by

Ekaterina Skulskaya | Aug 20, 2013

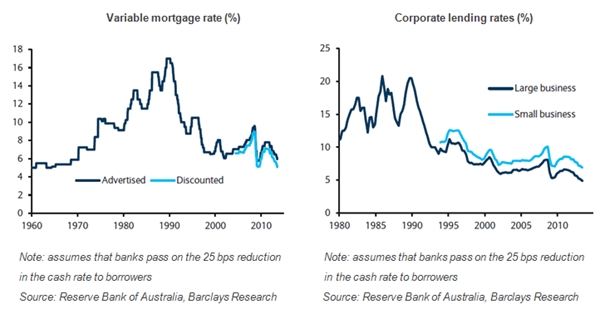

Last week Barclays reported that Australian house prices reached an all time high after the RBA announced the latest cash rate cut to a record low of 2.5%. According to Barclays, slower inflows into term deposits are due to a rising demand for houses. Investors are prepared to take more risk despite the fact that house prices increased 5% from last year’s low to a new record high. Barclays cited the standard variable mortgage rate waned to 5.95% compared to 5.75% lows during the global economic crisis (GFC) (see Figure 1). On a corporate level, the lending rate for large businesses is 4.9% which is well below the 5.4% mark reached during the GFC (see Figure 2).

Figure 1 Figure 2

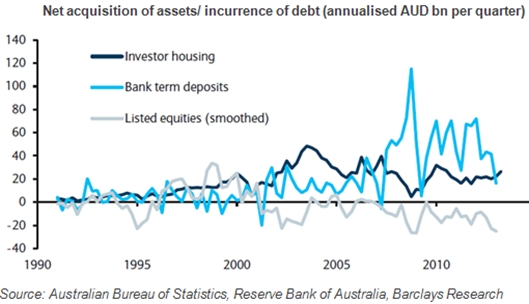

Low interest rates positively affected housing affordability. According to Barclays estimates, if a buyer has a 20% deposit on a new home and the loan terms are 25 years the repayments are calculated to be 21% of income. Levels of housing affordability are well below the long term average of 25% and remain as low as during the GFC (see Figure 3).

The paper revealed that the number of loans to homeowners who either upgrade or take out additional mortgages is 25% higher since the Reserve Bank started cutting rates in late 2011, while lending to investors is up 27%. A strong recovery in lending is mainly due to a gradual increase in demand from first home-buyers. Overall, households are paying their loans at a moderate rate since the pickup in new lending has not yet had a significant impact on the total growth in mortgages. A further increase in new loans is expected to drive a modest recovery in credit growth.

Total household gearing appears to remain relatively high at 1.7 times annual income.

The paper also highlighted that households tend to invest at a slower rate in term deposits and continue to sell equities. According to the Reserve Bank of Australia, households invested $4bn in bank term deposits at an annualised rate in 1Q13 which was the smallest increase since 2009. Households are reported to sell a net $25bn of shares on an annualised basis in 1Q13 and appeared to be net sellers for the past three years (see Figure 3).

Figure 3