by

Alen Golubovic | Oct 28, 2014

FIIG offers exposure to mining companies and to companies which service the sector. All of the bonds available in this sector are US dollar bonds, which also aids diversification. There’s been plenty of activity in this space over the past week. A summary of each of the companies whose bonds are available through FIIG is outlined below.

Please speak to your FIIG representative if you are interested in a fixed income exposure to the broader commodities sector.

Mining Companies

FIIG offers exposure to some of the world’s leading mining companies in both the gold (Newcrest) and iron ore (Fortescue) sectors.

While each of these companies’ earnings has been impacted by falling commodity prices, there has also been some offsetting benefit to their earnings coming from a stronger US dollar. The miners’ US dollar revenue bases provide a natural hedge for their US dollar debt, and with a portion of costs in Australian dollars, margins will improve as the US dollar strengthens.

Newcrest

Newcrest is the largest gold producer listed on the Australian Securities Exchange and one of the world's largest gold mining companies. It has a market capitalisation of $7.4bn and is currently rated BBB- (stable outlook) / Baa3 (negative outlook). Just last week, Moody’s affirmed its investment grade rating.

Credit metrics have improved off the back of a better than expected gold price and cost reductions. Moody’s expects Newcrest's credit metrics to improve in FY16 as the company continues to ramp up its large, very low cost and world class Cadia mining operations.

The continued negative outlook from Moody’s reflects the short track record in recent cost improvements, as well as continued uncertainty around the company's ability to sustainably improve the performance of the challenging Lihir mine, which is the company’s largest mine. While plant reliability and throughput at Lihir remains a key risk for the business, Newcrest's costs of production compare very well to other investment grade peers in the market. Its successful Cadia Valley operation is a world class asset operating at the lowest point on the global cost curve for gold production.

FIIG offers exposure to Newcrest through the 2021 and 2022 US dollar bonds, which are currently indicatively offered at yields to maturity of 4.95% and 4.60% respectively. The bonds do not contain early call provisions and therefore we expect them to run until their respective maturity dates. Both bonds are available in minimum parcels of US$10,000 and these smaller investment parcels are attractive for investors seeking only a light exposure to the commodities sector in their overall investment portfolio.

Newcrest is the lowest risk of the five companies listed in this update and is considered sound relative value for those looking for a lower risk, investment grade bond. It will also appeal to those looking for an exposure to gold or a hedge against a global uncertainty which would typically see the gold price and US dollar rally.

For further information on the Newcrest bonds mentioned above, please see the research report at the following link.

Fortescue Metals

Located in the iron ore rich Pilbara region of Western Australia with close proximity to the world's major markets of China and India, Fortescue is the world's fourth largest iron ore producer. Listed on the ASX it currently has a market capitalisation of $9.2bn and its unsecured bonds are rated BB/Ba2 with a stable outlook.

Following an extremely strong performance in FY14, Fortescue repaid US$3.6bn of debt. With a continued focus on cost reduction and maximising free cash flow, Fortescue is well placed to manage the current downturn in iron ore prices.

The Fortescue US dollar 8.25% bond maturing in November 2019 is now available as a DirectBond through FIIG in minimum parcels of US$10,000 and is the best value of the various Fortescue bonds. Its high coupon is a standout feature relative to other Fortescue bonds, and is being offered to investors at an indicative yield to maturity of 6.70%.

The 2019 bond can be called early by Fortescue, with call dates in November 2015, 2016 and 2017. Recently, Fortescue has shown an appetite to pay back debt early, repaying US$3.6bn of debt since November 2013 following strong free cash flow generation in FY14, Going forward, we expect the company to look to continue to repay debt ahead of schedule, with the amount of repayment dependent on future free cash flows, and therefore there is the possibility of an early call on the bonds. Fortescue’s free cash flow generation in turn will largely depend on future iron ore prices, as well as the company’s continued ability to reduce its costs and meet its production targets in the coming years.

Whilst higher risk that Newcrest due to its higher financial leverage, the BB/Ba2 rating is deemed appropriate and the return of 6.70% on the November 2019 bonds is viewed as excellent value. A possible early call at November 2016 would see the yield fall to 5.75%, which is still an attractive return for only a two year investment horizon. As a comparison, the 6.875% 2022 Fortescue bonds are yielding 5.89% which further reinforces the excellent value on the 2019 bonds. This bond would suit investors with a higher risk appetite, being sub investment grade and exposed to the volatile iron ore market, but confident in Fortescue’s position as a global top 4 iron ore producer.

For further information on the Fortescue DirectBonds available, please see the fact sheets by clicking here and here

Mining Services Companies

FIIG offers exposure to the mining services sector through the US dollar Ausdrill and Emeco DirectBonds. Mining services companies have been impacted by the overall slowdown in the Australian mining sector. Lower iron ore and coal prices have impacted the profit margins of domestic miners, and in turn, the miners have reduced their scope of work and renegotiated contracts with the mining services companies. The current weakness in the mining services sector is reflected in the higher returns on offer, with yields in excess of those offered by the mining companies.

It is important to be aware that this sector and the bonds below are high risk and will be impacted by a further deterioration in mining activity in Australia.

Ausdrill

Ausdrill Limited is a leading provider of mining services in Australian and African mines. Ausdrill is one of the largest listed mining services companies on the ASX with a market cap of $207m. It is currently rated BB- (Negative Outlook) / Ba3 (Stable Outlook). Its core activity is providing production related services to major mining clients, including drilling, blasting, grade control, mineral analytics, load and haul, crusher feed services, water well drilling and equipment hire. Ausdrill clients are predominantly mining companies in the gold and iron ore sectors, with a split of roughly two-thirds gold and one-third iron ore.

The downturn in mining activity has hit Ausdrill in the past 18 months with a large loss reported in FY14 after various write-downs and a further profit warning to the market on 20 October 2014. In essence the company are now expecting EBITDA of $150m to $160m for FY15, a reduction of approximately $30m from previous guidance. There is also the prospect of further writedowns with a bottom line loss or possibly a small profit now expected for FY15.

While this most recent profit warning is not positive news, we are confident that Ausdrill is generating sufficient EBITDA to continue to reduce debt and pay interest bills. As previously written, the ability to greatly reduce capex in tough times does provide a lever for Ausdrill and similar companies to improve cashflow metrics in periods of downturn.

We will be watching closely for any further downgrades but based on the current guidance, the expected positive cashflow will allow for further debt reduction. Following the recent profit warning, Standard and Poor’s revised the outlook from stable to negative but this was a less severe move than we were anticipating, however further deterioration in the mining sector would likely see a rating downgrade, a clear indication of an increase in risk.

The 2019 Ausdrill Finance Limited US dollar 6.875% November 2019 bond (available in minimum parcels of US$200,000), is viewed as a relatively high risk bond given the uncertainty in the Australian mining sector and relatively high exposure to politically unstable Africa. However, with recent weakness in high yield and in particular mining related US dollar bonds, we believe the current indicative yield to maturity of 8.89% is fair compensation for that risk. We expect the bonds to run to legal maturity and not be called early.

Whilst Ausdrill is rated BB-/Ba3, we view the risk as closer to B+/B and note that at current trading levels the market is treating it as B-/CCC+.

It is also important to highlight that in line with the differences in return between Ausdrill and Emeco (see below), that Ausdrill is considered a lower risk credit at this point in time. As mentioned above, both Ausdrill and Emeco as mining services companies with a high exposure to the Australian mining sector, are significantly higher risk that the large Newcrest and Fortescue companies.

For further information on the Ausdrill DirectBond, please see the fact sheet at the following link

Emeco

Emeco is the world’s largest independent rental provider of heavy earthmoving mining equipment. The company has a 40 year history with operations currently in Australia, Canada and Chile and has a current market cap of $110m. The end of the mining investment boom in Australia, coupled with falling commodity prices and cost cutting measures have progressively hit Emeco’s bottom line over the last couple of years. However, the Canadian and Chilean operations have performed well over this period and the business has exited its unprofitable Indonesian business, generating $40m of cash on exit of the business through fleet sales.

There are some initial signs of recovery in the mining equipment market. Fleet utilisation is at 60% currently, up from 41% a year ago, and is expected to rise above 70% once the Canadian winter works kick in. About half of the utilisation increase comes from fleet reductions. However, it is still too early to call the “bottom of the market” and we will continue to maintain a watching brief on Emeco’s performance.

The Emeco US dollar 9.875% March 2019 senior secured bonds (available in minimum parcels of US$200,000) are currently offered at an indicative yield to maturity of 10.89%. The bonds can be called prior to the maturity date, with the next call date in March 2017 at $104.938. However, it is unlikely we would see the bonds called early unless the company’s performance can turn around in the next 12-24 months. This very high yield reflects the relatively weak credit metrics of the business as well as the headwinds facing the mining equipment sector. Having said this, the bonds are senior secured, backed by Emeco’s fleet of owned mining equipment. As at 30 June 2014, the company reported a leverage ratio of net debt to tangible assets of 43.4% in their financial accounts. There is no other material Emeco debt outstanding.

Emeco is rated B+ (stable) / B1 (negative) however the bonds are rated one notch higher at BB-/Ba3 given the senior secured position. The probability of downgrades is considered high and we currently assess Emeco as a B-/B3 credit and note it is trading in the market at CCC/CCC- distressed levels.

The price of the Emeco bonds has fallen in the last couple of weeks off the back of a block sale trade which has generated a value opportunity for those willing to take on the significant risks detailed above. The bond suits investors with a high return / high risk appetite, and with nearly an 11% yield this is amongst the highest yielding bonds in the market, with an equity like return.

Alternatively, investors may wish to wait for any further guidance on recent performance and utilisation rates that may be provided at the upcoming AGM on 20 November before investing. It would be expected a positive update would see a significant rally in the bonds given recent poor performance, however, the opposite is likely if management were to confirm tougher than expected conditions and outlook.

For further information on the Emeco DirectBond, please see the fact sheet at the following link.

Relative Value

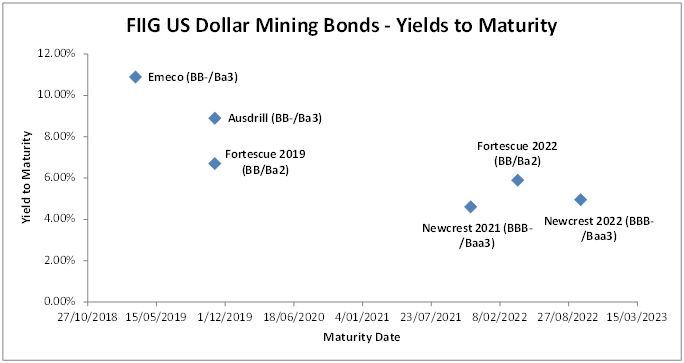

The chart below shows a comparison of yields to maturity for each of the mining bonds listed above. As outlined above, the available bonds in the mining services sector (Ausdrill, Emeco) carry a higher credit risk than the bonds issued by the mining companies (Newcrest, Fortescue), and this is reflected in the relative returns below, with bonds issued by the mining services companies offering higher yields to maturity. Please note the ratings shown next to each name represent the current credit ratings on each of the bonds.

Antares Energy

As a final note, it is worth updating Antares Energy. Earlier this year, FIIG successfully raised $19.5m in 10% convertible notes for the oil and gas company. True to form, Antares has announced the sale of one if its Permian Basin assets, Southern Star, to a US limited partnership Breitburn Energy Partners (‘Breitburn’). The sale proceeds were made up of $US50m in cash and 4.3m units in Breitburn, worth about A$150m in total at current exchange rates.

Antares Energy has paid off the remainder of its term loan facility with Macquarie and is debt free for the first time in three years. Further, it has successfully been able to roll over the US$200m facility for another five years. The sale of Southern Star positions Antares well to further develop its remaining Northern Star and Big Star assets.

The price of the notes on the ASX increased by 4% to $2.05 following the announcement.

Further information

Over recent weeks we have written a number of updates and factsheets on many of the above bonds. If you would like to receive further information on any of these bonds, please contact your FIIG representative.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. All US dollar bonds mentioned in this article are available to wholesale investors only.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.