by

Elizabeth Moran | May 13, 2014

Key points

- Fiscal tightening will act to constrain growth

- Expected to reduce the likelihood of interest rate increases (this means that the market might have overestimated future increases, which is good for bond prices. However, as markets are forward looking, the real question is whether the market has already priced in the economic dampening impact of the budget or if there is more to come).

- Strengthens our belief that interest rates will be lower for longer

Like past budgets, the government has been preparing us for some of its measures to be formally announced tonight. Generally, the government is seeking to:

- Cut the deficit and bring the budget back to a surplus by cutting costs and increasing income

- Reduce the size of government, cutting the number of departments and staff,

- Make welfare harder to attain, reducing expenditure and thus income of recipients

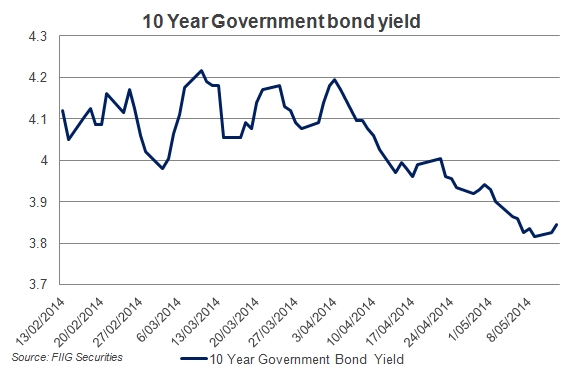

A fiscal tightening will act to constrain growth. We’ve seen some evidence of the market already predicting the tightening with the contraction in the 3-year and 10-year Commonwealth government bond yields over the last month (see Figure 1). The yield curve (which projects forward rates) for both these bonds has flattened, indicating the perceived chance of future interest rates rises has declined.

Figure 1

If the pre-budget conversation has been tougher than what is announced overnight, then we may see the yields for the two Commonwealth government benchmarks rise again, however, a harsher than expected budget may see them contract further. Our expectations are that the curve will be flatter but upward sloping. If the curve continues to flatten, all else being equal, the price of fixed rate bonds should rise.

We think it unlikely that the curve would become inverse, indicating a contractionary environment, where we would expect further rate cuts.

Our stance has been for some time that we “expect low interest rates for longer” and we continue to hold that conviction. The loss of government jobs, lower welfare payments and higher taxes through the deficit levy should act to dampen confidence. We may see savings rates increase and faster repayment of debt in the coming year, neither of which are particularly conducive to growth or a booming share market.

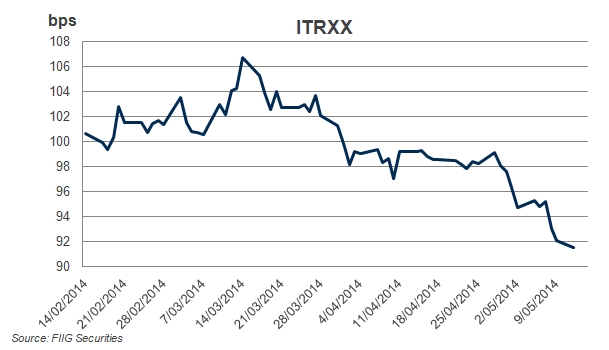

Like government bonds, corporate bond spreads have also contracted (as evidenced by a contraction in the Australian iTraxx) highlighting the lower perceived risk of default as well as lower returns needed to invest in Australian corporate bonds (see Figure 2). Mid-March, the index was 106 basis points (bps) (100 bps = 1%), but over the last month this has contracted to under 92bps. iTraxx spreads were approximately 30bps prior to the GFC then blew out to circa 400bps during the GFC. A contractionary budget provides scope for further spread tightening in the coming months.

This would suggest that bonds in general, may provide further upside in term of price appreciation.

Figure 2

A key and widely reported measure that will be backed by The Greens is the reintroduction of the link between petrol excise and inflation. Rising petrol prices are one of the factors that can act broadly to increase inflation.

We expect interest rates to remain low and inflation to remain in the RBA target range of 2 to 3%.

Greater savings would increase deposits held by banks and, coupled with fiscal tightening and lower spreads required for new bond issuance, may see term deposit rates contract further. Building a bond portfolio or increasing your allocation to bonds is one way to improve returns over deposits and increase certainty of your returns compared to shares.