thought of as a “balanced” portfolio. Importantly, it can be shown that the exact opposite asset allocation; 75% bonds and 25% equities provides the “balance” that is needed. Not only does such an allocation provide good average diversification, the impact of that diversification rises dramatically when needed most; when equity markets are in crisis.