Assessment of the probability of a security being called has become more complex and needs to be assessed by jurisdiction, entity and security.

Australian banks continue to call step-up hybrid Tier 1 and Tier 2 securities at the first opportunity but this is not the case in other jurisdictions. In Europe around half of such instruments have not been called over the last two years and in the US the decision to call or not is primarily an economic one, with two large banks recently not calling their issues. The introduction of Basel III will give impetus across all jurisdictions to call non-compliant step-up instruments at the first opportunity however there are some circumstances where leaving a security outstanding may still be an attractive proposition, or indeed mandated by regulators. Assessment of the probability of a security being called has therefore become more complex and needs to be assessed by jurisdiction, entity and security.

Asia Pacific

Asia Pacific banks, including the Australian banks, continue to call their step-up issues at the first opportunity – and it is expected they will continue to do so. This is primarily due to:

- Non Basel III compliant step-up securities will lose all capital weighing if not called at their first call date

- Reputational risk, that is not calling could alienate investors who may not participate in future issues. This is particularly important for Australian banks, that are interested in developing a market for their new capital instruments and suggests a broader interest to call

- They are generally in stronger financial positions than global peers and therefore under less pressure from regulators, governments or shareholders. This point is illustrated by the fact that APRA recently removed the need for their approval prior to Australian banks making distribution payments on Tier 1 and Tier 2 instruments (which led to S&P putting such securities on watch positive as discussed here)

- Not calling may be seen as a sign of financial weakness, which may have an impact on access to and the cost of wholesale funding

- It is also worth noting that from an economic perspective (i.e. funding costs to the bank) a bank’s impetus to leave a non-compliant capital instrument outstanding (theoretically this would now only contribute to the funding requirement of the bank) and thus the cost would be compared to issuing new senior debt of comparable maturity. Most Asia Pacific banks with issues having call dates over the next two years appear mostly to be more expensive than senior debt in the current environment

The stance of most Asia Pacific banks is similar: they are likely to choose to call issues in order to maintain good relationships with investors. Large banks that require ongoing market access have a higher incentive to call than smaller banks with limited need for capital instruments. Australian banks are large issuers of debt and will want to continue tapping domestic and offshore wholesale markets and will seek to maintain access to a wide investor base. It is likely Asia Pacific banks will continue to call their wholesale issues when due.

ASX listed securities without a step-up are a different kettle of fish. One has failed to call at the first opportunity (NABHA), while the BOQ PEPs (BOQPC) were exchanged into a new security as opposed to redeeming for cash.

NABHA: While the PEPS were the first bank preference shares not to be redeemed, there have been bank ‘income securities’ which were not redeemed at first call date. For example the 1999 issued NABHAs. These however were sold explicitly as perpetual with no step-up, while NAB has the option to call these at each payment date it has no obligation. The following is taken from the original prospectus:

“The income securities...have no maturity date, and will not be repayable by the National. To realise your investment you will need to sell your National Income Securities on the ASX at the prevailing market price, or privately. There can be no assurance as to what that price will be.”

Bank of Queensland PEPS: December 2012, BoQ became the first Australian bank to opt not to redeem an issue of preference shares on the first optional call date. This however was a retail offering with no coupon step-up. PEPS stands for Perpetual Equity Preference Shares which alludes to the very equity/perpetual nature of these securities.

BoQ offered to roll PEPS holders into a ‘new style’ Basel III complaint security (CPS). While investors were not forced to take the new security, the alternative was to continue to hold the PEPS as a perpetual security with a lower distribution than the CPS, no maturity date and a high probability of illiquidity. The exchange into the new CPS, while providing a higher return to investors, was lower than the Bank would have had to pay for a new issue.

Europe

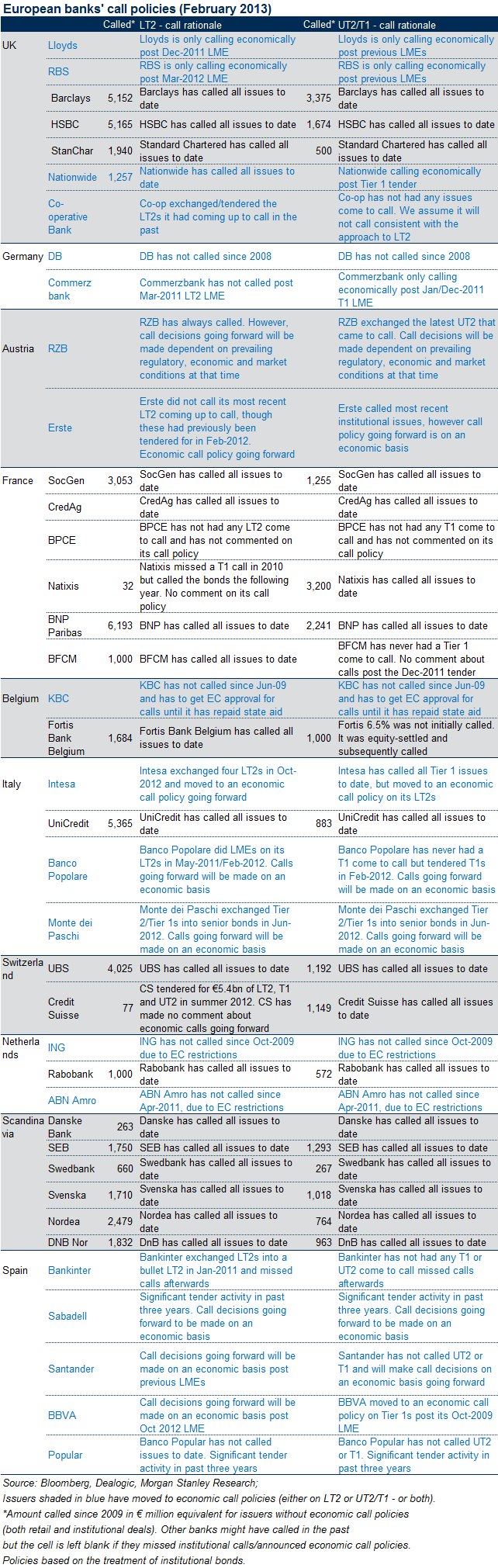

Once upon a time, European banks automatically redeemed step-up, callable, upper Tier 2 subordinated and Tier 1 hybrid securities at their first call date. Indeed, if they had not done so, there would have been a significant negative market reaction. All this changed once the banking crisis started. The stigma of not calling bonds at their first call date began to dissipate making it difficult to predict which bonds would and would not be called, meaning they are harder to value. Across 2011 and 2012, European banks did not call about half their subordinated and hybrid Tier 1 step-up securities due at that time.

However, some of the stronger European banks still consider that not calling bonds is a sign of weakness and have continued to call step-up securities through the financial crisis, including BNP Paribas, Société Générale (however it did undertake LME – see below), HSBC, Barclays, Standard Chartered, Rabobank and the major Nordic, Scandinavian and Swiss banks.

Of the issuers that have not called, this is generally due to either:

- Banks that have been prevented from calling bonds by regulators (most commonly by the European Commission as a condition of state aid approval). This includes banks such as RBS, Lloyds and ING.

- The bank has done so on economic grounds given the step-up rate is cheaper than the bank could access through a new issue (or the bank might not be able to refinance the bond at all due to difficult funding conditions). The banks which have not called on economic grounds are generally in weaker financial positions (mainly smaller regional banks in Italy and Spain). However, Deutsche Bank was the first major European bank to announce it would call Tier 1 and Tier 2 bonds on an economic basis (in 2009) and since then it has declined to call bonds.

The step-up feature is meant to be an incentive to call the security but this can be something of a misnomer. A lot of hybrid Tier 1 and subordinated securities switch from a fixed rate to a variable rate. However, given the lower level of current interest rates, what was a coupon step-up at issue is now effectively a coupon step-down. The new distribution rate is often well below the level at which the bank could issue in the current environment. This is particularly the case for weaker institutions.

For example, hybrid Tier 1 securities that are coming up to their first call date in 2013 (i.e. typically issued in 2003) tend to step-up to around Euribor + 180-200bps. In practice therefore, given current interest rates (three month Euribor is around 0.19%), this represents a step down, rather than a step up, in the coupon, compared to the fixed rate at first issue was typically 5% to 6%.

Liability management exercises (LME): Prior to the recent “risk on” rally, European banks had taken advantage of lower security prices and offered to repay outstanding securities at a discount to face value; thus managing the liability side of their balance sheets (LME). By buying the securities at a discount, the banks were able to book a profit, thus improving capital. The majority of bonds involved in the LME had not been repaid at their first call date, where the price of the security fell to reflect its perpetual nature and thus uncertainty. Most of these offers were made after the decision not to call the securities. However, some of the buybacks were carried out before the first call date, often with the threat that future calls would only be considered on an economic basis. This provided an additional incentive for bondholders to participate in the offer. Such exercises are known as ‘coercive exchanges’ and allow an institution the ability to book a capital gain given securities are bought back below par.

US banks

Call options for US banks are mostly embedded in securities issued offshore and are almost non-existent in the US domestic market. In general terms the decision for a US bank to call or not is primarily an economic one. US regulators have also been pushing banks to look at the economics of calling bonds. As a result, securities reverting to a variable rate with a nominal spread are viewed as cost effective funding and therefore may be left outstanding until maturity.

During April 2012 Bank of America and JPMorgan both missed calls on European issued lower Tier 2 notes. The Bank of America deal was a €1.25bn 4.75% May 2017 issue. Prior to the non call, the bank had launched two tender offers on capital securities and subordinated paper, including this note. They offered to buy back the paper in January 2012 at 84.95% of par, then at 93.5% of par in March 2012. Similarly to the major European banks, this gave a strong indication that the paper would not be called. Economically the non call option was attractive for the bank with the deal switching to 77bps over one month Euribor. The BoA is facing at least US$50bn of various lawsuits giving further incentive not to economically disadvantage itself in favour of European investors. The security was priced to maturity and after the lower than par buy back offers the market was not surprised by the non call.

The JP Morgan deal however surprised the market. The security was priced to the call date, and JP Morgan had not issued a tender offer targeting the security. This was a £700m 6.25% May 2017 issue with a first call date on 16 May 2012. The note was unusually structured by only giving the bank the option to call the bond during 2012 (16 May or 30 August), and not on each subsequent distribution date. It was sold with the suggestion it would be called. When this security was not, it switched to a variable coupon of 56bp over 1 month Libor. This was cheap compared to senior or subordinated debt issuance. The security also has subordinated debt benefits for a couple of years. Economically, the argument for non call was very strong.

It’s interesting to note that both of these non calls were outside the bank’s domestic markets. Further, while US banks issue limited securities with call options, the decision whether or not they call seems to be primarily an economic one.

Conclusion

It is expected that the major Asian and Australian banks will continue to call their step-up Tier 1 and Upper Tier 2 securities when due, we have less confidence in the retail ASX market given the NABHA and BOQ examples listed above. In Europe, the stigma attached with non calls is diminishing with many banks. US banks issue limited securities with call options however their decision whether or not they call is primarily an economic one. The introduction of Basel III will give further impetus across all jurisdictions to call non compliant step-up instruments at the first opportunity. Looking forward, once Basel III compliant bonds become the norm, supervisors will be play a larger role in deciding whether banks can call instruments and may well not permit them to do so.

In principle, Basel III compliant Tier 2 instruments should therefore be priced based on their final maturity and Tier 1 instruments should be viewed as perpetual since banks may not be free to call them, even if they are in good shape and can afford to do so. However, there is some uncertainty over this and we also question whether regulators will in practice not allow a bank that is sound and well capitalised to call capital instruments if it chooses to do so.