by

William Arnold | Nov 11, 2014

Performance of FIIG-originated bonds

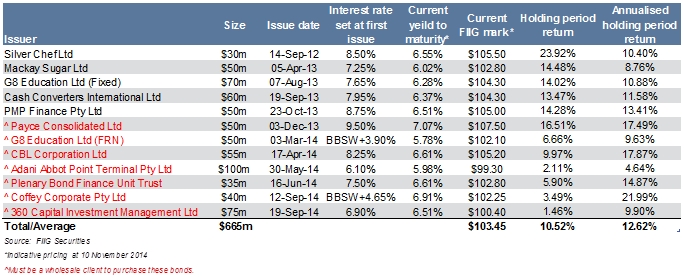

FIIG has originated 12 high yield corporate bonds since September 2012. Table 1 lists each in date order and shows the total and annualised holding period returns.

The holding period return measures the total return on an asset or portfolio over the period it is held. This encompasses the change in the bond price as well as the interest payments. The annualised holding period return represents the equivalent rate of return per year. The return figures in Table 1 are calculated assuming the bonds were bought at issue at par ($100), held and now valued at the current indicative FIIG mark (as at 10 November 2014). All bonds are available in a minimum parcel size of $10,000.

Table 1

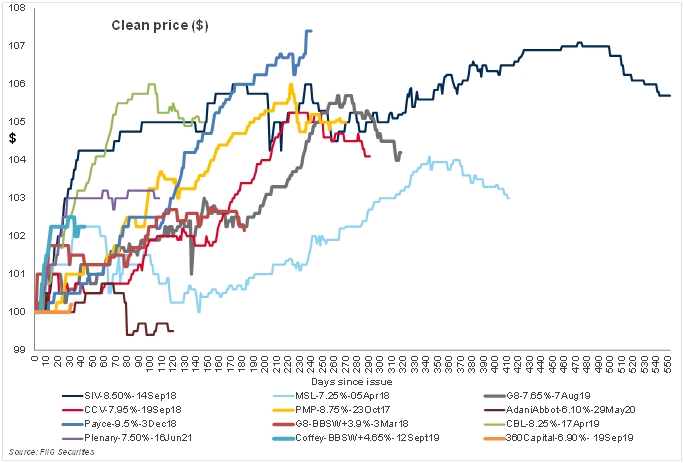

Figure 1 below plots the historical clean price for each bond by days since issue.

Figure 1

The table and graph above demonstrate the strong performance of FIIG-originated high yield corporate bonds over recent years. High yield investments however come with higher risks than traditional investment grade bonds, notably greater volatility, the possibility of lower liquidity in a stressed market and a higher risk of default. To compensate for such risk, investors generally can expect to receive at least 150 to 250 basis points greater yield in high yield bonds than to investment grade bonds at any given time.

Investors can endeavour to manage the risks in high yield bonds by diversifying their holdings across issuers, industries and regions, and by monitoring each issuer’s financial health. Further to this, high yield bonds typically have a lower correlation to investment grade fixed income sectors, such as Treasuries and highly rated corporate debt, which means that adding high yield securities to a broad fixed income portfolio may enhance portfolio diversification. Diversification does not insure against loss, but it can help decrease overall portfolio risk and improve the consistency of returns.

For further information on how to assess unrated, high yield corporate bonds, see the article “Assessing high yield bond investments” in this edition of the WIRE.

Credit profile evolution for each FIIG-originated bond

The following section looks at each of the 12 bonds and how the credit profile has changed between issue date and now. We highlight a selection of key credit metrics and conclude with a comment on historical price/yield performance and current relative value.

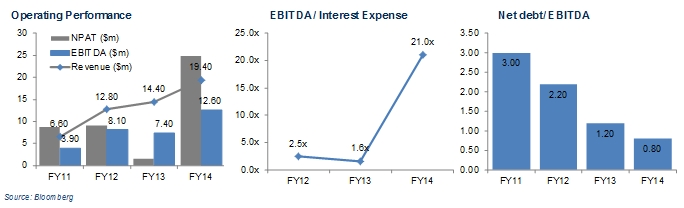

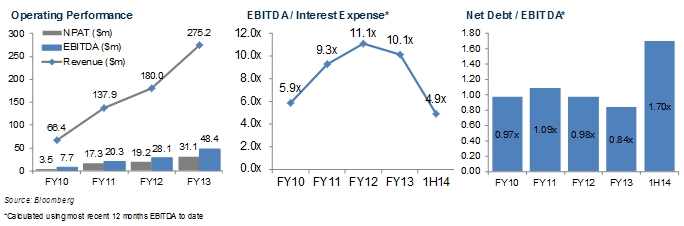

Silver Chef (issued 14 September 2012, available to retail and wholesale clients)

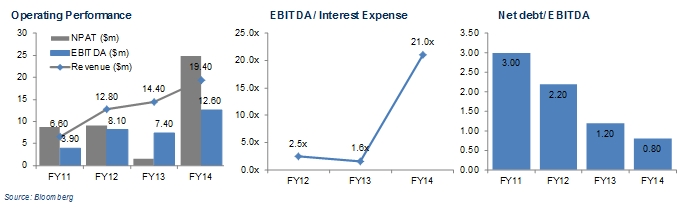

Silver Chef, FIIG’s first originated deal in September 2012, has gone from strength to strength with its market capitalisation growing from about $65m when the bond was issued to circa $178m today. Not only has the group recorded strong top and bottom line performance, it has been able to maintain or improve its credit metrics during this strong growth period (improving interest coverage and net debt to EBITDA as demonstrated in the charts below). If purchased at issue investors would have recognised a return of approximately 10.41% per annum with a total holding period return of around 24%.

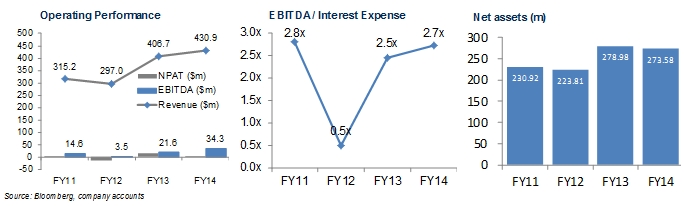

Mackay Sugar (issued 5 April 2013, available to retail and wholesale clients)

With a history tracing back to 1883, Mackay Sugar has proven its ability to operate through difficult economic cycles, and with significant barriers to entry in the Australia market, competition is limited. The main credit strength of this company is its significant asset backing in marketable, easily divestible assets. With a book value of $336.2m in property, plant and equipment and $134.4m in associated investments Mackay Sugar has a net asset position of $273.6m at YE14. The bond has performed well with an annualised return since issue of approximately 8.76%, and while it is among the lowest yielding of the FIIG-originated bonds, is also one of the lowest risk.

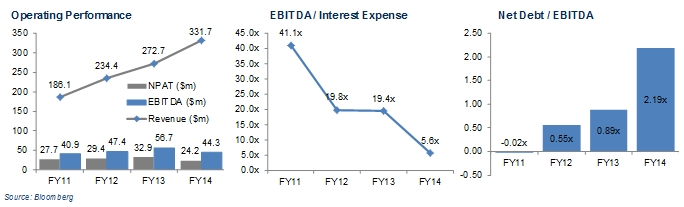

G8 Education (fixed rate note issued 7 August 2013, available to retail and wholesale clients), floating rate note issued 3 March 2014, wholesale clients only)

G8 Education has stepped up its expansion strategy, boosting the number of centres it manages by 54% since the end of 2013. As G8 expands, it is likely that it will use an increased proportion of debt to fund future acquisitions in order to continue to deliver shareholder growth. The company may potentially continue to pay higher acquisition multiples than the stated 4.0x to secure premium assets. If debt funded growth continues, the credit profile of G8 could deteriorate over time. Covenants will limit G8’s capacity in this regard. Despite such factors, G8 bonds have performed well at an annualised return of around 11% and 9.67% for the fixed and floating respectively.

Cash Converters (issued 19 September 2013, available to retail and wholesale clients)

Cash Converters is growing strongly and taking on additional debt to fund this, leading to weakening credit metrics. However this is coming off a low base and its level of debt continues to be manageable with gearing of some 28.4% and strong interest coverage of 5.6 times. The Cash Converters’ bond has performed well, generating an annualised return of 11.59%. FY14 was impacted by the transitionary impact of a new regulatory regime for short term lending. Looking forward, the business expects greater regulatory certainty, and improved performance.

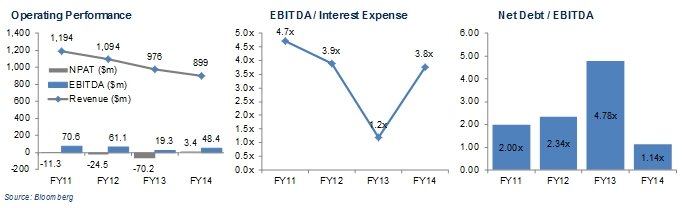

PMP Limited (issued 23 October 2013, available to retail and wholesale clients)

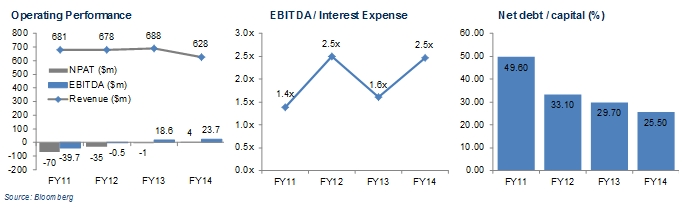

Despite reporting statutory losses in recent years, the company’s ability to articulate then execute a transitional strategy underpins PMP’s credit story.

The FY14 results were excellent as both the operational performance and balance sheet continued to improve. Not only has management achieved what they clearly set out to do in their “transitional” plan, they have exceeded expectations, particularly in the reduction of net debt and turnaround of cashflow from operations. These two developments, together with the strong gearing, interest cover metrics and tight covenant package, more than compensate for the industry risk the printing industry currently presents. At today’s prices, this bond has returned about 13.4% per annum. Given such a strong turnaround, the company may seek to call this bond early if it can source cheaper debt and/or do not make further acquisitions. Either way, this good credit still offers a solid return to call, or maturity.

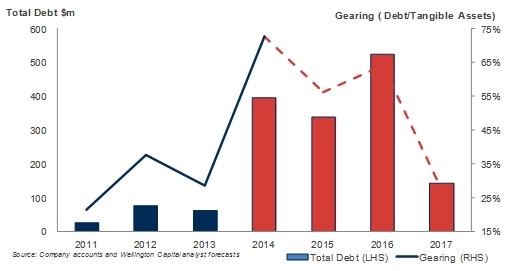

PAYCE (issued 3 December 2013 available to wholesale clients only)

The PAYCE bond is a credit story of two halves. The bond started with a mezzanine debt type risk profile, then on completion of the East Village project, evolved into a significantly lower risk second mortgage type position when bondholders were granted a corporate guarantee. Compared to other FIIG-originated deals PAYCE now offers one of the lowest risk profiles. While performing very strongly since issue (with an annualised return of circa 17.5%), it offers value with a current yield to maturity of 7.07% given the recent change in risk profile. Like PMP above, the company may consider calling this bond early if debt can be refinanced at a rate below the current 9.5% fixed rate.

The key credit metric that has changed for PAYCE is the security position, with bondholders now holding a (second ranking) guarantee from the owner of the East Village retail/commercial assets which was most recently valued at $210m and prior ranking bank debt of just circa $100m. Further to this, the below chart illustrates the forecast (in red) reduction in gearing.

CBL Insurance (issued 17 April 14, available to wholesale clients only)

CBL Corporation Limited (CCL) is a privately owned insurance/reinsurance Group that has been operating for more than 40 years, with a highly regarded and experienced Board of Directors and management team. The main operating subsidiary, CBL Insurance Limited, is regulated by RBNZ and also has an investment grade rating from A.M. Best, which we expect will be upgraded in coming years, producing volume and profitability growth opportunities from new markets such as Asia.

Both the oversight and rating disciplines are viewed as key supporting strengths for the company and bondholders. As with all insurers, there is a degree of risk in its operations and growth strategy, however the solid revenue, profitability and cashflow the Group has produced over recent years, together with expectations of continued growth, provide comfort that the moderate debt levels of circa NZ$59m can be serviced and repaid on a timely basis. Regulatory capital solvency margin improved substantially due to the reinvestment of funds from the CBL bond into capital of CBL Insurance Limited, lifting the ratio from 121.0% at 31 December 2013 to 139.8% as at 30 June 2014.

Adani Abbot Point Terminal (issued 30 May 2014 available to wholesale clients only)

The Abbot Point Coal Terminal is an essential piece of mature infrastructure for the Queensland and Australian economies (operating for almost 30 years) and a key link in the coal export market. While debt levels are relatively high, this is typical for infrastructure assets, and it has long-term take-or-pay contracts in place. The Terminal has a weighted average life of 11.5 years, which is well past the bond maturity. The main risks are renewal of contracts and refinance although these are viewed to be longer term concerns. This senior secured bond (secured against assets and a 99 year lease), is rated investment grade by two credit rating agencies, benefits from ring fencing and other protective covenants, as well as step up coupons if it was to fall below investment grade. The company has not released updated financials since the bond was launched in May 2014 but the financials are expected to be relatively unchanged given the take-or-pay contracts. Much of the recent negative news-flow has been around the depressed coal price and issues related to the Abbot Point Terminal expansion project, which is an unrelated to this bond.

Plenary Bond Finance Unit Trust (issued 16 June 2014 available to wholesale clients only)

Plenary Bond Finance Unit Trust (Plenary) is a public private partnership (PPP) funding vehicle. With eight PPPs included in the structure, Plenary enjoys cash flows from a diverse range of projects including diversity across geographic location, government and project type/sector (eg hospital, rail, tourism). The bonds also benefit from government-backed revenues (including inflation protection) and simple operational models of the projects.

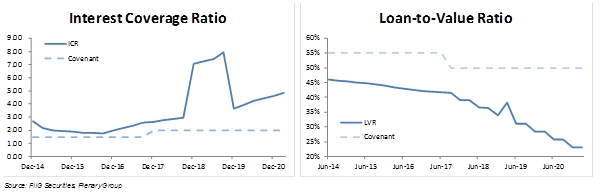

The bonds have performed strongly since issue (with a return, if annualised of around 15%). In terms of outlook, credit metrics are forecast to stay within the LVR covenant (which decreases due to a gradually increasing valuation balance) and the significant reduction in loan balance from the first amortisation date (October 2017) onwards – which will likely drive performance of these securities. Since issue, there has been limited updated financial information. The charts below are forecasts at the time of the bond issue.

Coffey (issued 12 September 2014 available to wholesale clients only)

Coffey International, a specialist professional services consultancy with expertise in engineering, geosciences and international development, was able to return to profitability in FY14 with a general stabilisation in poor performing areas. Management has taken various actions to turn this business around and such action appears to be working.

FY14 profit was driven by cost cutting measures (mainly head count reduction), and a focus on debt reduction. The company has also negotiated extensions in bank facilities to FY17 so this with the FIIG issued bond takes the company’s average debt duration from 1.4 years to a much more manageable 3.7 years. Performance for this bond has been very strong, with a total return over the two months since issue of around 3.5%. This is a floating rate note and could appeal to investors seeking to benefit from rising rates, and those compelled by Coffey’s turnaround story. Again, with only a few months since issue there is not a lot of new information. However, the company did provide a market update on 4 November where, positively for bondholders, management reiterated their intention to remain focused on debt reduction and cash generation.

360 Capital (issued 19 September 2014 available to wholesale clients only)

360 Capital is a property investment and funds management group. With the recent unconditional sale (announced 30 October 2014) of its Hurstville property 360 Capital has materially reduced the risk of its bond given the lease on this property is due to expire in February 2015.

360 Capital will no longer have any direct property exposures and will become a pure fund manager and investment group in line with its stated strategy. Further, the excellent contract price of $47m with no bank debt offsetting the sale provides 360 Capital with scope to reinvest and further grow the business. This bond is considered to have one of the lower risk profiles due to the underlying property business, including indirect property backing, and now the removal of one of the key risks. Like Coffey above, with only a few months since issue there is not a lot of new information other than the sale of the Hurstville property.

ConclusionThe potential to provide attractive levels of income and the ability to reduce overall portfolio volatility are both good reasons to consider high yield investments. Before you invest in high yield securities, you should be aware of the risks involved. Investors can endeavour to manage the risks by diversifying their holdings across issuers, industries and regions, and by monitoring each issuer’s financial health.

Looking at the market currently, we can make various value assessments. With the shortest maturity date, and good management executing a strong turnaround strategy, the PMP bond is well worth consideration with a yield to maturity of circa 6.5% (or circa 5.4% to first call in just under a year). Similarly, Mackay Sugar is relatively short dated, and benefits from significant asset backing supporting its low risk credit profile.

While PAYCE has performed very strongly since issue, it still offers value at circa 7.1% to maturity given the recent change in risk profile, which may see margins tighten further, although returns to call date are lower at 6.0% to December 2016. Similarly, with 360 Capital’s recent property sale and subsequently de-risked position, the bonds appear very attractive. The Adani bond is also noteworthy appearing to have underperformed due to the negative news-flow (which is largely unrelated to the credit fundamentals of the bond), and with a sub-par price, represents a good buying opportunity for investors. It has an investment grade rating and significant margin step-ups in the event it falls sub-investment grade. CBL Insurance and Cash Converters have positive outlooks and the potential to perform strongly.

While G8 Education is a solid credit, significant expansion intentions and the potential to continue to pay higher multiples on acquisitions may have a detrimental effect on its credit profile and therefore it looks fully priced.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.