by

Dr Stephen J Nash | Dec 05, 2012

While many investors think that cash is king, the reality is that, in a low growth environment, bonds are “the king in waiting”. Corporate bonds are king, for an important reason; they have the extra risk that provides additional return.

With one official institution after the next lining up to downgrade growth forecasts, the idea that growth will race away any time soon is not viable or logical at this time. Hence, in the current low growth macro-economic environment, overreliance on cash can drag returns, especially when corporate bond yields are almost double the cash rate. After reviewing the recent official sector warning on growth, this article then looks at how corporate bonds can lift returns substantially, and how they are likely to beat cash over 2013.

General economic outlook

As we have noted recently, the IMF and the Federal Reserve in the United States have revised down growth forecasts. More recently, the OECD supported the more cautious approach of the IMF with further revisions of growth and warnings about the risks to growth, as follows:

After five years of crisis, the global economy is weakening again. In this we are not facing a new pattern. Over the recent past, signs of emergence from the crisis have more than once given way to a renewed slowdown or even a double-dip recession in some countries. The risk of a new major contraction cannot be ruled out. A recession is ongoing in the Euro area. The US economy is growing but performance remains below what was expected earlier this year. A slowdown has surfaced in many emerging market economies, partly reflecting the impact of the recession in Europe (Editorial, The policy challenges: now and in the long term, p.4, OECD Economic outlook 92, Press Conference, Paris, 27 November, 2012, Angel Gurría Secretary-General & Pier Carlo Padoan Deputy Secretary-General and Chief Economist).

Such a low growth outlook supports the idea that Australia will, like the rest of the developed world, struggle to grow during 2013 and this means that cash rates are not set to rise for the next few years. Rather, it is likely that cash rates will fall further, and are likely to average 3% or less over 2013. Such an outlook for cash really focuses the argument on what corporate bonds can do in such low growth scenarios.

Corporate bonds and cash

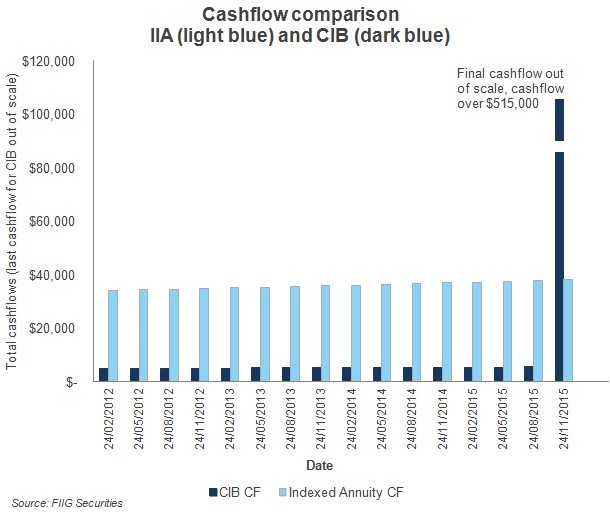

Last week, we looked at the characteristics of the UBS Corporate Bond 3 to 5 year Index (corporate bond index), and compared the return and risk attributes to equities (click here to read the article). This week, we will compare the return characteristics to cash. Here, we note that on average, corporate bonds beat cash by over 3% over the medium to longer term, as shown in Figure 1 below. Only when cash rate was tightened for an extended period, between 2006 and 2008, did the average three year return of the corporate bond index, less the UBS Bank Bill Index, turn negative. Given the overall momentum in official sector growth revisions, for lower and lower growth, it can be argued that the possibility of cash rising in 2013 remains extremely low. Also, getting roughly 3% better than cash is very significant, given that the cash rate should average 3%, or lower, over 2013. In the current climate, investors can earn almost double returns from cash. Yet, because the cash rate is low, investors seem largely uninspired by corporate bonds. Investors have been conditioned to look for high returns, but if the current climate is here to stay, then they need to adjust to this new environment; the faster the better. As 2013 rolls on, the prospect of doubling cash returns, for a very small increase in risk will be exploited by more and more investors, so those who move early will reap the benefits.

Figure 1

Extra return accrues to corporate bonds because corporate bonds have two main risks that cash does not:

- Interest rate risk: this is the risk of accepting a fixed interest rate, when there is a possibility that interest rates might rise, and the price of the bonds fall, but the opposite is also true, fixed rate bond prices rise in a declining interest rate environment

- Credit risk: this is the risk that the issuer may not pay the agreed coupon (interest) payment, or return capital at maturity

The market rewards those who take these risks quite well.

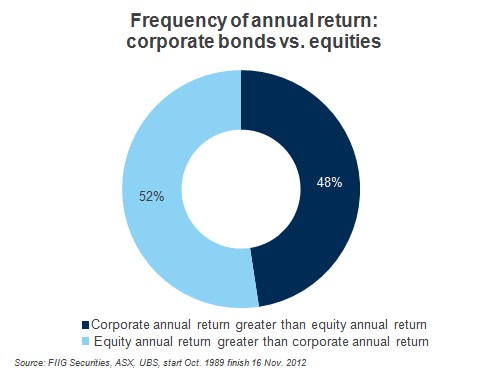

This is not to disregard the macroeconomic view, as the view on cash remains important. Figure 2 shows that when cash rises, corporate bonds can underperform cash.

Figure 2

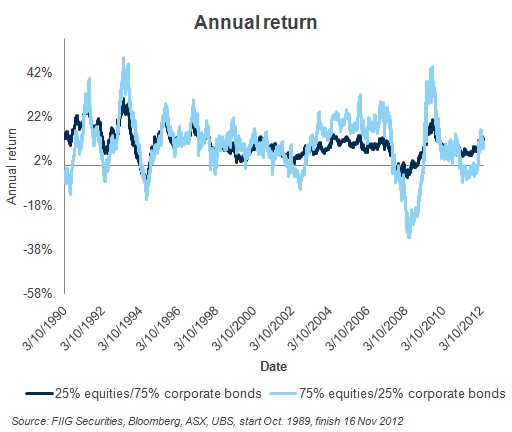

Corporate bonds provide a great basis for portfolio asset allocation, where a portfolio with a 75% corporate bond weighting (and 25% equities) achieves 97% of the return achieved by a portfolio with 75% equities (and 25% to corporate bonds). However, the bond weighted portfolio cuts risk in half, as Figure 3 shows below, with the equity biased portfolio varying radically over time, while the bond biased portfolio is much more consistent, and has much less volatility.

Figure 3

Conclusion

Cash is not king in a low growth environment, and if the macro-economic view supports the continuation of low cash rates, bonds are a much better alternative to cash. Official support for low growth has been confirmed again and again. If anything, the risks for a further correction in equities is building, as the market revises over optimistic growth estimates in the lead up to the long and drawn out announcement of QE3, while the wrangling of the US fiscal position continues. Looking to corporate bonds is logical, as the extra return has averaged over 3% over the bank bill return over many years. An increase of 3% return comes in very handy when cash averages 3%, or less, as it probably will, over 2013.