by

Elizabeth Moran | Mar 11, 2014

Interpretation of the market and concluding strategy

The last six months have seen returns available across all asset classes contract and more recently an uptick in inflation. Some key investment themes that we have been relaying to fixed income investors have been:

- Take profits in higher risk assets and invest in lower risk investments for greater capital certainty.

- Low interest rates are likely for longer and the highest returns available are on fixed rate bonds in the six to eight year maturity bucket.

- If our interest rate assumptions are wrong and interest rates start to rise, hedge the possibility by having an allocation to inflation linked bonds and floating rate notes.

Since inception, the largest change in my portfolio was the sale of a Rabobank Tier 1 hybrid last August. I had bought the securities at a discount (when face value was lower than $100) and locked in a high fixed rate return. The price of the hybrids appreciated to be over the $100 face value and I sold, taking profits from a high risk asset and investing in lower risk Australian corporate bonds. The Rabo Tier 1 reached a low of $65 in 2009 and the risk (while seemingly unlikely) was that the hybrid price could return to that level and I would have lost the potential gain. Another risk with the security was that Rabobank wouldn’t call the hybrid at the first opportunity and the security would become perpetual, having no defined maturity date. In that instance the price of the bond would fall below the $100 face value and I would have to sell to recoup capital. These trades followed themes 1 and 2 above.

The themes still apply and I’m of the belief that interest rates will remain low for longer.

Portfolio performance

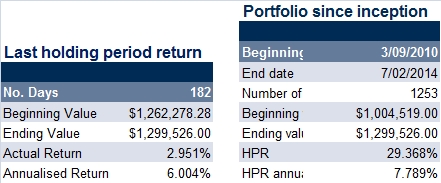

Over the 182 days since the last valuation, the portfolio returned 2.951%, which equates to 6.004% on an annualised basis (see Table 1). The majority of the return was based on income from the bonds and the portfolio continues to benefit from the higher allocation to fixed rate bonds and yields that have been locked in over recent years. Income over the six months was $34,468.50 and a further $2,143 was made on the net change in value of the bonds, although some of the positive valuation would be accrued interest. I also made the assumption that cash at bank and accruing interest payments on the bonds was earning 3% per annum, which contributed $651 in interest (see Table 2).

Source: FIIG Securities Limited

Table 1

Source: FIIG Securities Limited

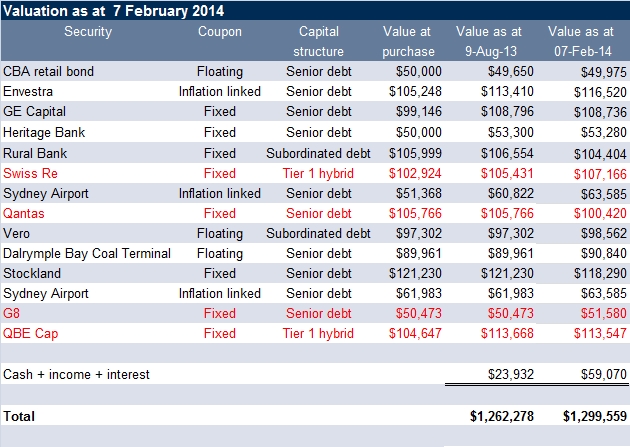

Black = retail and wholesale clients, red= wholesale clients only

QBE Cap valuation shown in equivalent AUD, calculated using exchange rate AUD1= USD0.8939

Table 2

There were only small changes in the valuation of the bonds but unfortunately the largest was negative $5,346 from Qantas. The loss reflected a combination of poor results, lack of government commitment to assist and a credit rating downgrade to sub-investment grade. The bonds’ loss in value was around 5%, while the shares over the same period were much more volatile and peaked at $1.53 in September and hit a low of $0.96 cents in December 2014. The share price loss in value from 9 August 2013 until 7 February 2014 was 11%. While a paper loss is disappointing, the significant cash on the balance sheet and access to bank finance, as well as some very valuable assets, mean I’m not concerned with Qantas’ overall credit quality.

The foreign currency, US dollar QBE hybrid didn’t make the gains I expected. While the currency depreciated, adding value it was offset by a net loss in the USD price of the hybrid due to write-downs and provisions on various North American businesses. I’m tempted to sell this security but the currency has strengthened, and QBE’s credit is at a low point, so there’s scope for management to make improvements and benefit from improved US economic conditions. I’ll hold onto the investment for now.

Gains in the value of the Sydney Airport and Envestra inflation linked bonds were a mix of inflation and market movements.

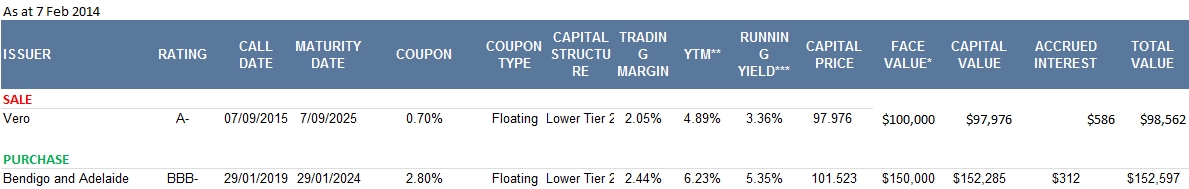

I haven’t had a large allocation to floating rate notes, as the returns have been low. However, returns are generally higher than deposits and it’s time to bump up my allocation. I’ve sold the Vero Insurance bond as it is approaching first call in 2015 and the income is low. The proceeds of the sale of $98,562 coupled with my cash holdings of $59,070 have allowed me to invest $150,000 face value ($152,597 total cost) in the new Bendigo and Adelaide subordinated, floating rate bond issued in the wholesale market. The estimated income next year is 5.35% on the Bendigo bond, much higher than the 3.36% for the Vero (see the running yield in Table 3).

Source: FIIG Securities Limited

Notes: Yield to maturity is the return an investor will receive if they buy a bond and hold the bond to maturity.

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year.

Prices accurate as at 7 February 2014 and subject to change.

Table 3

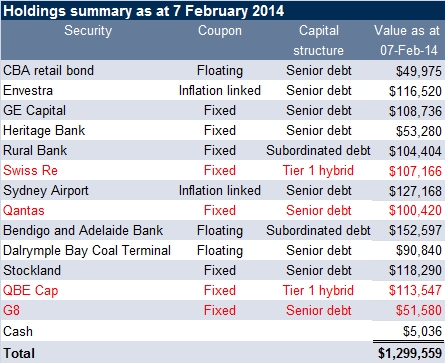

The remaining cash of $5,036 is low but I’ve purposely invested most of my available cash. The income I can generate from cash is just too low and the portfolio generates a good level of income, with steady interest payments. Having cash in the bank at this point of the economic cycle diminishes the overall portfolio return. I can sell down the CBA retail bond, which is ASX listed if I need funds or the bonds available to retail investors in my wholesale portfolio (shown in black) can be sold down in $10,000 parcels (funds will generally be available on a trade plus three business days basis) and act as a buffer if I need funds.

Summary

Bonds have predictable and steady income and are great for investors wanting a known cashflow. They can also provide higher than expected returns while reducing volatility, as demonstrated by the differences in the price of the Qantas bonds compared to shares.

While investors setting up a new portfolio would have difficulty in achieving the same returns without taking on a higher level of risk, there are investment grade bonds delivering income of over 6%, higher than many of the dividend yields of the ASX 200.

Source: FIIG Securities Limited

Black = retail and wholesale clients, red= wholesale clients only

Table 4