by

Elizabeth Moran | Nov 03, 2014

Virtually all economists predict the cash rate will be left on hold next Tuesday when the RBA board meets but a growing number are now calling for the next move in rates to be a cut.

One of the concerns about a rate cut is that it could further stimulate the frothy property market. However, there are good alternatives to monetary policy which could be used to restrain the market instead. These include macro prudential controls where the regulator limits borrowing to a group of applicants, or where there are limits to the amount the banks can lend as a proportion of the value of the property such as those in New Zealand.

A rate cut would support a lower Australian dollar, improving the prospects of exporters and the education and tourism sectors.

The recent annualised, headline inflation rate of 2.3 per cent, down from the previous quarter, somewhat supports the call for a rate cut.

Regardless, mounting evidence supports the call that interest rates will be lower for longer. But the bills of investors still need to be paid and deposit rates at around 3.5 per cent don’t help much.

Fixed rate bonds are one low risk investment that could provide some relief.

While some market commentators have been warning about investing in fixed rate bonds, their absolute certainty of income and return of principal at maturity can outweigh the disadvantages.

Before I make some suggestions, I’d like to put some balance into the argument.

Fixed rate bond prices do have an inverse relationship with yield meaning that higher interest rates will cause bond prices to move lower. However, future interest rate expectations are already built into the price of fixed rate bonds. If rates are viewed as likely to move higher then bonds will already be cheaper to reflect this. It’s only changes that are higher or lower than expected that will subsequently influence the price.

If there are negative movements in fixed rate bond prices you can simply hold the bond until maturity when it repays $100 face value and your overall return will be positive. If you think interest rates will move higher in say three years, then you would seek fixed rate bonds that mature in three or four years to limit that risk.

It is true that the longer the term to maturity of a fixed rate bond, the greater the changes in price when interest rates change. This is known as duration. Investors certainly wouldn’t want to hold a portfolio that is all long dated fixed rate bonds, but including floating rate bonds and holding a range of maturities in the fixed rate part of your portfolio will limit the impact of duration.

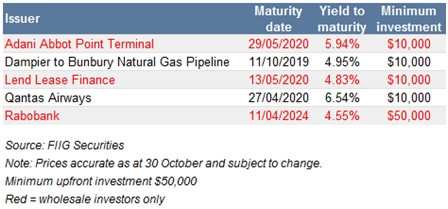

It’s no surprise then that the best fixed rate bond returns are in companies that are lower credit quality, or have longer terms until maturity. Fixed rate bonds offered by Adani Abbott Point, Dampier to Bunbury Natural Gas Pipeline and Lend Lease Finance, are similar investment grade quality over similar terms. The standout being the Adani Abbott Point offering 5.95 per cent to maturity, at least a 1 per cent higher return than the other two.

If you are prepared to take on extra risk, the Qantas 2020 bond with a yield to maturity of 6.54 per cent offers stand out value, especially given positive results announced this week.

For those investors seeking minimal risk, Rabobank has a long dated fixed rate bond maturing in ten years, in 2024 that pays 4.55 per cent yield to maturity.

While it might be hard to imagine, interest rates could be cut and investing in fixed rate bonds will provide certainty of income and the possibility of higher bond prices. They have a place in every portfolio. Like all good investment it’s about weighing the risks and returns and working what suits your specific goals.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.