by

Elizabeth Moran | Feb 04, 2014

Key points:

- The higher than expected December quarterly inflation figure of 0.8 per cent took annual inflation to 2.7 per cent.

- Current low deposit rates and the relatively high inflation rate mean investors need to start thinking about how they better protect against inflation.

- Inflation linked bonds offer returns of up to CPI plus 4.5 per cent , that is a real return of 4.5%, and are available from $10,000 (with a minimum $50,000 total spend).

Inflation is the quiet destroyer. In the last 25 years in Australia, there’s only been one quarter when it was negative; it progresses at a steady creep. It destroys the value of money, so it’s important to assess returns after inflation (known as “real returns”) as pre-inflation returns do not account for inflation erosion.

The higher than expected December quarterly inflation figure of 0.8 per cent took annual inflation to 2.7 per cent. That means if you started 2013 with $100 in your pocket, by the end of the year, that same $100 had lower purchasing power and was worth an equivalent of $97.37 in January 2013.

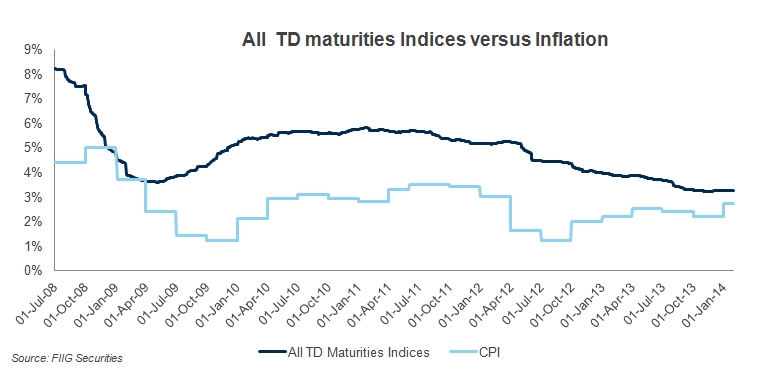

Current low deposit rates and the relatively high inflation rate mean investors need to start thinking about how they better protect against inflation. Term deposit rates no longer provide adequate protection with the margin over inflation at around 1 per cent (see the graph).

Recent Australian Taxation Office figures state that SMSFs hold 29% of their portfolios in cash. The low real return from term deposits will restrain overall returns this year. Earning a 1 per cent real return on a third of your portfolio simply isn’t enough.

Bonds offer an alternative, while still defensive and low-risk, they offer higher returns and other important protections that cash does not. Inflation linked bonds where the return is linked to the Consumer Price Index, are excellent alternatives to term deposits for SMSFs seeking higher returns and inflation protection.

Governments and corporations, who have income linked to inflation, raise debt (issue bonds) which is also linked to inflation to reduce risk. For example the gas distributor, Envestra, has a highly regulated income stream where inflation plays a part in determining annual increases in distribution charges. Envestra issues bonds that are linked to inflation to match some of its income, thus reducing the risk that interest rates move out of step with inflation.

In the same way, SMSFs should link some of their investments to inflation. Retirees, in particular, who spend significant percentages of their income on inflation linked consumables need inflation protection, or they risk having to use capital to fund living expenses.

Large company-run superannuation schemes in Europe, which have defined benefits (so the company bears the risk that it will provide a defined benefit on retirement) have significant allocations to bonds. The British Airways pension scheme as at 31 March 2013 had a 30 per cent allocation to “liability matching assets” comprising: 14.1 per cent fixed rate bonds, 13.3 per cent inflation linked bonds and just 2.6 per cent cash.

In Australia, governments, companies and various other entities issue inflation linked bonds. Commonwealth government inflation linked bonds can be purchased through the ASX. Direct investment in other issuers such as: Sydney Airport, Australian National University and The Melbourne Convention Centre, need to be made through a broker. Inflation linked bonds offer returns of up to CPI plus 4.5 per cent , that is a real return of 4.5%, and are available from $10,000 (with a minimum $50,000 total spend).