by

Elizabeth Moran | Dec 12, 2012

I had a question from Jason Barker from Lomax Financial Services that was so good, I thought it worthy of an article. Jason asked whether it’s time to reassess passive investment in fixed income via managed funds given a flattening of the yield curve. If clients can’t own direct fixed income, are managed funds still better than cash or listed hybrids?

In the last 12 months Commonwealth government bonds and semi-government bonds (bonds issued by the states and territories) have outperformed other higher risk asset classes. Many of the bonds have increased in price substantially and sit well over par value of $100. For example the Commonwealth government May 2021 5.75% fixed rate bond (most government bonds are fixed rate although they do issue inflation linked bonds) is trading around $121 with a yield to maturity of 2.80% and a running yield of 4.71%. New South Wales Treasury Corporation have an April 2016 6.00% fixed rate bond that is trading at about $109 with a yield to maturity of 2.99% and a running yield of 5.49%.

Coupled with declining interest rates, the other reason for the outperformance of Commonwealth government and semi-government bonds has been that foreign investors consider them a safe haven (they hold about 80% of all Commonwealth government bonds outstanding), which are still paying a relatively high interest rate for AAA rated sovereigns of circa 2.5%. This highlights the imbalance in global return expectations. Australians view the 2%+ interest rate as too low while others looking to preserve capital by investing in the lowest risk assets available view it as great relative value.

The risk with government bonds is that changes in perceived global risk or increasing interest rates could mean investors start to sell their government bond holdings and the price of the bonds would decline. If the price of government bonds declines then the value of the managed funds (particularly those that hold significant government bond allocations) would also decline; as would their unit prices, and the value of investors’ holdings.

To gain an appreciation of whether a fund’s prices might move we need to assess four main factors:

- Is the fund actively or passively managed?

- The underlying benchmark on which the performance of the fund is being judged

- The percentage allocation to government bonds

- Expectations regarding government bond yields

1. Is the fund actively or passively managed?

An active fund manager will be buying and selling investments in the fund in an attempt to maximise return. It will be in their interest to crystallise some of the recent government bond gains to minimise the downside risk of the bond prices declining.

In contrast a passive fund won’t have the oversight of an active manager. If their aim is to replicate the broader market, their fund will hold similar proportions of bonds as the underlying index. I’d suggest these managed funds are more at risk of loss from a decline in government bond prices.

2. The underlying benchmark on which the performance of the fund is being judged

The most commonly used benchmark is the UBS Bond Composite Index. This index has a high weighting to Commonwealth and semi-government bonds of 67.3%. The other sectors in the Index are supra-nationals (defined by Investopedia as An international organisation, or union, whereby member states transcend national boundaries) with 18.3% and corporate bonds 14.4%.

A passively managed fund should hold an allocation close to the benchmark it is trying to replicate which would mean most passive funds have a high exposure to Commonwealth government and semi-government bonds.

3. The percentage allocation to government bonds and fund performance

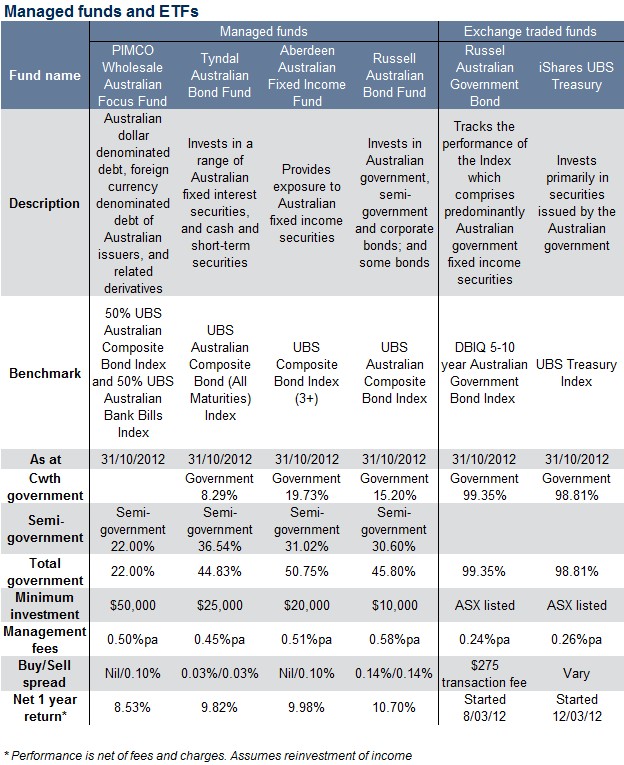

In Table 1 below we show four Australian managed bond funds. The allocation to government bonds varies between 22% for the Pimco Wholesale Australian Focus Fund to 50.75% for the Aberdeen Australian Fixed Income Fund. The table also includes two exchange traded funds (ETFs) with almost 100% weightings to government bonds.

All the managed funds state they are actively managed, yet the returns and fees differ significantly. Interestingly, the Russell Australian Bond Fund outperformed the others and had a high weighting of 45.80% to government bonds with a net one year return of 10.70%. The fund with the lowest weighting to government bonds had the lowest annual return of 8.53%.

Without knowing exactly what the fund holds and all the trades made during the year, it’s difficult to ascertain the reason for any outperformance.

Source: FIIG Securities

Table 1

4. Expectations regarding government bond yields

If you expected that we were in for a period of growth and increasing interest rates in an attempt to limit growth, then you would be a seller of fixed rate government bonds (including managed funds with a high allocation to government bonds) as you would have the expectation that yields would increase and fixed rate bond prices would decline.

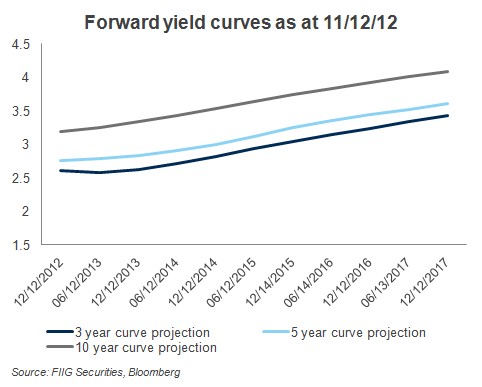

One way bond analysts measure expectations is by assessing the markets’ expectations of forward interest rates. Figure 1 below shows the market’s expectation of the five year future rates for three, five and ten year government bonds.

Little upward movement is shown in the next five years. So the market doesn’t expect any large increases in yield, although the market has been wrong in the past.

I think if you’re trying to call the bottom of the cycle this is very hard to do but the low point is the ideal point to sell government bonds.

Figure 1

Commentary

I don’t expect demand or the yields/ prices for Australian Commonwealth or semi-government bonds to dramatically change any time soon because there is still quite a lot of global uncertainty and foreign investors still view our government bonds as good relative value. Also, as you would have read in past WIRE articles we expect we are in a period of “lower interest rates for longer”. However because the bond prices are so high there is considerable downside risk with limited upside risk.

If you compare the returns on FIIG’s top performing bonds (see the article published in this week’s WIRE) with the managed bond fund returns you can get a feel for the additional return possible if you invest direct. Of course, with the minimum investment of $50,000 for DirectBonds, this market isn’t available to all investors. I think managed funds still remain a worthy consideration for investors with lower amounts to invest. However, you’ll need to do your homework. Is the fund active or passively managed? Maybe compare portfolio allocations from end 2011 to end 2012; this should give you some indication. What is the percentage allocation to government bonds? If you’re concerned at the high level perhaps find a managed fund with a lower allocation and switch or split your investment to spread your risk.

ETFs solely invested in government bonds may find it hard to attract new investment once Commonwealth government bonds are listed on the ASX, as they will be more accessible and more easily traded. However those linked to the UBS Bond Composite Index, with some corporate exposure could be an alternative for smaller investors.

Going back to Jason’s question, many of the listed hybrids offer better returns but much higher risk. If you compare annual returns for these securities, they would fall below our best performing DirectBonds although may have outperformed some managed funds. But, if a managed fund has a 50% allocation to government bonds you just aren’t comparing apples with apples. Listed hybrids because of their high risk nature aren’t a good substitute for bonds that sit higher in the capital structure. They don’t offer the same protection in a declining market which you can see from their price movements in the last 12 months. Also in a poor performing market, hybrids display more volatility than more senior bonds and act much more like the underlying equity.

Summary

Investors need an allocation to bonds in their portfolios. Cash doesn’t offer the upside protection via capital appreciation as seen in the last 12 months. Direct bond ownership gives investors control and the opportunity to own the best relative value bonds. Managed funds offer the protective benefits of a fixed income allocation, however usually invest similarly to underlying benchmarks and while investors pay fees, managed funds are a good option for investors with limited funds.