by

Elizabeth Moran | Aug 13, 2013

I have to confess that I’ve been a bit relaxed regarding my model portfolio. When I first set out the portfolio almost three years ago, I invested predominately in fixed rate bonds and as the RBA cash rate has been coming down the price of the bonds has risen so the portfolio has performed as I expected. In most cases not having to worry about fluctuating bond prices is one of the good things about bonds (I will sell down some of the fixed rate bonds when I think interest rates will start to rise as this will mean fixed rate bond prices should start to fall). Aside from a company going into liquidation, the worst case scenario from a lack of attention is that you hold the investments to maturity when you receive your $100 back.

Keep in mind a good broker will be in contact if there are new opportunities or switches they think you should make.

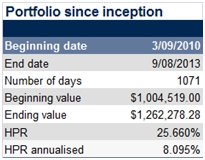

The ultimate goal for the portfolio was to have a return of between 6 to 8%. The portfolio has performed above expectations, delivering a return of 8.095% since inception. Since the last review in October 2012, bond prices have flattened, most being close to par of $100, meaning returns are more representative of expected income, so are generally lower, which has been the case across all asset classes.

The return for the portfolio since the last review in October has been 5.15%, but as the period is less than a year, we calculate the holding period return (HPR) which equates to 6.44% p.a. to give a better annual return indication. This is a standard calculation for bond market investors.

Source: FIIG Securities

Figure 1

Source: FIIG Securities

Figure 2

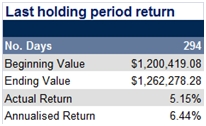

You can see from Figure 2 that most of the values of the securities have only moved marginally since the last review, although the Envestra inflation linked bond has outperformed with the value increasing $7,238 or 6.8%. About $1,000 of the value will be the next coupon (interest) payment which is due in just over a week’s time.

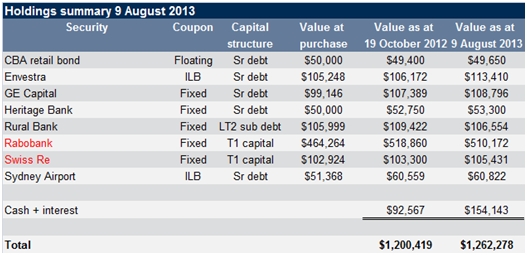

The Rabobank Tier 1 hybrid price has been declining since the last review date, which isn’t surprising given it is trading at a premium (over the $100 par price) and it’s getting closer to the first call date of December 2014 when investors expect to be repaid. As bonds only ever repay $100, the price of securities trading at a premium will move closer to par as they approach first call/ maturity. The declining price has been offset by the high coupon but I can lock in the $10,172 gain and reinvest in securities that I think may appreciate. For this reason, I’ve decided to sell the Rabobank Tier 1 hybrid and reinvest the proceeds in other securities as shown in Figure 3. Rabobank proceeds of $510,172 plus cash held of $154,143 which include all coupon payments (interest) since the last portfolio review plus an assumed interest rate of 3.5% (Rabobank At Call Account standard rate) give me $664,315 to invest.

Current best returns are in longer dated bonds; in part compensating investors for a longer term to maturity as well as coinciding with the time the market expects interest rates to rise (known as the “sweet spot” on the yield curve). I’m happy to extend the maturity profile of the portfolio to maximise returns as I think low interest rates are here to stay for at least the next two to three years. Low rates could possibly hang around for quite a lot longer as global economies must at some point start to repay the huge sums they’ve borrowed and I think any significant growth will be extremely difficult. So, I still want to maximise known income and you’ll note I’ve opted to reinvest more than half of the funds in fixed rate bonds.

I’m still adding floating rate notes (FRNs) with $100,000 allocations to Vero Insurance (a subsidiary of Suncorp Metway) and Dalrymple Bay Coal Terminal, an infrastructure investment with long, known minimum performance contracts. I want the portfolio to take advantage of interest rate rises when they eventually occur although the low income on offer is less attractive at this point. The FRNs you’ll note are trading at a capital price discount meaning I will have a gain at maturity and the yield to maturity calculation is higher than the running yield (expected income for the next year).

Qantas and Stockland fixed rate bonds boost income and you’ll see I’ve added $50,000 of G8 Limited an ASX200 listed company that recently had its first bond issue. The fundamentals of G8 are strong. It is the largest ASX listed child care provider in a fragmented industry and is growing through acquisition but under very strict maximum prices of four times EBIT. The company generates a strong cashflow and the sector is stable in that it isn’t influenced by the economy too much. Market capitalisation is circa $700m and the bond issue was $70m. The yield to maturity is a very attractive 7.48% fixed which will boost my income without adding much risk.

I’ve doubled my holding of the Sydney Airport 2020s to increase my inflation linked bond allocation. The very low cash rate of 2.5% is only just higher than the current annual inflation rate of 2.4%, meaning that we are almost in a “zero real rate” environment. So, the margin over and above inflation is what I’ll be earning and the rate on this bond is close to 4% over inflation. A fantastic return if you compare it to fixed rate term deposits paying around 4% without any allowance for inflation. In fact your real return on a 4% term deposit is 1.6% (4% less 2.4%), a poor return in comparison.

The very last addition to my portfolio is a US dollar denominated security issued by QBE. It’s a step-up Tier 1 hybrid but QBE has, to my knowledge, always repaid at first call on such securities, giving me confidence they will again with this one in June 2017. I’ve added this foreign currency bond in part as a hedge against the US dollar and in part because so many retirees like to travel and take their families with them that I think it’s worth locking into the exchange rate.

Source: FIIG Securities

Prices are accurate as at 9 August 2013 and subject to change.

QBE USD security purchase price shown in AUD equivalent using exchange rate of 1 USD = 1.0862 AUD

Figure 3

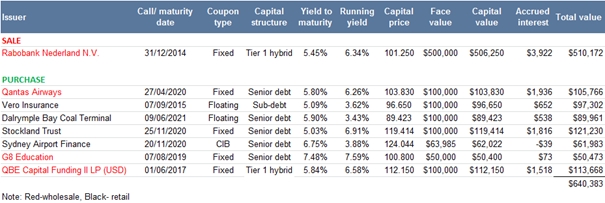

The model portfolio will now hold 13 securities with a greater number and value of Australian corporate bonds (much of the value in international companies has gone with the very large supply of money, making default much less likely).

The portfolio is still weighted towards fixed rate bonds (see Figure 4) as I think interest rates will be low for some years and I want to maximise the known income and hedge against rates being cut further. I still have $23,932 in the bank although given the real return calculation on the Sydney Airport ILB above, cash returns are very low in relation to the inflation rate and funds can be put to better use in the bond market than sitting in deposits.

Source: FIIG Securities

Note: QBE USD security value shown in AUD equivalent using exchange rate of 1 USD = 1.0862 AUD

Figure 4