Key points:

- Revenues up 7%

- Net profits up 47%

- Improved tariffs on the back of new regulatory decisions continue to flow through to the bottom line

- Envestra remains one of our favourite infrastructure investments

Last week Envestra Limited announced its first half results with revenue and profits up despite lower volumes. The drivers of the improved results being increased revenue tariffs from its regulated pipeline business with profits also improved from lower fixed interest swaps and unhedged debt. Key results are summarised in the table below.

Table 1

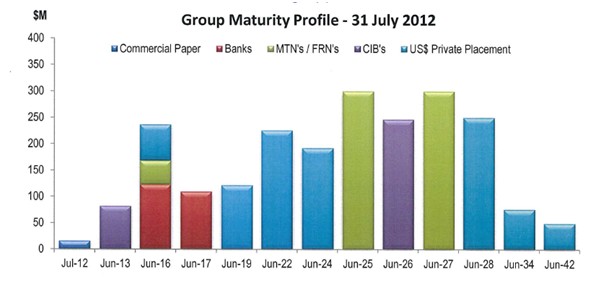

The results were in line with market expectations. Queensland and South Australia were the stand out performers on the back of the increased tariff levels which came through in the states respective latest regulatory decision. NSW, which is by far the smallest exposure of Envestra was the only jurisdiction where EBITDA decreased from the prior year comparable period. Credit metrics for the company continued to improve over the period, though we expect them to begin to plateau as management approach their stated preferred levels. Gearing is currently sitting at 64%, relatively low for a regulated infrastructure company and we remain very comfortable with Envestra’s bonds at this level.

Envestra remains one of our preferred infrastructure exposures however we note that the bonds are generally very tightly held. When they become available we recommend investors add them to their portfolio. Noting the limited availability of these bonds, in their absence we continue to look favourably on Sydney Airport, which reports next week.