From the Trading Desk

We have encountered a parcel of Suncorp Insurance Fund 6.25% 13 June 2017 Lower Tier 2 bonds in Great British Pounds (GBP) at a comparatively attractive yield. These bonds are currently offered at a margin of 365 basis points (bps) over the UK swap curve (~5.04% yield). This looks to be great value when compared to the Australian Dollar Vero Insurance fixed coupon bond maturing in October 2016, which is currently offered at a margin to (Australian) swap of around 205bps.

The recent Cash Converters bond still looks cheap compared to our other FIIG-originated issues. The offer yield is 7.53% (+380bps), compared to 6.98% (+325bps) on Silver Chef, 6.85% (+323bps) on Mackay Sugar, and 7.24% (+332bps) on G8 Education.

Are you stuck in a (term deposit) rut?

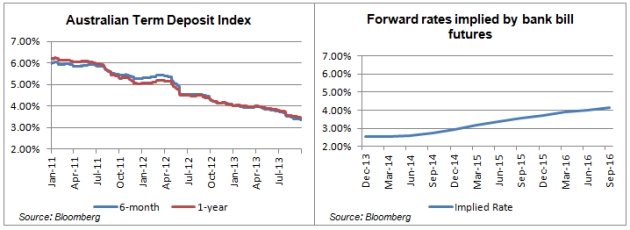

One of the common complaints we hear from our client base is about the lousy rates available on term deposits. The reality is that interest rates have been falling steadily in Australia and will likely remain low or even continue to decline for at least another six to 12 months, until growth in the economy and employment is evidenced. The two charts below illustrate the recent history in interest rates and expectations going forward.

We get it. Term deposit rates are poor, at-call rates are even worse. But you need somewhere to park your cash so it is available when you are likely to need it. You could put it into equities, but it may be worth a lot less when you need it. Granted it may be worth a lot more too, but security rather than profit (return) is the ultimate goal for your cash.

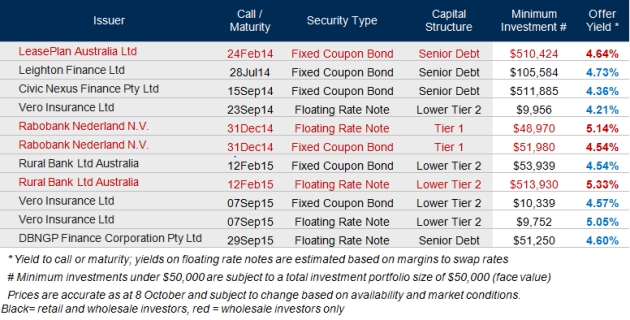

It would seem that few are aware that you can buy a fixed income investment that matures in 12 months or less, and earn a return on that investment that is significantly higher than that of a term deposit. As I write, the best 12 month term deposit rate is 3.90% for a deposit of $25,000 from a range of banks and the best two year rate is 4.08% for $125,000 from a regional bank. The following is a list of some of the bonds maturing in two years or less that offer higher yields than 4.08%. Note that over a third of these mature in less than one year.

This range of yields (4.21% to 5.33%) represents anywhere between 13 and 143 basis points (bps) over the best term deposit rates mentioned above. Five years ago, when term deposit rates were a lofty 8% that difference may not have been enough to raise eyebrows, but 100bps over 4% is quite a different story. One percent is only a 12.5% improvement over a base rate of 8%, but it is twice that, or a 25% improvement, on a base rate of 4%.

Another often-overlooked advantage that fixed income can offer over term deposits is liquidity. When you invest in a term deposit, you agree to leave your funds in place for the duration of the deposit. Should you need to withdraw your funds early, the fee charged for early redemption is entirely at the discretion of the deposit-taking institution, and can equate to all of the interest you would have otherwise earned on the deposit.

Bonds, on the other hand, are tradeable instruments and can be liquidated at any time. As with any tradeable instrument, there is a price difference between where you can buy and sell. If you are increasingly frustrated by the diminishing returns of the cash portion of your portfolio, it is worth considering short term bonds.