by

Ekaterina Skulskaya | Jul 22, 2014

Key points:

1. Seven of the top 10 performing bonds were long dated and inflation linked

2. Returns include moves in the bond price and interest income

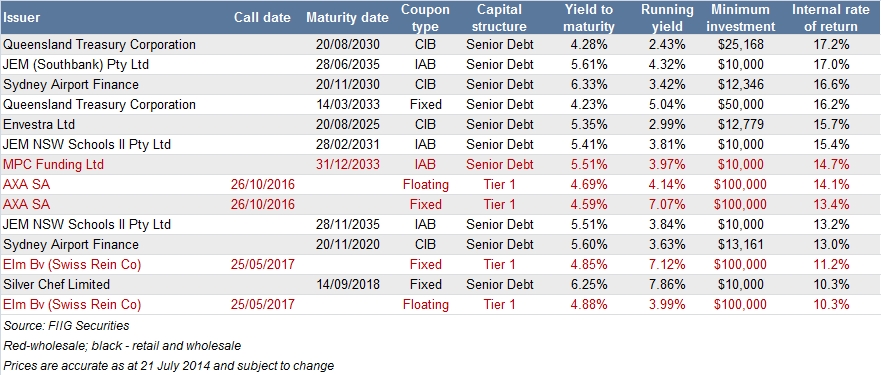

Following the end the 2013-14 financial year, we have done the numbers and found the top performing bonds traded by FIIG over the period.

Many types of bonds were represented but at the top of the rankings one clear theme emerged: inflation protection.

Most of the top returns were generated by long dated Capital Indexed Bonds (CIBs) and Indexed Annuity Bonds (IABs). Queensland Treasury Corp, which raises funds for the Queensland State Government, issued two of the bonds on the list: the QTC 2030 CIB, which achieved the highest return in the group at 17.2% and the QTC 2033 fixed rate bond which returned a very respectable 16.2%.

Another top performer was the JEM (Southbank) Pty Ltd 2035, an indexed annuity bond issued to fund infrastructure developer Axiom Education Queensland Pty Ltd, which built the Southbank Education and Training Precinct for the Queensland State Government. The deal is now in the low risk operational phase which will continue until 2039 at which time the assets will revert back to the State of Queensland. The bond returned 17.0%.

Rounding out the Top 3 was the ever popular Sydney Airport 2030 CIB which returned 16.6%. All of the three bonds offered investors a direct hedge against unexpected inflation by linking cash flows to movements in the Consumer Price Index (CPI). This gives investors a simple means to protect the real value of their investment and offers significant diversification benefits to any portfolio. CIBs and IABs clearly dominated throughout FY13-14 with seven bonds positioned in the top ten.

Seven of the Top 10 performers were also longer dated inflation linked bonds that pay fixed coupons each quarter. The outperformance of these bonds can be partially explained by the significant rally of government-issued inflation linked bonds during the year on the back of renewed concerns about inflation.

As well as offering inflation protection, IABs suit many SMSF investors in pension pay down phase and those looking for higher cash flow investments.

However, there were a few exceptions to the inflation protection theme. Fixed rate, short dated, yield to call hybrids AXA SA and Swiss Re returned 13.4%, 11.2% while Silver Chef’s senior bond returned 10.3%. Floating rate AXA SA and Swiss Re bonds also made the list.

Both the AXA SA and Swiss Re floating rate bonds as well as JEM NSW Schools and MPC Funding indexed annuity bonds all continue to trade at a discount to their face value so investors can expect a capital gain if they buy these bonds now and hold them to call/ maturity.

Performance has been exceptional and highlights the need to have a diversified portfolio to capture gains across the different bond types.

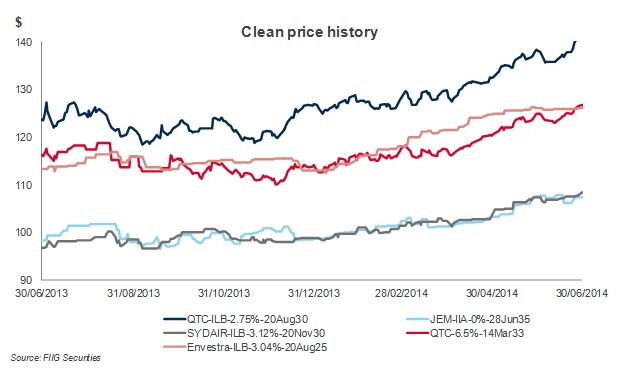

The graph below illustrates the price history of the top five performing bonds: QTC 2030 (CIB), JEM Southbank 2035(IAB), Sydney Airport 2030(CIB), QTC 2033 fixed and Envestra 2025 (CIB).

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

For more information, please call your local dealer on 1800 01 01 81.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.