Key points:

1. Morgan Stanley, ING Bank and AMP Bank bonds have performed well, but further outperformance will be tough going forward.

2. The downside of a reversal in spreads is now greater than the upside of continued contraction.

3. There are better opportunities in corporate bonds, so it's time to move on

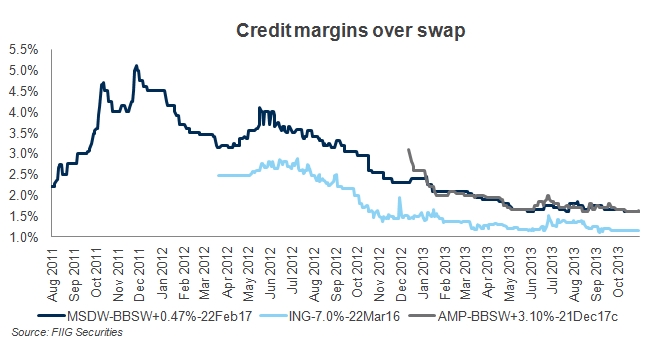

We have quite a few clients who bought Morgan Stanley, ING Bank and AMP Bank bonds over the past couple of years and they should be very happy with the performance of these bonds. The credit margins on these issues have narrowed to less than half their highs over that period. The following chart shows a sample of each of these issuers over that period.

Figure 1

The other noticeable feature of this chart, however, is that these spreads have now reached a level of equilibrium, where there is little left to drive them much lower. The risk appears to be much greater that these spreads widen rather than narrow from these levels. As you can see from the left-hand side of the chart, this can happen quickly and sharply.

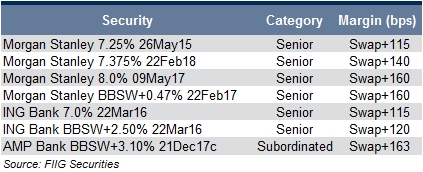

This story is the same for most investment bank senior and subordinated debt, across many individual bonds. The reason I am concentrating on these three issuers is because this is where our clients have the most exposure, so that is where the message is most relevant. There are seven specific bonds for which the message applies, as shown in Table 1.

Table 1

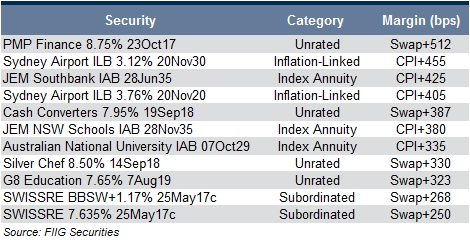

There are a number of corporate and financial issuers that offer more room for improvement and thus a much better risk/reward trade off, especially in inflation-linked products and unrated bonds. Some of the bonds that have the most room for improvement are outlined in Table 2.

Table 2

If you are a holder of these Morgan Stanley, ING Bank, or AMP Bank bonds, or indeed any investment bank debt, you may wish to consider taking profit on your investment and switching into an asset that will extend your excellent performance record into the future.

For more information, please call your local dealer.

Note: Prices are accurate as at 4 November but subject to change.