Key points:

- The probability of a hard landing in China is growing.

- If it were to eventuate, the AUD would fall, as would the value of Australian bank shares.

- A Chinese investment slowdown would hurt apartment sales and prestige suburb house prices.

- The RBA would likely cut interest rates and term deposit rates would likely move lower.

Let’s be clear at the outset: China is not expected to have a “hard landing”. The hard landing scenario the media and economists refer to is a slowdown in China’s GDP growth from the current 7.5% per annum to 5.0% per annum or less. The base case that almost all economists believe is that the Chinese slowdown will be gradual.

However, investing is as much about wealth preservation as it is achieving the returns that meet our goals. Wealth preservation is particularly important the older we get as we either don’t have the flexibility the go back to work to recoup losses. Many Australians learnt this lesson the hard way in 2008.

So, a strong investment strategy will cater for the expected future scenario but will also ensure that in the less likely event of a Chinese hard landing, your savings are not severely impacted.

What are the chances of a Chinese hard landing?

As always, economists are mixed on this point. However, they all agree that the risk of a hard landing is rising.

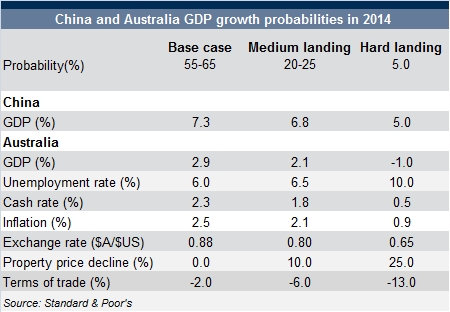

Morgan Stanley research in February this year concluded financial markets are pricing in around a 6% probability of a hard landing. This number aligns to a Standard & Poor’s report in August 2013 where they placed a 5% probability on a hard landing. Importantly they also placed a 20-25% probability on a “medium landing” where China’s GDP slows from 7.5% to 6.8%.

What would a Chinese slowdown do to Australia’s economy?

In line with the Morgan Stanley and S&P research, the International Monetary Fund (IMF)’s MD, Christine Lagarde, said in April 2014 that they didn’t believe China was heading for a hard landing. But she went on to say that China’s trading partners should hedge against such a possibility. In their view, Australia is more exposed to a China slowdown than any other country other than Mongolia.

S&P’s report states that a “hard landing” for the Chinese economy would severely impact Australia’s economy. The S&P report quantifies its expectations of the impact both a hard landing and a medium landing would have. The most critical points are:

1.The impact on the AUD

The medium landing scenario, which they place as a 20-25% probability, has the AUD falling to 80 cents against the US. This is likely to be driven by two factors simultaneously: global investors facing severe volatility to equity and commodity markets will flee to the perceived safety of the USD; and they will sell off the AUD specifically as Australia is considered to be dependent upon China GDP growth for its own growth.

In the hard landing, they see the AUD falling to 65 cents to the USD.

2. The impact on Australian housing

A decline in housing prices will hurt the Australian banking sector as they are dependent upon mortgages for their earnings. A severe drop in housing prices will cause losses due to a rise in bad debts. Again this impact will be driven by two factors: a fall in Chinese investment in property, which has driven prices upward recently; and a rise in unemployment.

As investors in specific properties these impacts will have very different consequences. Unemployment will impact property prices in lower socio-economic regions, while the Chinese investment slowdown will hurt apartment sales and prestige suburb house prices.

However, investors in bank shares will be impacted as any decline in home prices of 10% or more will have a direct impact on share prices, earnings and dividends. Even in the hard landing scenario, we don’t believe that the prices of Australian bank’s bonds will fall by any more than 3-4%. S&P suggests that the hard landing would result in a one notch downgrade of the majors, which is consistent with our view.

3. Interest rates

Any Chinese slowdown will directly impact Australian GDP and unemployment and the RBA will respond by cutting the cash rate further. S&P estimate that in hard landing scenario, the cash rate will fall to 0.5% per annum. This would leave term deposit rates at 1-2% per annum at best.

Don’t dump your Australian shares – just make sure you profit from the slowdown too

While a Chinese slowdown will cause considerable volatility for Australian equities, the key as always is to look at the long term fundamentals. Any slowdown will be short term eg a credit bubble correction. In the long run, China is now on an unstoppable trajectory driven by simple demographics and the freeing up of capital markets. Like Nigeria’s rise in Africa, Germany’s dominance in Europe, the US in the Americas, a free economy with a large population will dominate in the long run.

Furthermore, Australia is not completely dependent upon China. Only 5.7% of Australia’s GDP is dependent upon China. This is significant, but not so large that Australia won’t recover. Australia’s banks will take a hit to their earnings, and so bank share prices will fall, but they will recover in time as they did after the 50% falls in 2008.

Conclusion

What is important is that you can weather the storm that would be caused by a slowdown and the best way to do this is to profit from such a scenario. One way to do this is to simply invest in foreign currencies but the interest rates are very low. Alternatively, investing in USD bonds issued by familiar Australian issuers such as the major banks is another effective way to hedge a Chinese hard landing.

And for those exiting equities altogether because of growing concerns regarding China, a long USD position will enable them to profit from their views and earn a strong yield in the meantime.

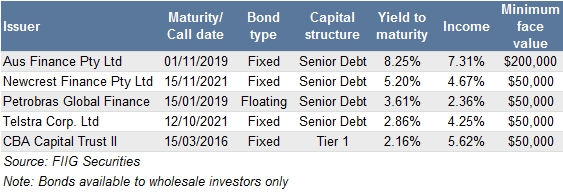

The table below shows some of the foreign currency bonds we currently see strong relative value in.