Last week G8 Education Limited (GEM) announced it had entered into contracts to acquire Sterling Early Education Limited (Sterling) including 91 premium childcare and education centres for $228m. GEM also confirmed that the acquisition will be largely equity funded with an equity raising of $100m to institutions and professional investors at $4.60 per share as well as a Share Purchase Plan for all existing GEM shareholders allowing them to purchase up to $15,000 of GEM shares at the same $4.60 price.

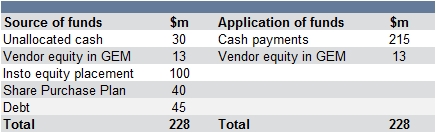

FIIG estimates that about $40m will be raised from the Share Purchase Plan based on around 35-40% of GEM’s 7,000 shareholders taking up their $15,000 allocation. We also estimate that GEM has about $30m in unallocated cash from their recent senior unsecured floating rate bond issue in February 2014 ($50m raised through FIIG), consequently we estimate that GEM will require additional debt funding of around $45m by the end of September 2014 in order to fully fund the acquisition – see the breakdown below. This could come from either additional bank debt or another senior unsecured bond offer and would be achieved well within their financial covenants maximum secured debt of 3x EBIT and minimum interest coverage ratio of 3.5x for all debt.

Acquisition highlights

The acquisition announced last week includes the right to all of Sterling’s issued capital and 91 premium childcare and education centres from various vendors. As a result of these acquisitions, GEM’s licensed places will increase by 6,203 places to 27,995 an increase of 28.5%.

The acquisition will occur progressively between 31 March 2014 and 30 September 2014 due to the size of the transaction. The 91 centres are expected to contribute $39.4m in annualised EBIT in the 2015 financial year with the aggregate price of $228m representing 5.79 times anticipated EBIT (noting that the acquisition includes the equity in Sterling Early Education in addition to the centres). This acquisition represents a significant transaction with broader benefits as GEM are acquiring one of the larger for-profit childcare providers in the Australian market. By acquiring a competitor that also had intentions to roll-up further acquisitions, GEM is containing competition that could have affected their centre based acquisition model of a maximum 4x EBIT.

Acquisition funding (FIIG estimates)

Based on the FIIG estimates discussed above, the $228m acquisition price is likely to be funded roughly as follows:

Assuming a debt requirement of $45m (the final figure largely dependent on the amount of equity raised in the Share Purchase Plan), debt to EBITDA gearing on the acquisition is only 1.14x with the balance (4.65x) funded by equity. If in the unlikely event that no equity was raised in the Share Purchase Plan and debt of $85m was required, debt to EBITDA gearing on the acquisition would rise to a manageable level of 2.16x.