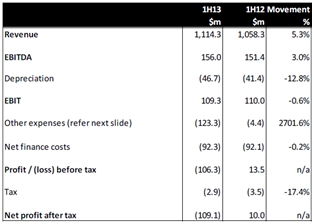

Healthscope Ltd swung to a large net loss in the first half on the back of a $120m write down of assets related to its Pathology Australia arm - with the private equity firms which bought the group have recognising the $2bn of goodwill paid on acquisition was too much. For 1H13 Healthscope posted a net loss of $109.4m compared the corresponding period's $10.02m profit.

- Revenues grew 5.3% to $1.11bn with all divisions contributing to the growth. EBITDA increased by 3.0% to $156m driven by growth in earnings from the Hospitals and Pathology International divisions, offset by a decrease from Pathology Australia

- An impairment charge of $120m was recorded relating to Pathology Australia. As at 30 June 2012, the NSW, QLD and WA pathology assets were subject to sale agreements with Sonic Healthcare, and as such impairment testing was completed

- The Hospitals division revenue grew 6% through a combination of volume and acuity (excluding discontinued business)

- Pathology Australia was impacted by the Queensland and New South Wales businesses, which were impacted by market conditions and the proposed divestment process. The Victorian and South Australian pathology businesses were stable. The sale of the Western Australia Pathology business was completed in October 2012, which negatively impacted revenue growth in 1H13

- International Pathology reported a strong result with revenue and earnings growth across all regions

- The Singapore business also reported revenue and earnings growth, especially in the specialist and commercial segments

- Cash flows from operations increased by 12.8% to $175.8m

- Net debt stood at $1.54bn and gearing of 66.8%

- The Total Leverage Ratio as at December 2012 is 4.94x

Healthscope is a highly levered company following its acquisition by TPG and Carlyle 2010. Despite the good recent performance of the underlying business and high conversion rate of EBITDA into cash, the net debt position has increased as the company has needed to borrow additional funds to meet some of its CAPEX requirements. After payment of the not-so-insignificant annual interest expense, there is little scope for the company to get things wrong and still have adequate liquidity to fund the expansion that the equity holders underwrote when they acquired the business in 2010.