Key points:

- Global Switch first issued an AUD bond late last year. The bond has been added to the DirectBonds list and is now available to wholesale investors from $10,000.

- The bond is investment grade, offering good relative value against overseas issues from the same company and compared to similarly rated issues in Australia

- Portfolio diversification opportunity with a new name and new industry for Australian bond investors

Global Switch Property (Australia) Pty Limited (Global Switch Australia) has recently launched a new investment grade fixed rate note with a 23 December 2020 maturity. FIIG Securities are now able to offer this issue to wholesale clients only, in minimum parcel sizes of $10,000.

UK headquartered Global Switch Holdings Ltd was founded in 1998 and owns and operates nine wholesale data centres across seven key business centres including: Sydney, London, Singapore, Paris and Amsterdam. In the most recent accounts, Global Switch reported GBP4.38bn in total assets and revenues of GBP340m. The senior bonds of Global Switch Australia enjoy a guarantee from the UK parent company.

Global Switch is a property business, offering design specific assets which meet the unique requirements of multi-use data centres for its clients. The properties are located adjacent to prime city centre locations and are designed and constructed to meet the standards required of the appropriate industry standards including redundant power and cooling distribution paths. Key to Global Switch’s business model is that it is ‘carrier-neutral’, ie. the company’s international clients can be assured they enjoy equal access to services (rather than subletting from a centre owner which is also a competitor). With the exception of the centres in Amsterdam and Singapore, Global Switch maintains freehold ownership of its properties.

The Global Switch Australia bonds maintain a ‘BBB’ credit rating from both S&P and Fitch Ratings thanks to the stable, consistent rental revenues the company’s assets enjoy as well as the high occupancy rates, low customer churn and ongoing demand which exceeds supply for ‘carrier-neutral’ data centre services. Investors also enjoy the added protection of a step-up should the rating fall below investment grade of 1.25% - a strong incentive for the company to ensure it maintains its current rating, and thus financial strength.

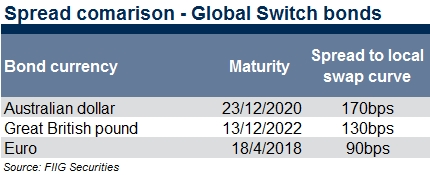

As Global Switch is a new name to the Australian market we are currently seeing it trade considerably wider than bonds from the same group in other currencies where it has a longer issuing history as shown in Table 1.

Table 1

This disparity provides an opportunity for investors to take ‘first mover’ advantage on an unknown name in a new market.

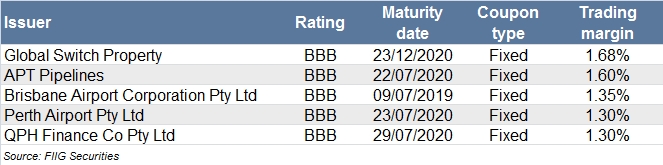

The Global Switch bond is also offering the highest return of similarly rated bonds maturing in 2020 (and 2019), and up to 38bps higher than Perth Airport and the Port of Brisbane bonds (see Table 2). This relative value equation is not unusual for new or first time issuers in the Australian market and may again provide an opportunity for investors.

Table 2

Investment Highlights:

- Senior debt position, fixed rate bond

- Investment grade BBB rating – with step-up protection should the bonds be downgraded to sub-investment grade

- Offering a yield to maturity of 5.75%

- No call risk, with a legal maturity on 23 December 2020

- Excellent relative value compared to the company’s European based bonds

- Opportunity for investors to diversify their fixed income portfolio into a new sector whilst retaining investment grade strength

Key terms:

Trading margin - The margin over the markets’ future expectations of the bank bill rate

Step-up securities - Increased penalty interest where the coupon payment is typically increased by the step up margin, subject to a specific trigger for example: a credit event, banking covenants or election by the issuer not to call or redeem a certain security. Older style subordinated debt and hybrid securities often had a step up if the issuer did not to call, however new Basel III compliant securities do not have a step up provision.

Yield to maturity - The return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.