by

Ekaterina Skulskaya | Jun 03, 2014

Key points

- Opportunity to diversify into the broader Australian corporate sector

- Invest in an engineering company that provides solutions across a number of sectors to clients throughout the Asia-Pacific region and is renowned for strong, stable and high value work in hand

- Offers a solid 5.55% running yield (and 4.85% yield to maturity)

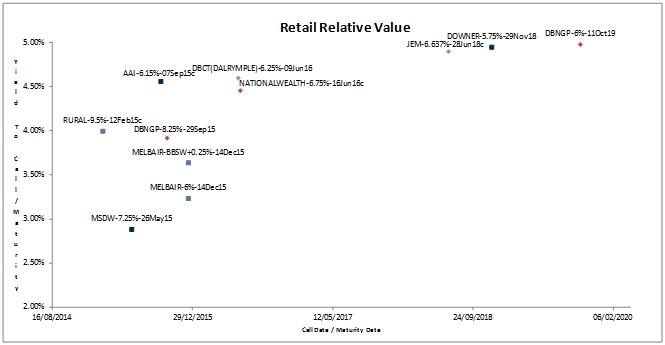

This week Downer fixed rate bonds maturing in November 2018 became available to retail clients. Currently, this bond offers a solid running yield of 5.55% and a yield to maturity of 4.85%. Downer joins Dampier to Bunbury, JEM Southbank, Dalrymple Bay Coal Terminal, AAI Ltd, National Wealth Management Holdings, Rural Bank Ltd Australia, Melbourne Airport and Morgan Stanley bonds which are also available to retail investors but outperforms most of them on current yield to maturity comparisons. The bonds, which mature in November 2018, provide retail investors with the ability to enhance their fixed income portfolio due to solid fixed rate return and diversification benefits.

On a relative value basis, Downer offers compelling value with a yield to maturity of 4.85%, similar to Dalrymple Bay Coal Terminal (4.60%) and JEM Southbank (4.98%).

Given the outright return opportunity provided by Downer, retail investors should strongly consider adding the 2018 bonds to their portfolios.

The strength of the Downer credit lies in the strong demand for company’s services as shown by their maintenance of high levels of work-in-hand, diversification of the business and the market capitalisation at over $2.32bn at the time of writing.

For the latest Downer research report, please click here

Please speak to your FIIG representative if you are interested in Downer retail bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.